Read the attached article entitled Comparing Success at Kmart and Wal-mart. a. What is the key to Wal-Marts success to date? Highlight the strategic role

Read the attached article entitled “Comparing Success at Kmart and Wal-mart.”

a. What is the key to Wal-Mart’s success to date? Highlight the strategic role of operations in this success story.

b. In March 2005, Kmart and Sears merged to form the Sears Holdings Corporation, the nation's third largest broadline retailer, with approximately $55 billion in annual revenues, and with approximately 3,800 full-line and specialty retail stores in the United States and Canada. To better compete with Walmart, name two recommendations that the Sears Holding Corporation might consider for its operations strategy.

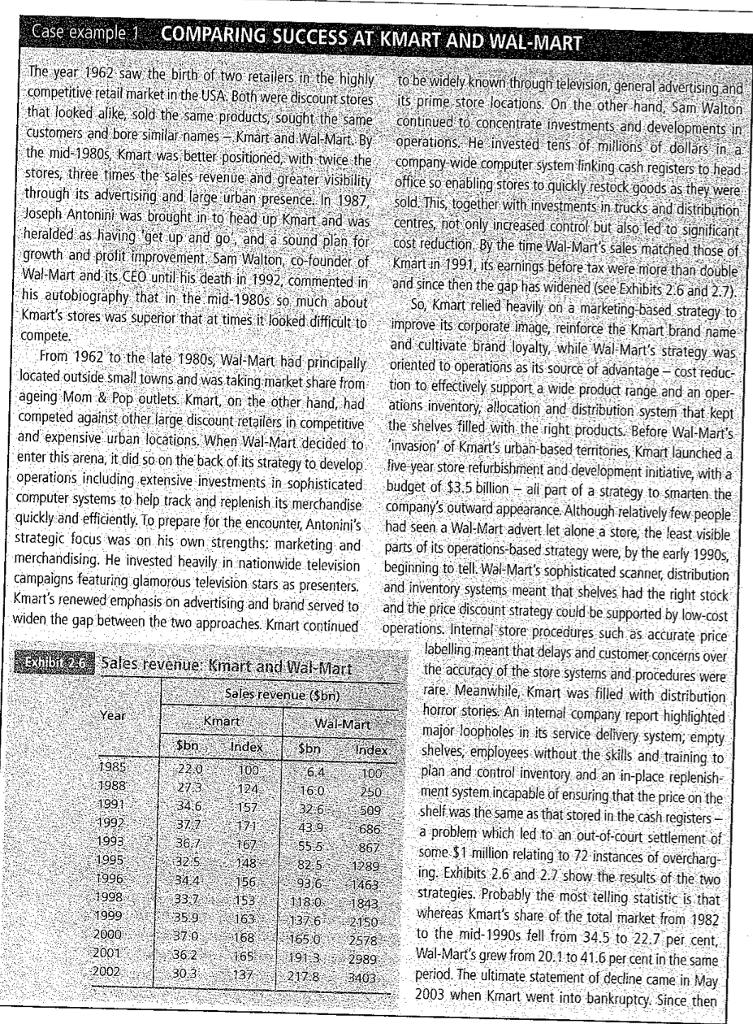

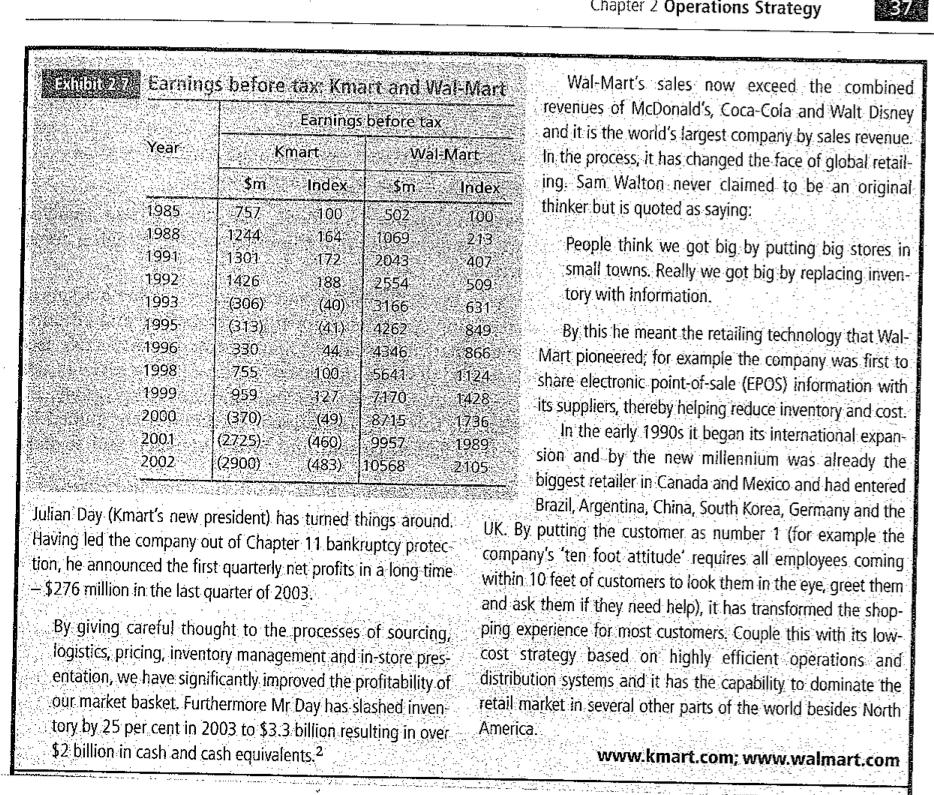

Case example 1 COMPARING SUCCESS AT KMART AND WAL-MART The year 1962 saw the birth of two retailers in the highly competitive retail market in the USA. Both were discount stores that looked alike, sold the same products, sought the same customers and bore similar names - Kmrt and Wal-Mart. By the mid-1980s, Kmart was better positioned, with twice the stores, three times the sles revenue and greater visibility through its advertising and large urban presence. In 1987, Joseph Antonini was brought in to head up Kmart and was heralded as having 'get up and go, and sound plan for growth and profit improvement. Sam Walton, co-founder of Wal-Mart and its CEO until his death in 1992, commented in his autobiography that in the mid-1980s so much about Kmart's stores was superior that at times it looked difficult to to be widely known through telvision, general advertising and its prime store locations. On the other hand, Sam Walton continued to concentrate investments and developments in operations. He invested tens of millions of dollars in a wide computer system linking cash registers to head office so enabling stores to quickly restock goods as they were sold. This, together with investments in trucks and distribution centres, not only increased control but lso led to significant cost reduction. By the time Wal-Mart's sales matched those of Kmrt in 1991, its earnings before tax were more than double and since then the gap has widened (see Exhibits 2.6 and 2.7). So, Kmart relied heavily on marketing-based strategy to improve its corporate image, reinforce the Kmart brand name and cultivate brand loyalty, while Wal Mart's strategy was oriented to operations as its source of advantage - cost reduc- tion to effectively support a wide product range and an oper- ations inventory, allocation and distribution system that kept the shelves filled with the right products. Before Wal-Mart's invasion' of Kmart's urban-based territories, Kmart launched a five year store refurbishment and development initiative, with a operations including extensive investments in sophisticated budget of $3.5 billion