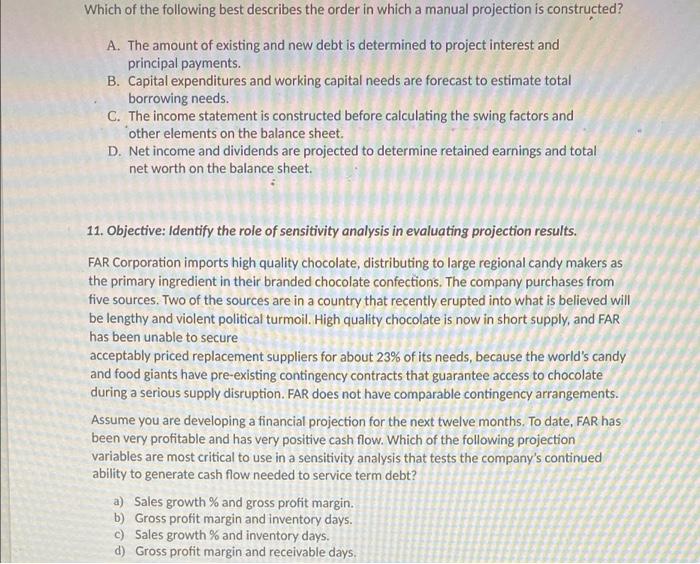

Which of the following best describes the order in which a manual projection is constructed? A. The amount of existing and new debt is determined to project interest and principal payments. B. Capital expenditures and working capital needs are forecast to estimate total borrowing needs. C. The income statement is constructed before calculating the swing factors and other elements on the balance sheet. D. Net income and dividends are projected to determine retained earnings and total net worth on the balance sheet. 11. Objective: Identify the role of sensitivity analysis in evaluating projection results. FAR Corporation imports high quality chocolate, distributing to large regional candy makers as the primary ingredient in their branded chocolate confections. The company purchases from five sources. Two of the sources are in a country that recently erupted into what is believed will be lengthy and violent political turmoil. High quality chocolate is now in short supply, and FAR has been unable to secure acceptably priced replacement suppliers for about 23% of its needs, because the world's candy and food giants have pre-existing contingency contracts that guarantee access to chocolate during a serious supply disruption. FAR does not have comparable contingency arrangements. Assume you are developing a financial projection for the next twelve months. To date, FAR has been very profitable and has very positive cash flow. Which of the following projection variables are most critical to use in a sensitivity analysis that tests the company's continued ability to generate cash flow needed to service term debt? a) Sales growth % and gross profit margin. b) Gross profit margin and inventory days. c) Sales growth % and inventory days. d) Gross profit margin and receivable days Which of the following best describes the order in which a manual projection is constructed? A. The amount of existing and new debt is determined to project interest and principal payments. B. Capital expenditures and working capital needs are forecast to estimate total borrowing needs. C. The income statement is constructed before calculating the swing factors and other elements on the balance sheet. D. Net income and dividends are projected to determine retained earnings and total net worth on the balance sheet. 11. Objective: Identify the role of sensitivity analysis in evaluating projection results. FAR Corporation imports high quality chocolate, distributing to large regional candy makers as the primary ingredient in their branded chocolate confections. The company purchases from five sources. Two of the sources are in a country that recently erupted into what is believed will be lengthy and violent political turmoil. High quality chocolate is now in short supply, and FAR has been unable to secure acceptably priced replacement suppliers for about 23% of its needs, because the world's candy and food giants have pre-existing contingency contracts that guarantee access to chocolate during a serious supply disruption. FAR does not have comparable contingency arrangements. Assume you are developing a financial projection for the next twelve months. To date, FAR has been very profitable and has very positive cash flow. Which of the following projection variables are most critical to use in a sensitivity analysis that tests the company's continued ability to generate cash flow needed to service term debt? a) Sales growth % and gross profit margin. b) Gross profit margin and inventory days. c) Sales growth % and inventory days. d) Gross profit margin and receivable days