which of the following are the two primary components of shareholders equity ?

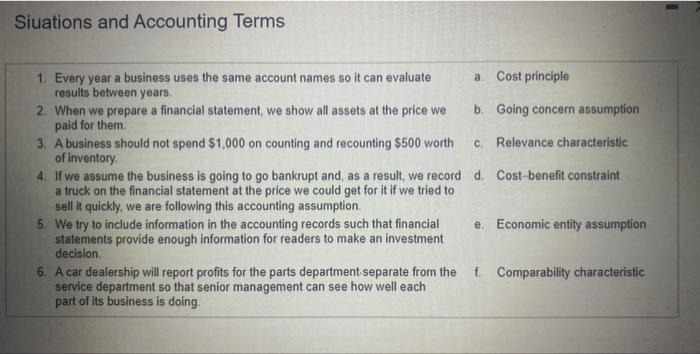

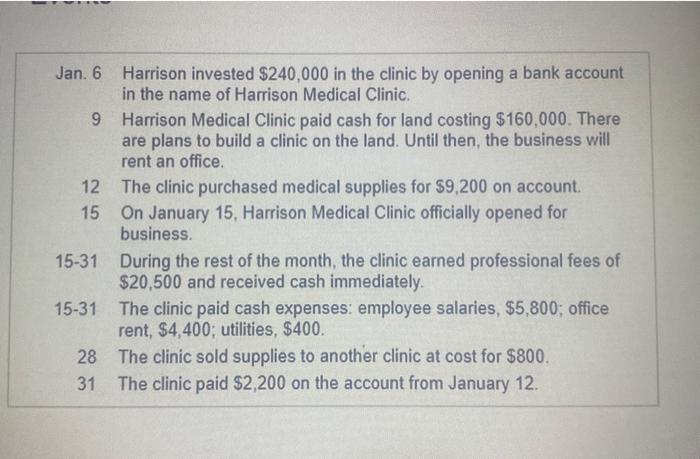

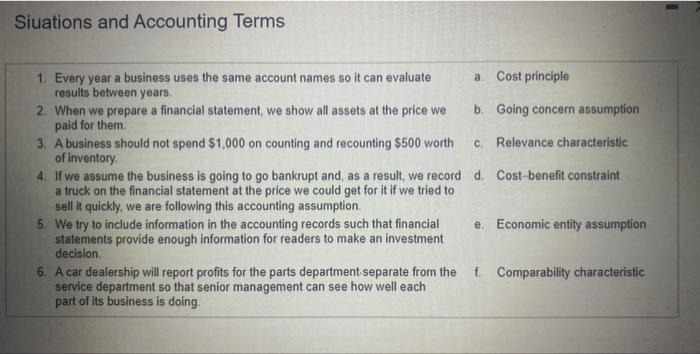

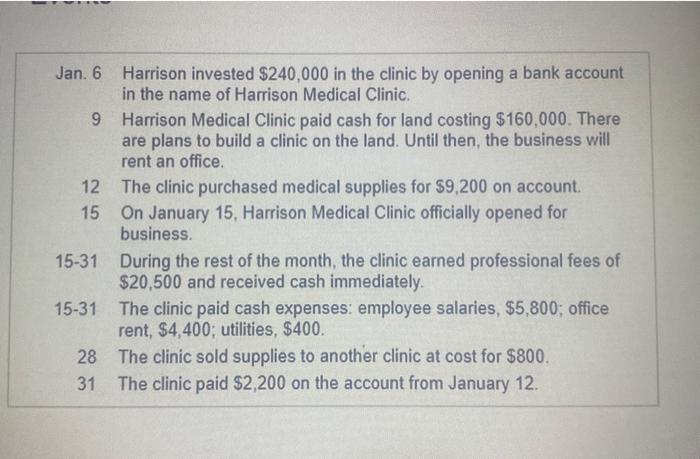

Siuations and Accounting Terms 1. Every year a business uses the same account names so it can evaluate a. Cost principle results between years. 2. When we prepare a financial statement, we show all assets at the price we b. Going concern assumption paid for them. 3. A business should not spend $1,000 on counting and recounting $500 worth c. Relevance characteristic of inventory. 4. If we assume the business is going to go bankrupt and, as a result, we record d. Cost-benefit constraint a truck on the financial statement at the price we could get for it if we tried to sell it quickly, we are following this accounting assumption. 5. We try to include information in the accounting records such that financial e. Economic entity assumption statements provide enough information for readers to make an investment decision. 6. A car dealership will report profits for the parts departmentseparate from the f. Comparability characteristic service department so that senior management can see how well each part of its business is doing. Jan. 6 Harrison invested $240,000 in the clinic by opening a bank account in the name of Harrison Medical Clinic. 9 Harrison Medical Clinic paid cash for land costing $160,000. There are plans to build a clinic on the land. Until then, the business will rent an office. 12 The clinic purchased medical supplies for $9,200 on account. 15 On January 15. Harrison Medical Clinic officially opened for business. 15-31 During the rest of the month, the clinic earned professional fees of $20,500 and received cash immediately. 15-31 The clinic paid cash expenses: employee salaries, $5,800; office rent, $4,400; utilities, $400. 28 The clinic sold supplies to another clinic at cost for $800. 31 The clinic paid $2,200 on the account from January 12. Siuations and Accounting Terms 1. Every year a business uses the same account names so it can evaluate a. Cost principle results between years. 2. When we prepare a financial statement, we show all assets at the price we b. Going concern assumption paid for them. 3. A business should not spend $1,000 on counting and recounting $500 worth c. Relevance characteristic of inventory. 4. If we assume the business is going to go bankrupt and, as a result, we record d. Cost-benefit constraint a truck on the financial statement at the price we could get for it if we tried to sell it quickly, we are following this accounting assumption. 5. We try to include information in the accounting records such that financial e. Economic entity assumption statements provide enough information for readers to make an investment decision. 6. A car dealership will report profits for the parts departmentseparate from the f. Comparability characteristic service department so that senior management can see how well each part of its business is doing. Jan. 6 Harrison invested $240,000 in the clinic by opening a bank account in the name of Harrison Medical Clinic. 9 Harrison Medical Clinic paid cash for land costing $160,000. There are plans to build a clinic on the land. Until then, the business will rent an office. 12 The clinic purchased medical supplies for $9,200 on account. 15 On January 15. Harrison Medical Clinic officially opened for business. 15-31 During the rest of the month, the clinic earned professional fees of $20,500 and received cash immediately. 15-31 The clinic paid cash expenses: employee salaries, $5,800; office rent, $4,400; utilities, $400. 28 The clinic sold supplies to another clinic at cost for $800. 31 The clinic paid $2,200 on the account from January 12