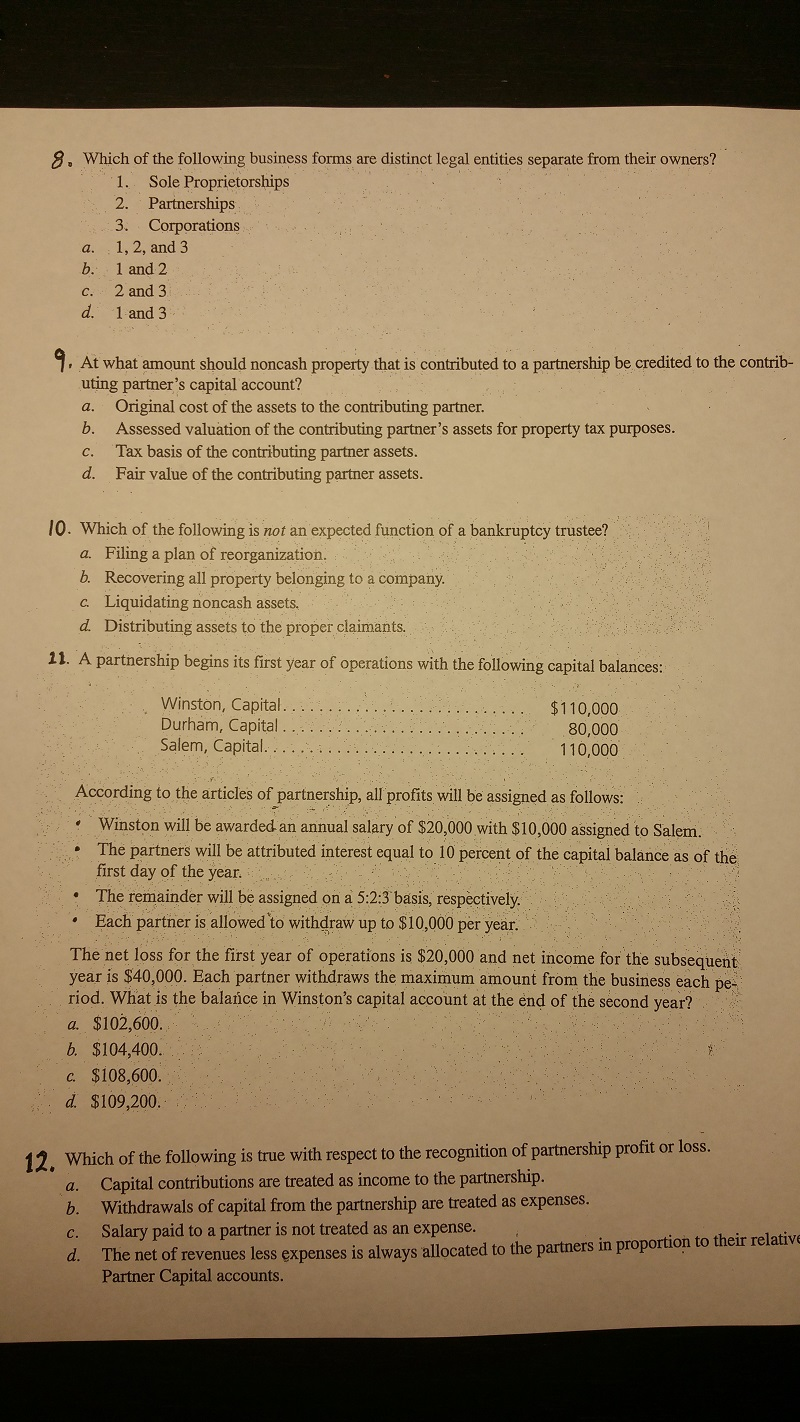

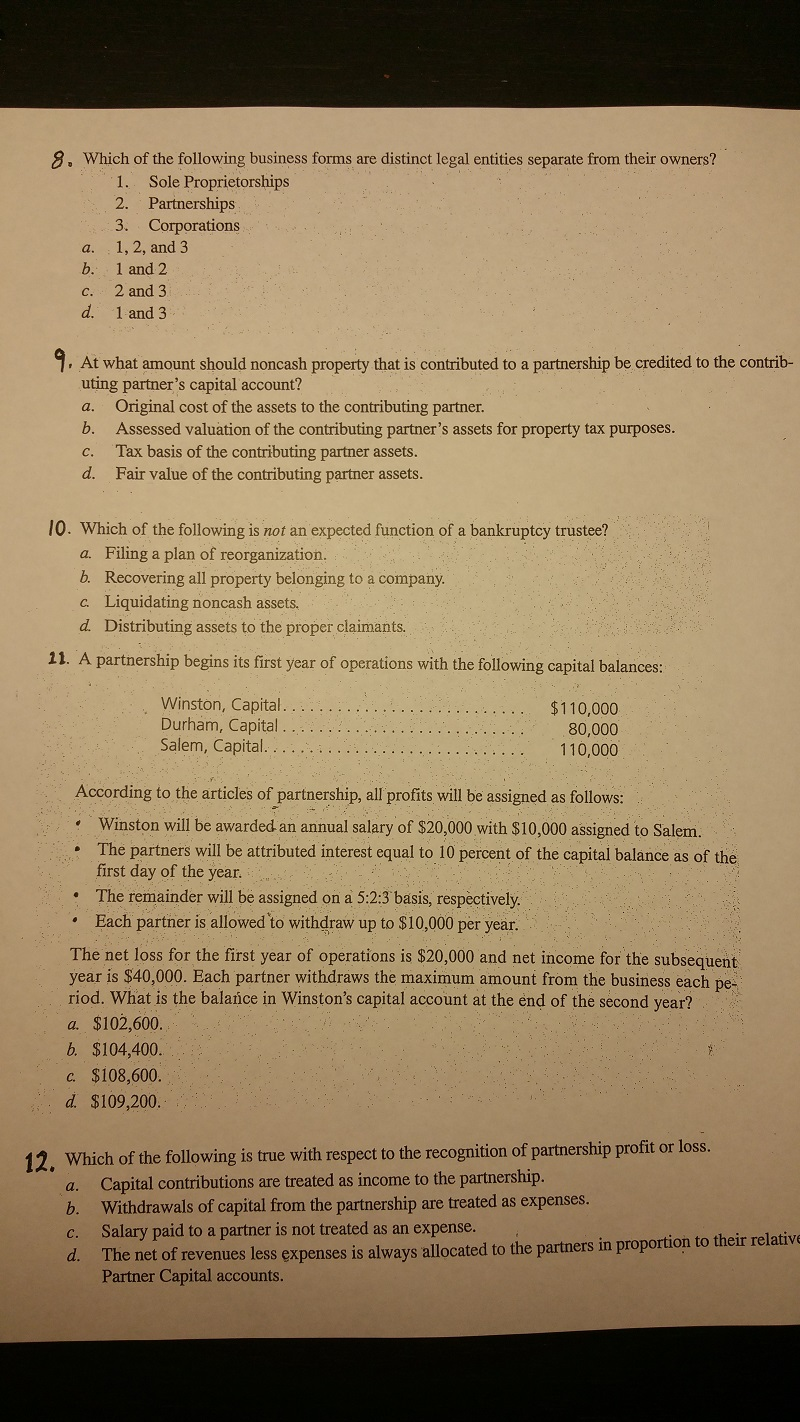

Which of the following business forms are distinct legal entities separate from their owners? 1. Sole Proprietorships 2. Partnerships 3. Corporations a. 1, 2, and 3 b. 1 and 2 c. 2 and 3 d. 1 and 3 9. At what amount should noncash property that is contributed to a partnership be credited to the contributing partner's capital account? a. Original cost of the assets to the contributing partner. b. Assessed valuation of the contributing partner's assets for property tax purposes. c. Tax basis of the contributing partner assets. d. Fair value of the contributing partner assets. 10. Which of the following is not an expected function of a bankruptcy trustee? a. Filing a plan of reorganization. b. Recovering all property belonging to a company. a Liquidating noncash assets. d. Distributing assets to the proper claimants. 11. A partnership begins its first year of operations with the following capital balances: Winston, Capital $110,000 Durham, Capital 80,000 Salem, Capital 110,000 According to the articles of partnership, all profits will be assigned as follows: Winston will be awarded-an annual salary of $20,000 with $10,000 assigned to Salem. The partners will be attributed interest equal to 10 percent of the capital balance as of the first day of the year. The remainder will be assigned on a 5:2:3 basis, respectively. Each partner is allowed 'to withdraw up to $10,000 per year. The net loss for the first year of operations is $20,000 and net income for the subsequent year is $40,000. Each partner withdraws the maximum amount from the business each period. What is the balance in Winston's capital account at the end of the second year? a. $102,600. b. $104,400 c. $108,600. d. $109,200. 12. Which of the following is true with respect to the recognition of partnership profit or loss. a. Capital contributions are treated as income to the partnership. b. Withdrawals of capital from the partnership are treated as expenses. c. Salary paid to a partner is not treated as an expense. d. The net of revenues less expenses is always allocated to the partners in proportion to their relative Partner Capital accounts