all part of a strategy to smarten the ompany compete, From 1962 to the late 1980s, Wal-Mart had principally located outside small towns and was taking market share from ageing Mom & Pop outlets. Kmart, on the other hand, had competed against other lrge discount retailrs in competitive and expensive urban locations. When Wal-Mart decided to enter this arena, it did so on the back of its strategy to develop computer systems to help track and replenish its merchandise quickly and efficiently. To prepare for the encounter, Antonini's strategic focus was on his own strengths: marketing and merchandising. He invested heavily in nationwide television cmpaigns featuring glamorous television stars as presenters. Kmart's renewed emphasis on advertising and brand served to widen the gap between the two approaches. Kmart continued company's outward appearance. Although relatively few people had seen a Wal-Mart advert let alone a store, the least visible parts of its operations-based strategy were, by the early 1990s, beginning to tell. Wal-Mart's sophisticated scanner, distribution and inventory systems meant that shelves had the right stock and the price discount strategy could be supported by low-cost operations. Internal store procedures such as accurate price labelling meant that delays and customer concerns over the accuracy of the store systems and procedures were rare. Meanwhile, Kmart was filled with distribution horror stories. An internal company report highlighted major loopholes in its service delivery system; empty shelves, employees without the skills and training to plan and control inventory and an in-place replenish- ment system incapable of ensuring that the price on the shelf was the same as that stored in the cash registers - a problem which led to an out-of-court settlement of some $1 million relating to 72 instances of overcharg- ing. Exhibits 2.6 and 2.7 show the results of the two strategies. Probably the most telling statistic is that whereas Kmart's share of the total market from 1982 to the mid-1990s fell from 34.5 to 22.7 per cent, Wal-Mart's grew from 20.1 to 41.6 per cent in the same period. The ultimate statement of decline came in May 2003 when Kmart went into bankruptcy. Since then Exhibit 2.6 Sales revenue: Kmart and Wal-Mart Sales revenue ($bn) Year Kmart Wal-Mart $bn Index Sbn 6.4 16.0 32.6 43.9 55.5 Index. 1985 1988 22.0 27.3 34.6 100 124 157 171 167 148 1991 1992 1993 1995 1996 1998 1999 37.7 36.7 32 5 34 4 33,7 153 35.9 163 37.0 36 2 30.3 100 50 509 686 867 1289 93 6 1463 1843 2150 2578 2989 217.8 3403 82:5 156 2000 2001 2002 118:0. 1376 165 0 191:3 168 165 137

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The following are the reasons to Walmarts success Walmart managed to differentiate itself from other ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e136a1ce33_181239.pdf

180 KBs PDF File

635e136a1ce33_181239.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started