Answered step by step

Verified Expert Solution

Question

1 Approved Answer

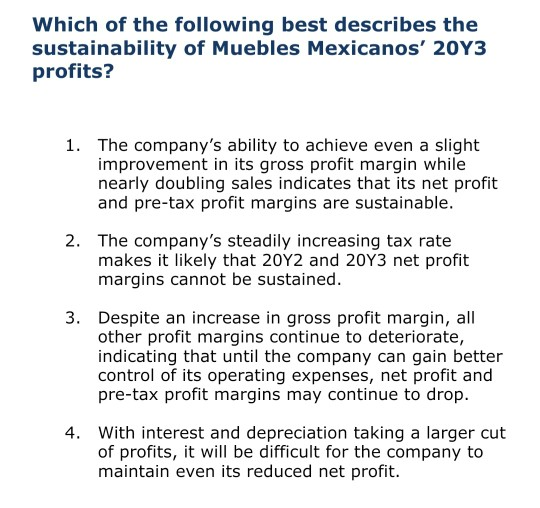

Which of the following best describes the sustainability of Muebles Mexicanos' 2013 profits? 1. The company's ability to achieve even a slight improvement in its

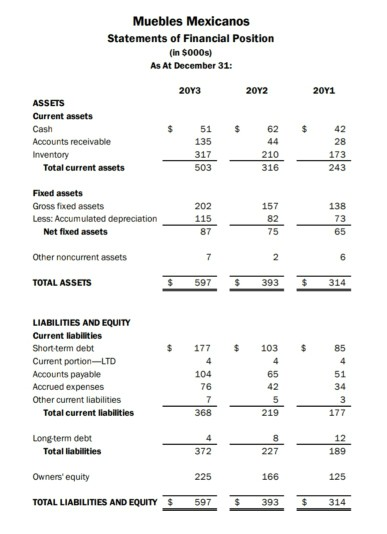

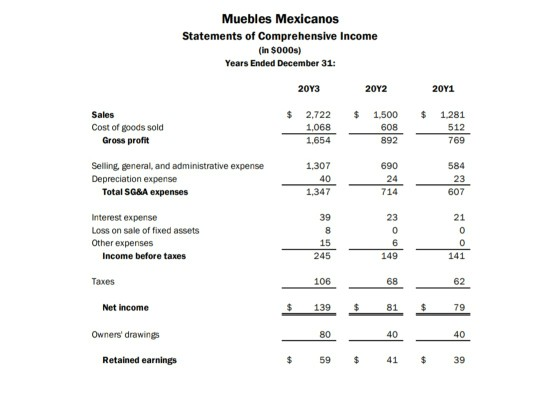

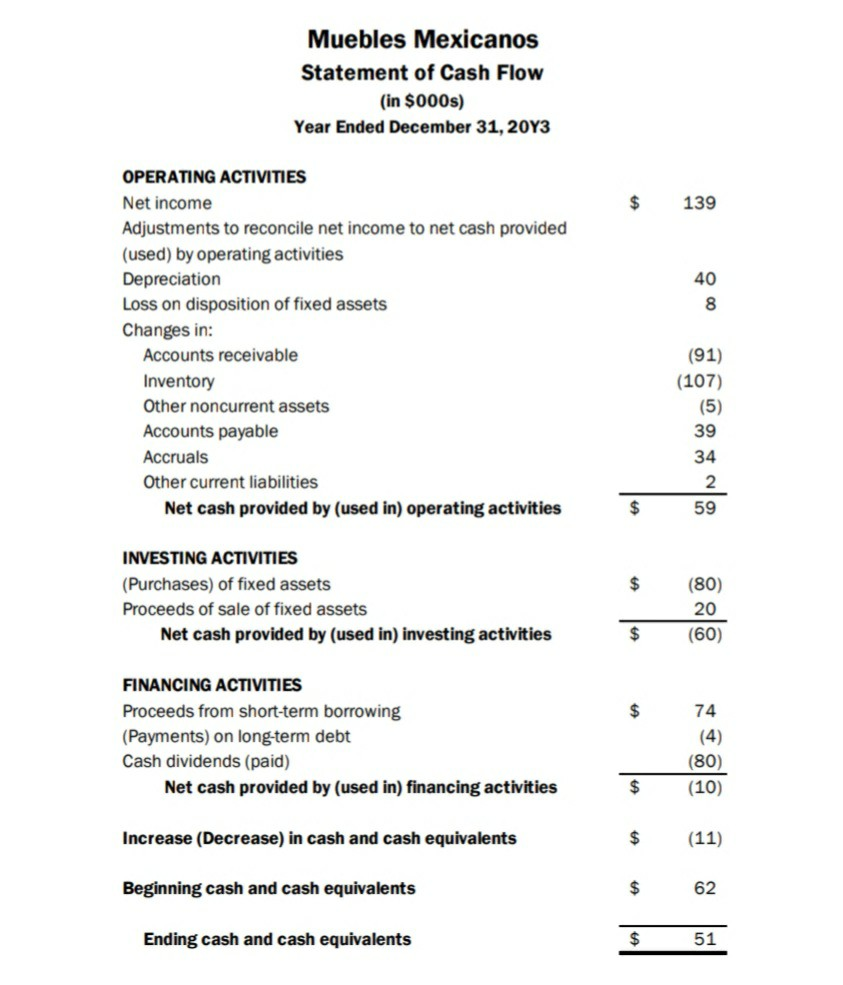

Which of the following best describes the sustainability of Muebles Mexicanos' 2013 profits? 1. The company's ability to achieve even a slight improvement in its gross profit margin while nearly doubling sales indicates that its net profit and pre-tax profit margins are sustainable. 2. The company's steadily increasing tax rate makes it likely that 2012 and 2043 net profit margins cannot be sustained. 3. Despite an increase in gross profit margin, all other profit margins continue to deteriorate, indicating that until the company can gain better control of its operating expenses, net profit and pre-tax profit margins may continue to drop. 4. With interest and depreciation taking a larger cut of profits, it will be difficult for the company to maintain even its reduced net profit. Muebles Mexicanos Statements of Financial Position (in $000s) As At December 31: 2043 20Y2 ASSETS Current assets Cash 51 $ 62 Accounts receivable 135 Inventory 317 210 Total current assets 503 316 2011 $ 42 28 173 243 Fixed assets Gross fixed assets Less: Accumulated depreciation Net fixed assets 202 115 87 157 82 75 138 73 65 7 2 6 Other noncurrent assets TOTAL ASSETS 597 393 $ 314 177 $ $ LIABILITIES AND EQUITY Current liabilities Short-term debt Current portion-LTD Accounts payable Accrued expenses Other current