Answered step by step

Verified Expert Solution

Question

1 Approved Answer

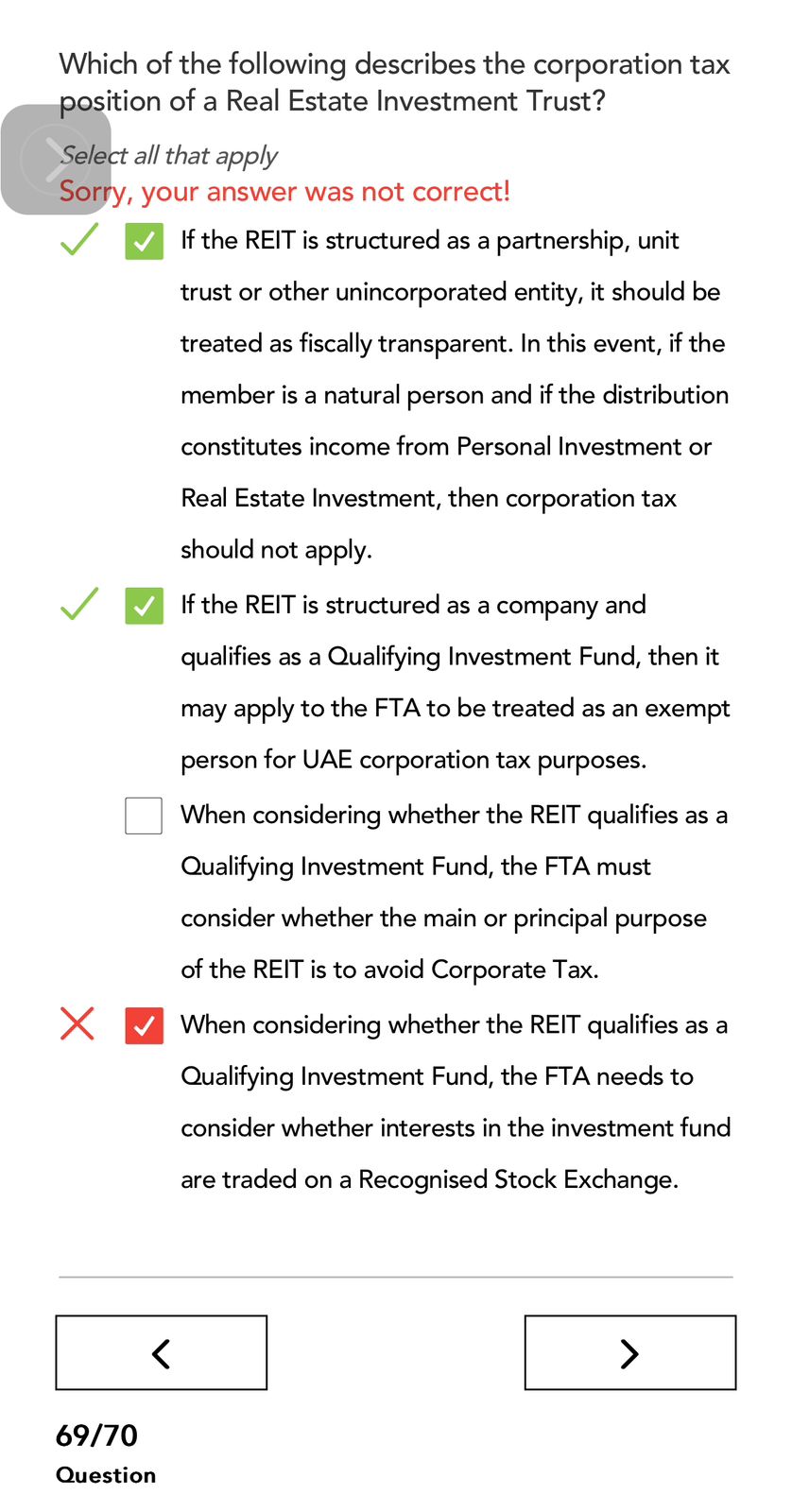

Which of the following describes the corporation tax position of a Real Estate Investment Trust? Select all that apply Sorry, your answer was not correct!

Which of the following describes the corporation tax

position of a Real Estate Investment Trust?

Select all that apply

Sorry, your answer was not correct!

If the REIT is structured as a partnership, unit

trust or other unincorporated entity, it should be

treated as fiscally transparent. In this event, if the

member is a natural person and if the distribution

constitutes income from Personal Investment or

Real Estate Investment, then corporation tax

should not apply.

If the REIT is structured as a company and

qualifies as a Qualifying Investment Fund, then it

may apply to the FTA to be treated as an exempt

person for UAE corporation tax purposes.

When considering whether the REIT qualifies as a

Qualifying Investment Fund, the FTA must

consider whether the main or principal purpose

of the REIT is to avoid Corporate Tax.

When considering whether the REIT qualifies as a

Qualifying Investment Fund, the FTA needs to

consider whether interests in the investment fund

are traded on a Recognised Stock Exchange.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started