Answered step by step

Verified Expert Solution

Question

1 Approved Answer

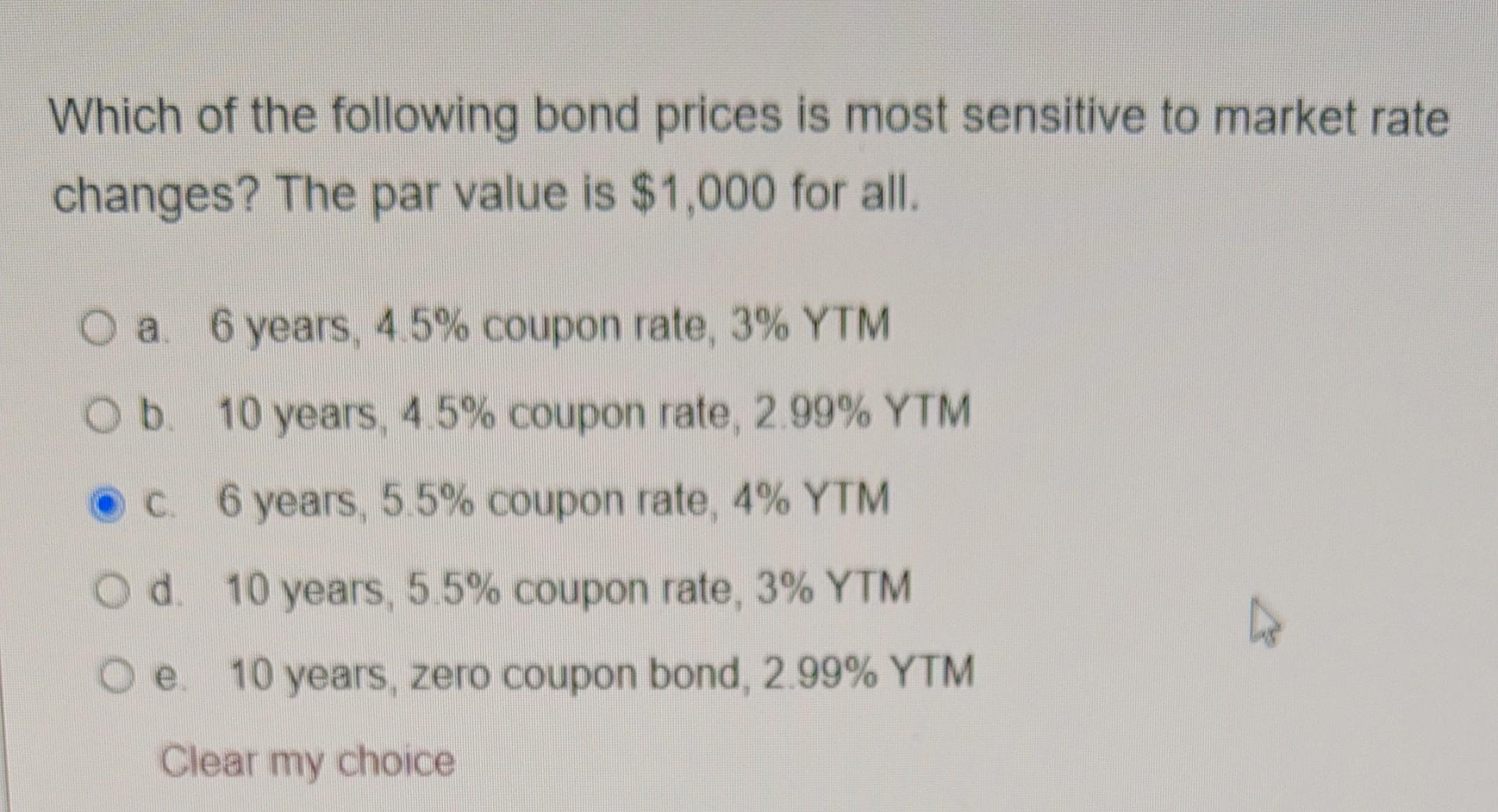

Which of the following bond prices is most sensitive to market rate changes? The par value is $1,000 for all. O a 6 years, 45%

