Answered step by step

Verified Expert Solution

Question

1 Approved Answer

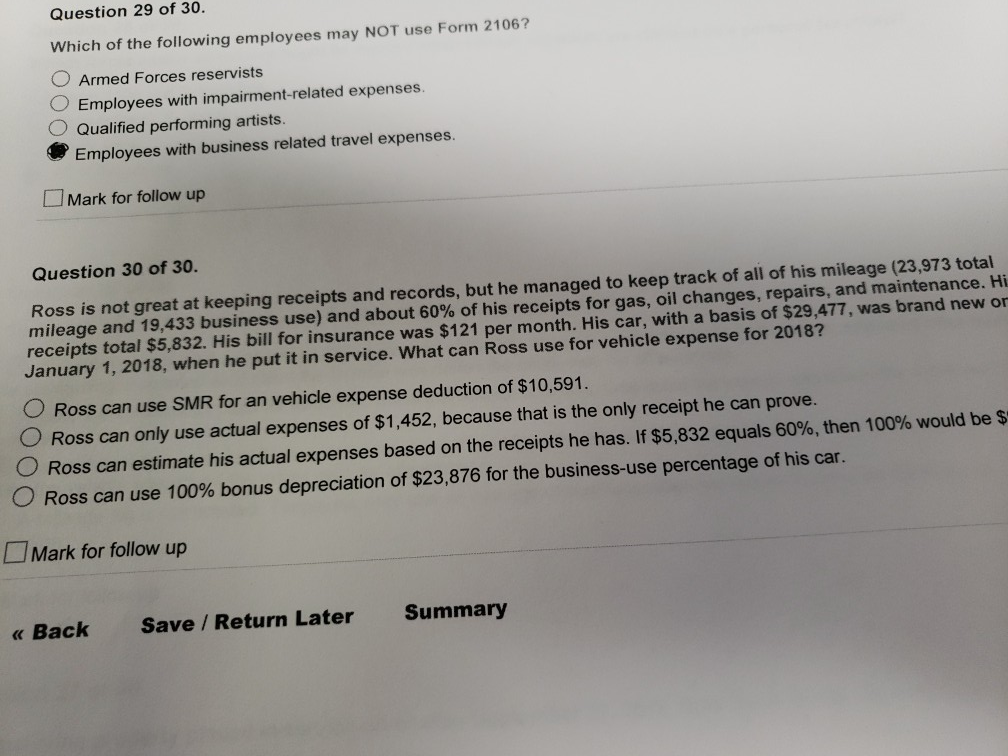

Which of the following employees may NOT use Form 2106? O Armed Forces reservists O Employees with impairment-related expenses. O Qualified performing artists. Employees with

Which of the following employees may NOT use Form 2106? O Armed Forces reservists O Employees with impairment-related expenses. O Qualified performing artists. Employees with business related travel expenses. Mark for follow up Question 30 of 30. Ross is not great at keeping receipts and records, but he managed to keep track of all of his mileage (23,973 total mileage and 19,433 business use) and about 60% of his receipts for gas, oil changes, repairs, and maintenance. H receipts total $5,832. His bill for insurance was $121 per month. His car, with a basis of $29,477, was brand new ou January 1, 2018, when he put it in service. What can Ross use for vehicle expense for 2018? O Ross can use SMR for an vehicle expense deduction of $10,591. O Ross can only use actual expenses of $1,452, because that is the only receipt he can prove. O Ross can estimate his actual expenses based on the receipts he has. If $5,832 equals 60%, then 100% would be $ Ross can use 100% bonus depreciation of $23,876 for the business-use percentage of his car. Mark for follow up Back Save / Return Later Summary Which of the following employees may NOT use Form 2106? O Armed Forces reservists O Employees with impairment-related expenses. O Qualified performing artists. Employees with business related travel expenses. Mark for follow up Question 30 of 30. Ross is not great at keeping receipts and records, but he managed to keep track of all of his mileage (23,973 total mileage and 19,433 business use) and about 60% of his receipts for gas, oil changes, repairs, and maintenance. H receipts total $5,832. His bill for insurance was $121 per month. His car, with a basis of $29,477, was brand new ou January 1, 2018, when he put it in service. What can Ross use for vehicle expense for 2018? O Ross can use SMR for an vehicle expense deduction of $10,591. O Ross can only use actual expenses of $1,452, because that is the only receipt he can prove. O Ross can estimate his actual expenses based on the receipts he has. If $5,832 equals 60%, then 100% would be $ Ross can use 100% bonus depreciation of $23,876 for the business-use percentage of his car. Mark for follow up Back Save / Return Later Summary

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started