Answered step by step

Verified Expert Solution

Question

1 Approved Answer

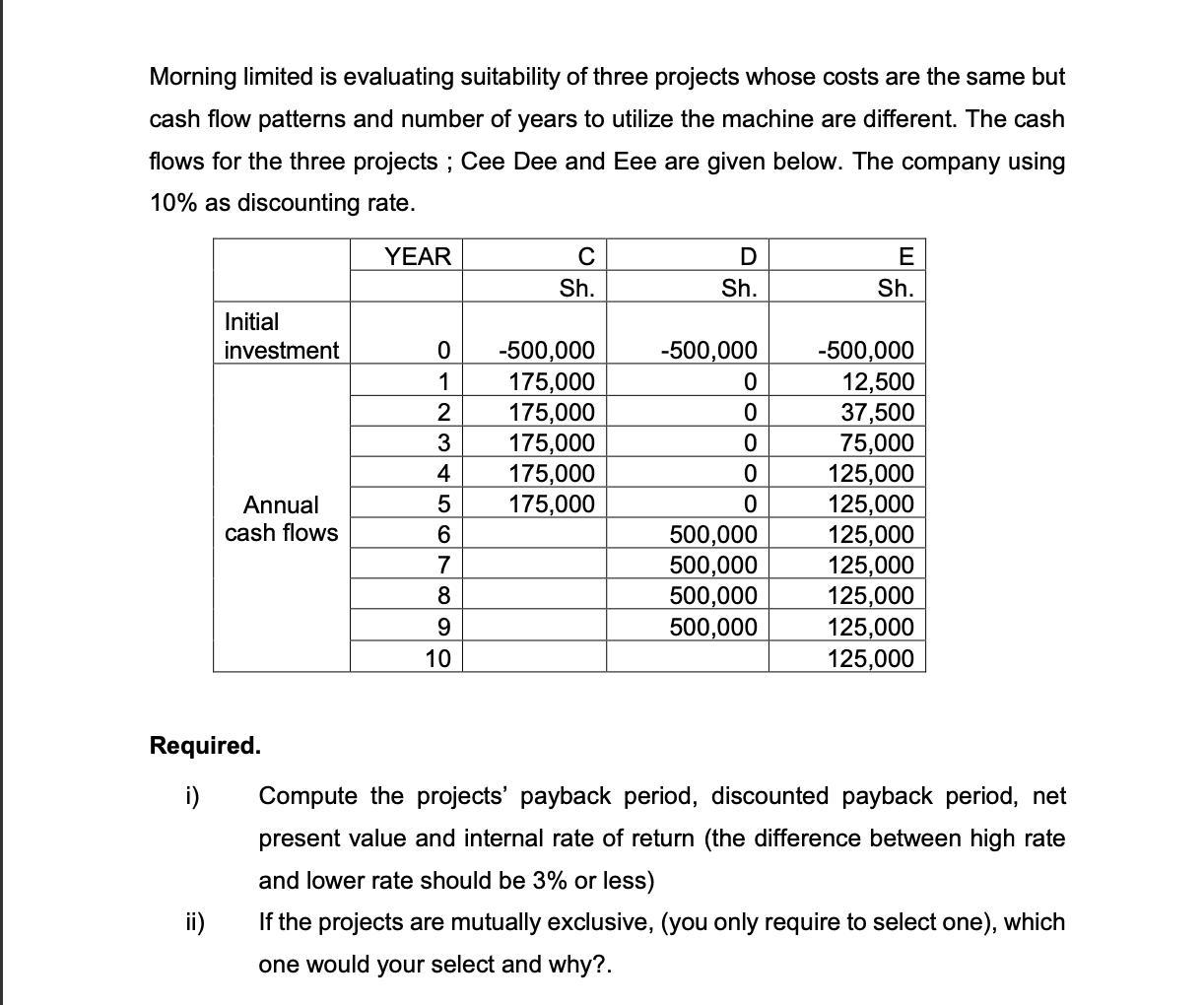

Morning limited is evaluating suitability of three projects whose costs are the same but cash flow patterns and number of years to utilize the

Morning limited is evaluating suitability of three projects whose costs are the same but cash flow patterns and number of years to utilize the machine are different. The cash flows for the three projects; Cee Dee and Eee are given below. The company using 10% as discounting rate. YEAR Initial investment ii) Annual cash flows Required. i) C Sh. 0 -500,000 1 175,000 2 175,000 3 175,000 4 175,000 5 175,000 6 7 8 9 10 D Sh. -500,000 0 0 0 0 0 500,000 500,000 500,000 500,000 E Sh. -500,000 12,500 37,500 75,000 125,000 125,000 125,000 125,000 125,000 125,000 125,000 Compute the projects' payback period, discounted payback period, net present value and internal rate of return (the difference between high rate and lower rate should be 3% or less) If the projects are mutually exclusive, (you only require to select one), which one would your select and why?.

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started