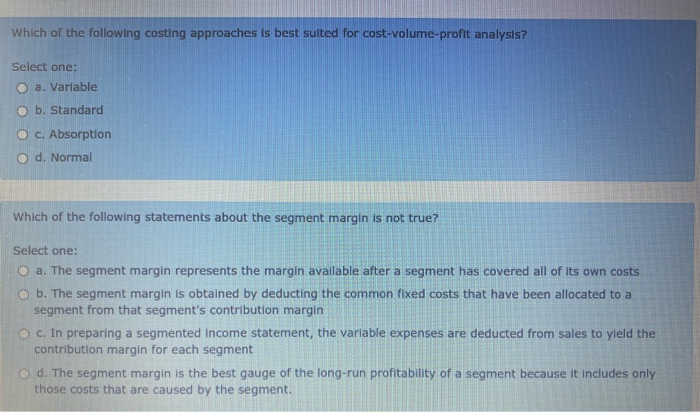

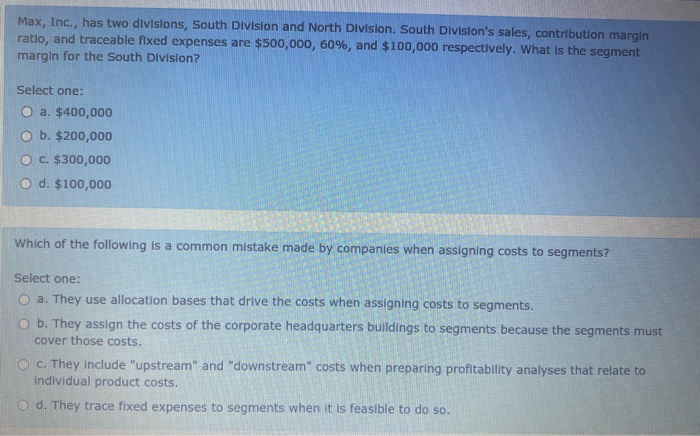

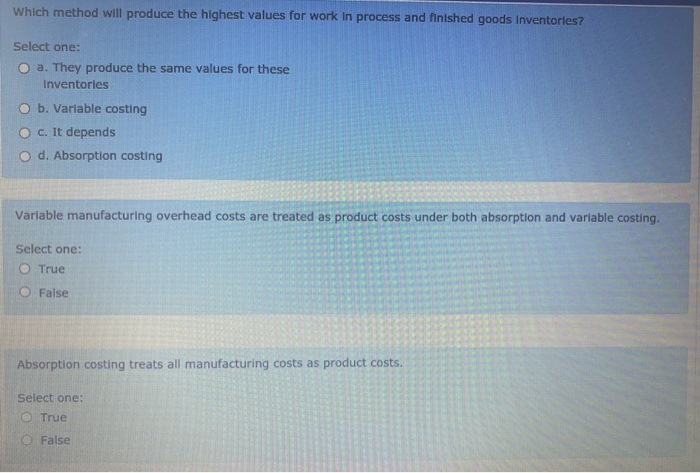

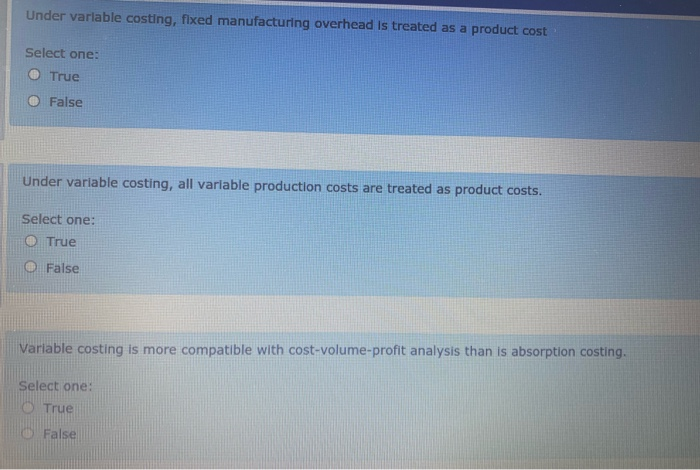

Which of the following costing approaches is best suited for cost-volume-profit analysis? Select one: a. Variable b. Standard c. Absorption d. Normal Which of the following statements about the segment margin is not true? Select one: O a. The segment margin represents the margin available after a segment has covered all of its own costs O b. The segment margin is obtained by deducting the common fixed costs that have been allocated to a segment from that segment's contribution margin c. In preparing a segmented income statement, the variable expenses are deducted from sales to yield the contribution margin for each segment O d. The segment margin is the best gauge of the long-run profitability of a segment because it includes only those costs that are caused by the segment. Max, Inc., has two divisions, South Division and North Division. South Division's sales, contribution margin ratio, and traceable fixed expenses are $500,000, 60%, and $100,000 respectively. What is the segment margin for the South Division? Select one: O a. $400,000 O b. $200,000 O c. $300,000 O d. $100,000 Which of the following is a common mistake made by companies when assigning costs to segments? Select one: O a. They use allocation bases that drive the costs when assigning costs to segments. O b. They assign the costs of the corporate headquarters buildings to segments because the segments must cover those costs. O c. They include "upstream" and "downstream" costs when preparing profitability analyses that relate to individual product costs. Od. They trace fixed expenses to segments when it is feasible to do so. Which method will produce the highest values for work in process and finished goods inventories? Select one: O a. They produce the same values for these Inventories b. Variable costing O c. It depends d. Absorption costing Variable manufacturing overhead costs are treated as product costs under both absorption and variable costing. Select one: True False Absorption costing treats all manufacturing costs as product costs. Select one: True False Under variable costing, fixed manufacturing overhead is treated as a product cost Select one: True False Under variable costing, all variable production costs are treated as product costs. Select one: True False Variable costing is more compatible with cost-volume-profit analysis than is absorption costing. Select one: True False