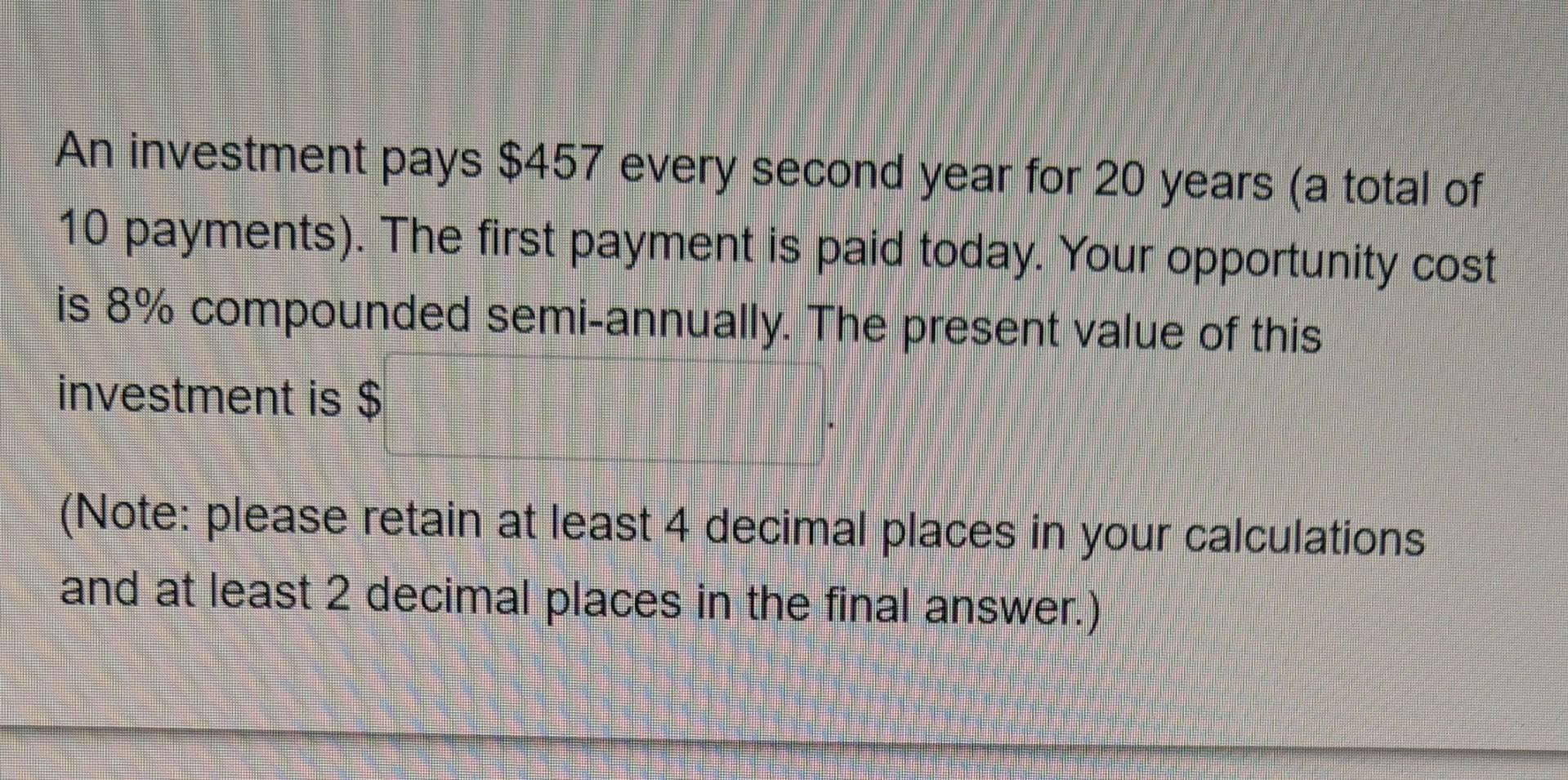

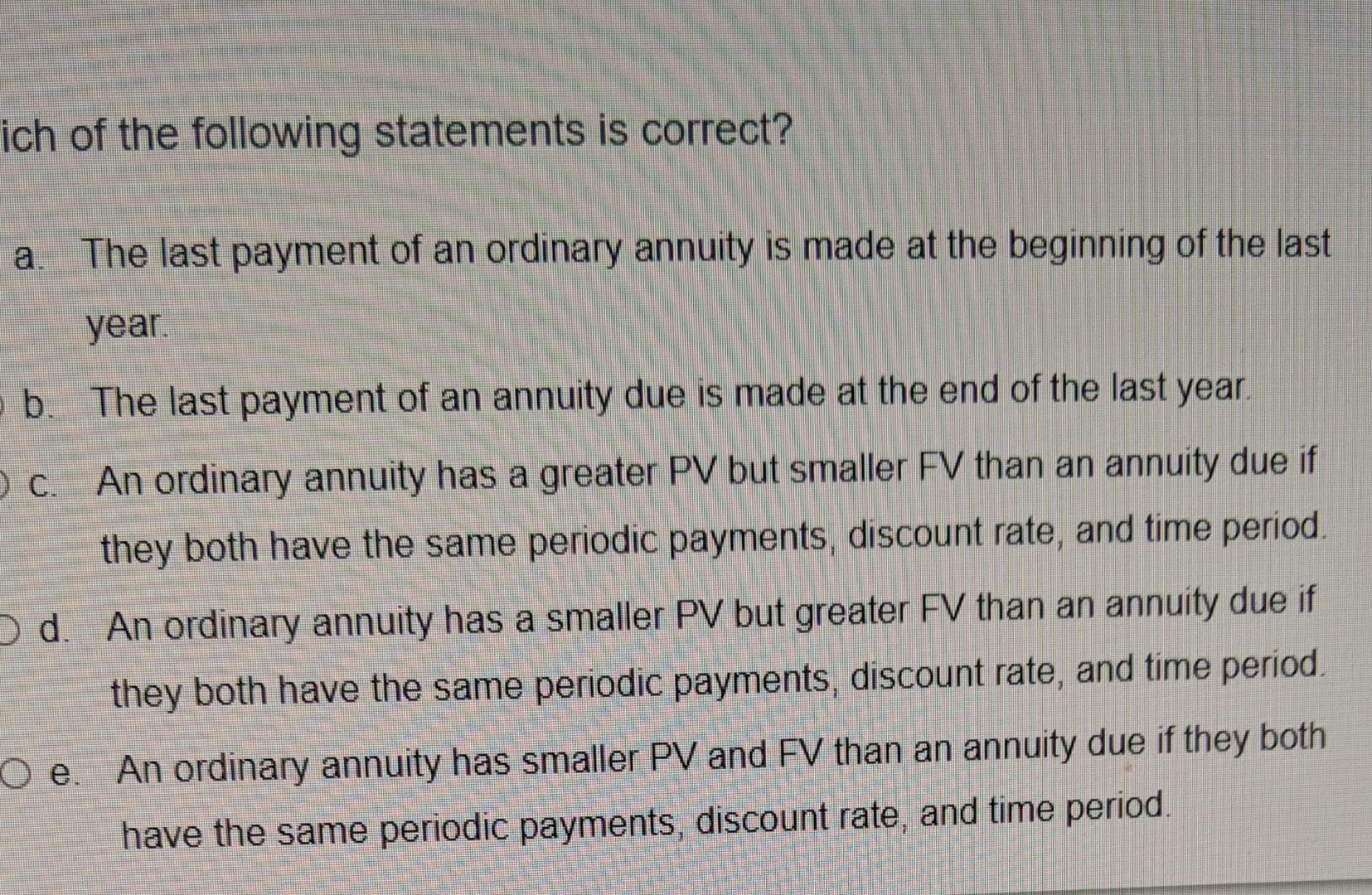

Which of the following bond prices is most sensitive to market rate changes? The par value is $1,000 for all. O a 6 years, 45% coupon rate, 3% YTM Ob 10 years, 4.5% coupon rate, 2 99% YTM c. 6 years, 5.5% coupon rate, 4% YTM Od 10 years, 5.5% coupon rate, 3% YTM e. 10 years, zero coupon bond, 2.99% YTM Clear my choice An investment pays $457 every second year for 20 years (a total of 10 payments). The first payment is paid today. Your opportunity cost is 8% compounded semi-annually. The present value of this investment is $ (Note: please retain at least 4 decimal places in your calculations and at least 2 decimal places in the final answer.) ich of the following statements is correct? The last payment of an ordinary annuity is made at the beginning of the last year. b. The last payment of an annuity due is made at the end of the last year. C. An ordinary annuity has a greater PV but smaller FV than an annuity due if they both have the same periodic payments, discount rate, and time period d. An ordinary annuity has a smaller PV but greater FV than an annuity due if they both have the same periodic payments, discount rate, and time period. O e. An ordinary annuity has smaller PV and FV than an annuity due if they both have the same periodic payments, discount rate, and time period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started