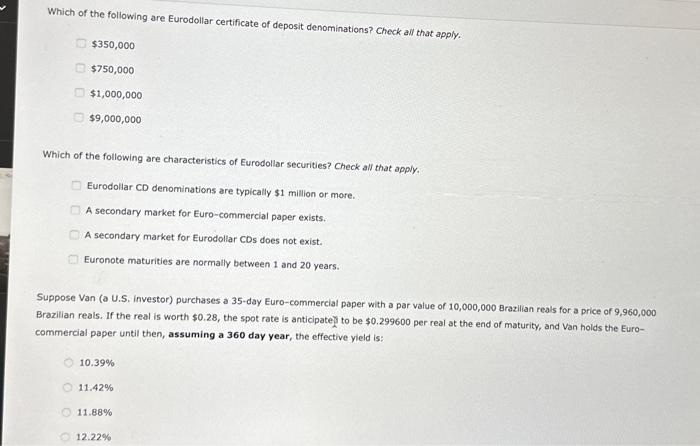

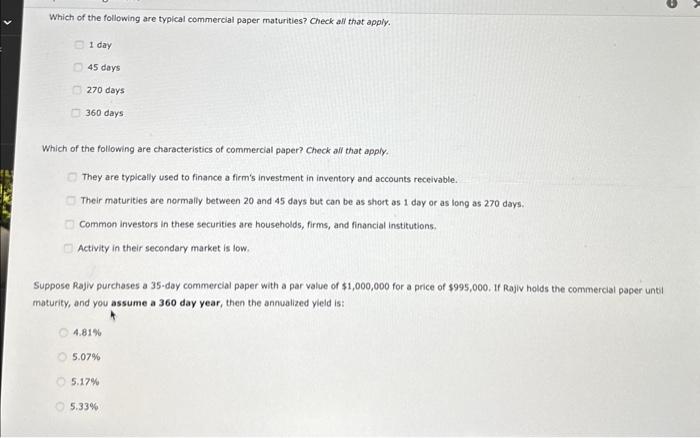

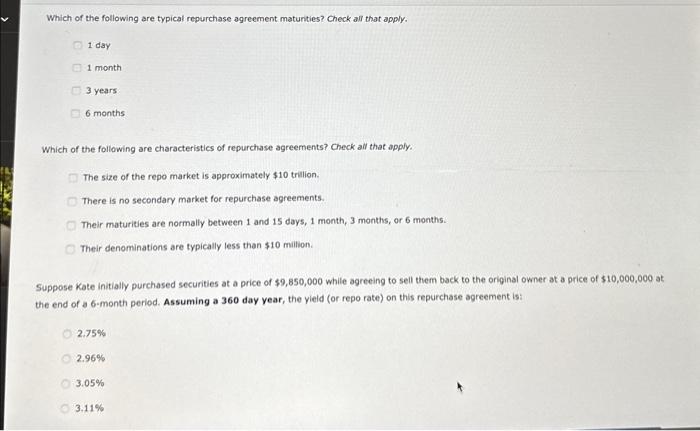

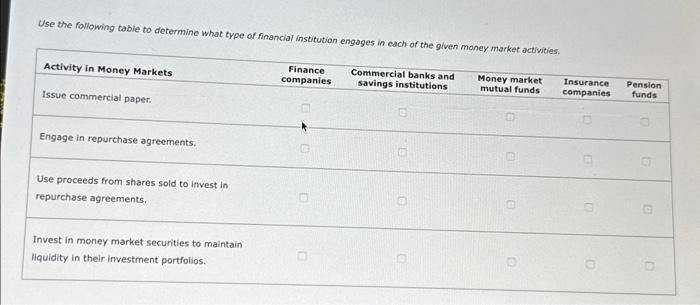

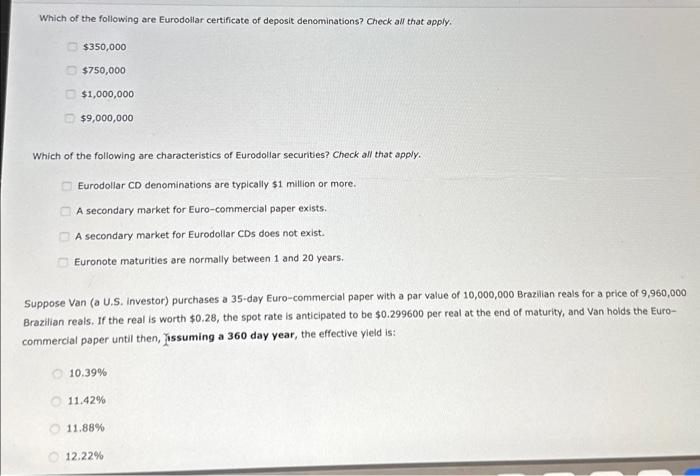

Which of the following are Eurodollar certificate of deposit denominations? check all that apply. $350,000$750,000$1,000,000$9,000,000 Which of the following are characteristics of Eurodollar securities? Check all that apply. Eurodollar CD denominations are typically $1 million or more. A secondary market for Euro-commerclal paper exists. A secondary market for Eurodollar CDs does not exist. Euronote maturities are normally between 1 and 20 years. Suppose Van (a U.S. investor) purchases a 35-day Euro-commercial paper with a par value of 10,000,000 Brazilian reals for a price of 9,960,000 Brazilian reals. If the real is worth $0.28, the spot rate is anticipateji to be $0.299600 per real at the end of maturity, and Van holds the Eurocommercial paper until then, assuming a 360 day year, the effective yleld is: 10.39%11.42%11.88%12.22% Which of the following are typical commercial paper maturities? Check all that apply. 1day45days270days360days Which of the following are characteristics of commercial paper? Check all that apply. They are typically used to finance a firm's investment in inventory and accounts receivable. Their maturities are normally between 20 and 45 days but can be as short as 1 day or as long as 270 days. Common investors in these secunities are households, firms, and financial institutions. Activity in their secondary market is low. Suppose Rajw purchases a 35-day commercial paper with a par value of $1,000,000 for a price of $995,000, If Rajlv holds the commercial paper until maturity, and you assume a 360 day year, then the annualized yield is: 4.814 5.07% 5.17% 5.33% Which of the following are typical repurchase agreement matunities? Check all that apply. 