liabilities Total current liabilities 104 76 7 368 103 4 65 42 5 219 85 4 51 34 3 177 Long-term debt Total liabilities 8 227 12 189 372 Owners' equity 225 166 125 TOTAL LIABILITIES AND EQUITY $ 597 $ 393 $ 314 Muebles Mexicanos Statements of Comprehensive Income (in $000s) Years Ended December 31: 20Y3 2012 2011 $ $ Sales Cost of goods sold Gross profit $ 2,722 1,068 1.654 1,500 608 892 1.281 512 769 Selling general, and administrative expense Depreciation expense Total SG&A expenses 1,307 40 1,347 690 24 714 584 23 607 Interest expense Loss on sale of fixed assets Other expenses Income before taxes 39 8 15 245 23 0 6 149 21 0 0 141 Taxes 106 68 62 Net Income $ 139 $ 81 $ 79 Owners' drawings 80 40 40 Retained earnings $ 59 $ 41 $ 39 Muebles Mexicanos Statement of Cash Flow (in $000s) Year Ended December 31, 20Y3 $ 139 40 8 OPERATING ACTIVITIES Net income Adjustments to reconcile net income to net cash provided (used) by operating activities Depreciation Loss on disposition of fixed assets Changes in: Accounts receivable Inventory Other noncurrent assets Accounts payable Accruals Other current liabilities Net cash provided by (used in) operating activities (91) (107) (5) 39 34 2 59 $ $ INVESTING ACTIVITIES (Purchases) of fixed assets Proceeds of sale of fixed assets Net cash provided by (used in) investing activities (80) 20 (60) $ $ 74 FINANCING ACTIVITIES Proceeds from short-term borrowing (Payments) on long-term debt Cash dividends (paid) Net cash provided by (used in) financing activities (80) (10) $ Increase (Decrease) in cash and cash equivalents $ (11) Beginning cash and cash equivalents $ 62 Ending cash and cash equivalents $ 51

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started