Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following factors is ( are ) often considered to be a problem with hedged positions? I. Uncertainty with roll - over of

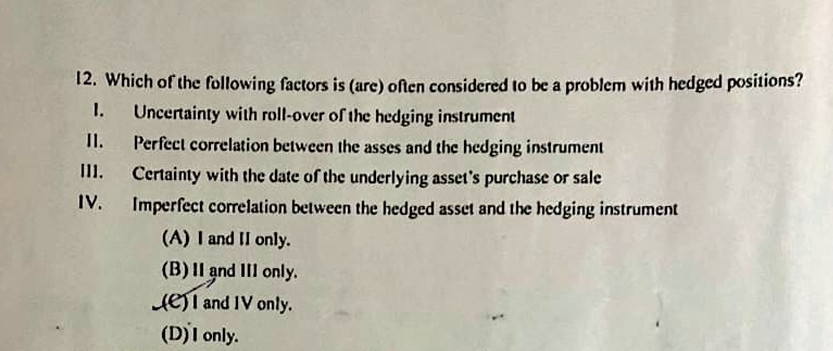

Which of the following factors is are often considered to be a problem with hedged positions?

I. Uncertainty with rollover of the hedging instrument

II Perfect correlation between the asses and the hedging instrument

III. Certainty with the date of the underlying asset's purchase or sale

IV Imperfect correlation between the hedged asset and the hedging instrument

A I and II only.

B II and III only.

C I and IV only.

D I only.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started