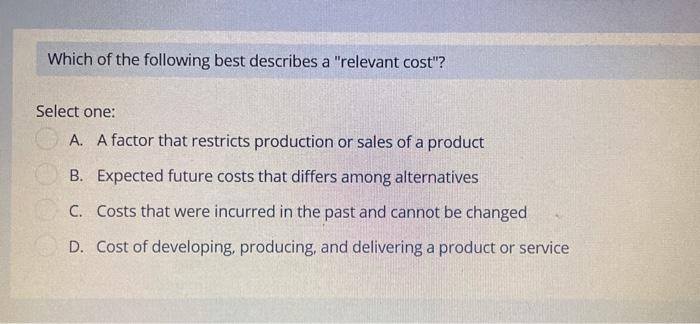

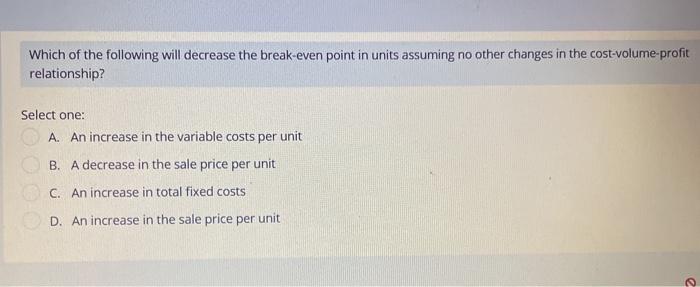

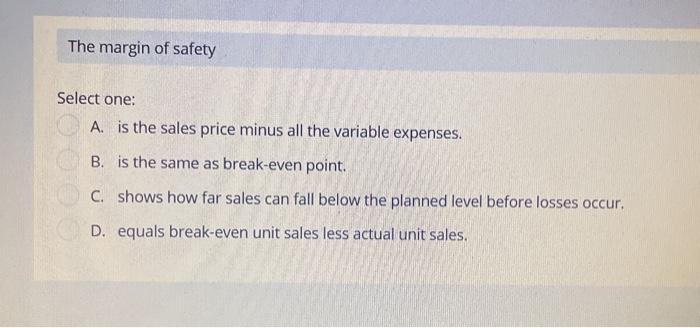

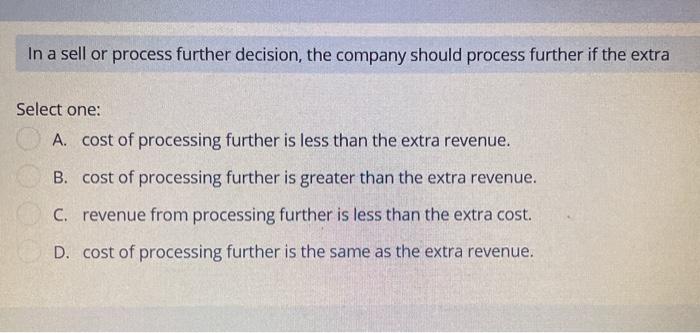

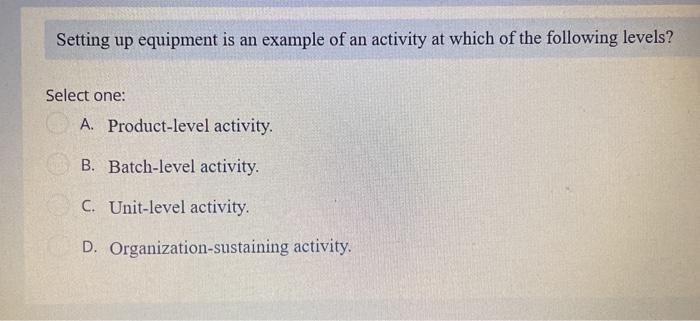

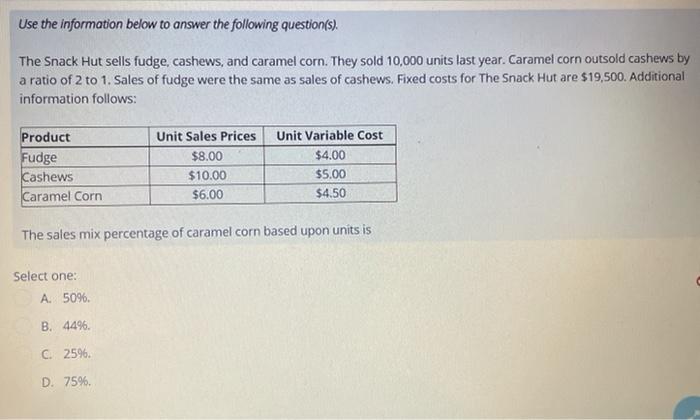

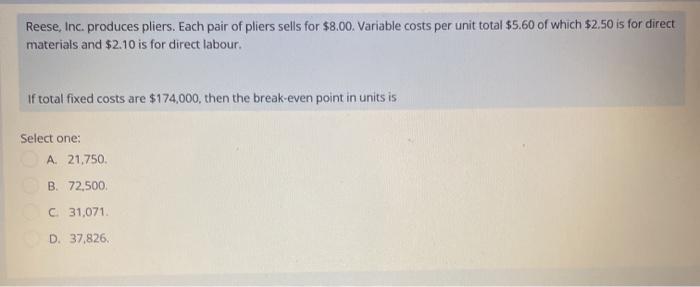

Which of the following best describes a "relevant cost"? Select one: A. A factor that restricts production or sales of a product B. Expected future costs that differs among alternatives C. Costs that were incurred in the past and cannot be changed D. Cost of developing, producing, and delivering a product or service Which of the following will decrease the break-even point in units assuming no other changes in the cost-volume-profit relationship? Select one: A. An increase in the variable costs per unit B. A decrease in the sale price per unit C. An increase in total fixed costs D. An increase in the sale price per unit The margin of safety Select one: CA. is the sales price minus all the variable expenses. B. is the same as break-even point. C. shows how far sales can fall below the planned level before losses occur. D. equals break-even unit sales less actual unit sales. In a sell or process further decision, the company should process further if the extra Select one: A. cost of processing further is less than the extra revenue. B. cost of processing further is greater than the extra revenue. C. revenue from processing further is less than the extra cost. D. cost of processing further is the same as the extra revenue. Setting up equipment is an example of an activity at which of the following levels? Select one: A. Product-level activity. B. Batch-level activity. C. Unit-level activity. D. Organization-sustaining activity. Use the information below to answer the following question(s). The Snack Hut sells fudge, cashews, and caramel corn. They sold 10,000 units last year. Caramel corn outsold cashews by a ratio of 2 to 1. Sales of fudge were the same as sales of cashews. Fixed costs for The Snack Hut are $19,500. Additional information follows: Product Fudge Cashews Caramel Corn Unit Sales Prices $8.00 $10.00 $6.00 Unit Variable Cost $4.00 $5.00 $4.50 The sales mix percentage of caramel corn based upon units is Select one: A 5096. B. 4496. C25%. D. 75%. Reese, Inc. produces pliers. Each pair of pliers sells for $8.00. Variable costs per unit total $5.60 of which $2.50 is for direct materials and $2.10 is for direct labour. if total fixed costs are $174,000, then the break-even point in units is Select one: A 21.750 B. 72,500 C31,071 D. 37,826