1 day 1 month 3 years 6 months Which of the following are characteristics of repurchase agreements? Check all that apply. The size of the repo market is approximately $10 trilion. There is no secondary market for repurchase agreements. Their maturities are normally between 1 and 15 days, 1 month, 3 months, or 6 months. Their denominations are typically less than $10 million. Suppose Kate initially purchased securities at a price of $9,850,000 while agreeing to sell them back to the original owner at a price of $10,000,000 at the end of a 6-month period. Assuming a 360 day year, the yieid (or repo rate) on this repurchase agreement ist 2.75% 2.96% 3.05% 3.11% Use the following table to determine what type of financlal institution engages in each of the given money market activities. Which of the following are Eurodollar certificate of deposit denominations? Check all that apply. $350,000$750,000$1,000,000$9,000,000 Which of the following are characteristics of Eurodollar securities? Check all that apply. Eurodoliar CD denominations are typically $1 million or more. A secondary market for Euro-commerclal paper exists. A secondary market for Eurodollar CDs does not exist. Euronote maturities are normally between 1 and 20 years. Suppose Van (a U.S. investor) purchases a 35-day Euro-commercial paper with a par value of 10,000,000 Brazilian reals for a price of 9,960,000 Brazilian reals. If the real is worth $0.28, the spot rate is anticipated to be $0.299600 per real at the end of maturity, and Van holds the Eurocommercial paper until then, Jissuming a 360 day year, the effective yield is: 10.39%11.42%11.88%12.22%