Answered step by step

Verified Expert Solution

Question

1 Approved Answer

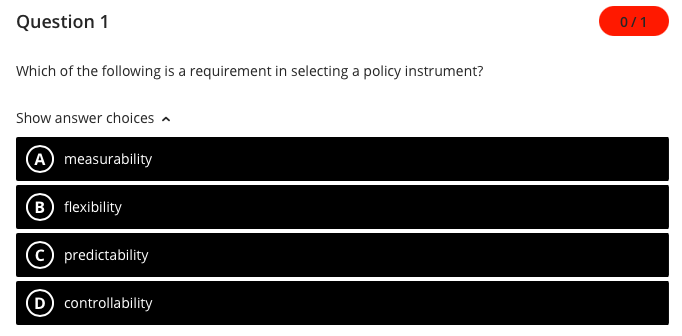

Which of the following is a requirement in selecting a policy instrument? Show answer choices ^ (A) measurability B flexibility (C) predictability (D) controllability Question

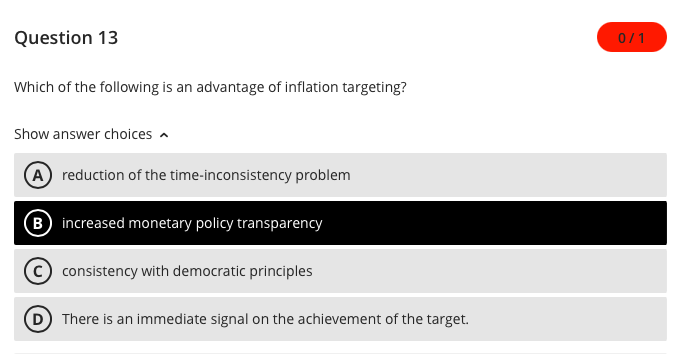

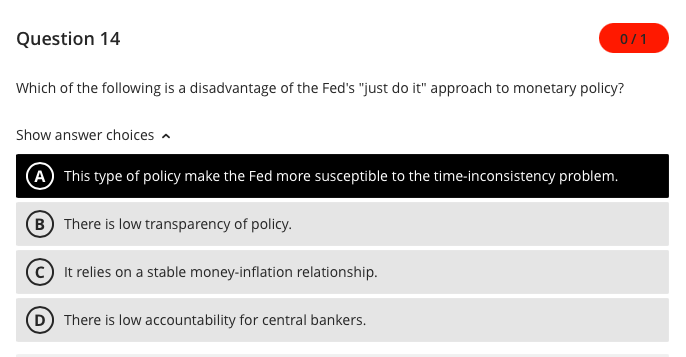

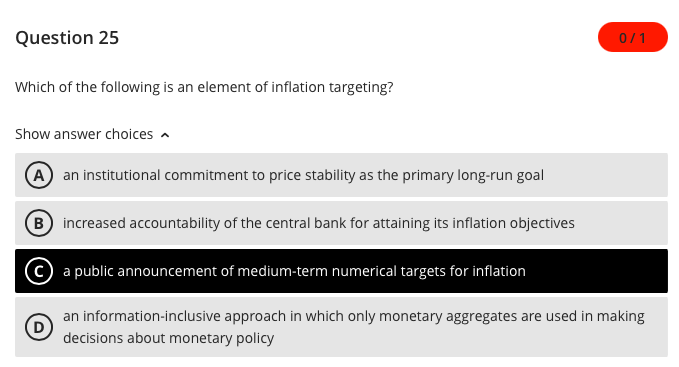

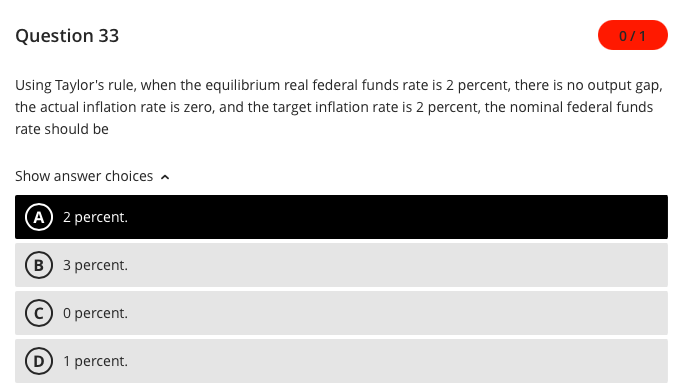

Which of the following is a requirement in selecting a policy instrument? Show answer choices ^ (A) measurability B flexibility (C) predictability (D) controllability Question 13 Which of the following is an advantage of inflation targeting? Show answer choices ^ reduction of the time-inconsistency problem increased monetary policy transparency consistency with democratic principles D There is an immediate signal on the achievement of the target. Question 25 Which of the following is an element of inflation targeting? Show answer choices an institutional commitment to price stability as the primary long-run goal increased accountability of the central bank for attaining its inflation objectives a public announcement of medium-term numerical targets for inflation an information-inclusive approach in which only monetary aggregates are used in making decisions about monetary policy Which of the following is a disadvantage of the Fed's "just do it" approach to monetary policy? Show answer choices ^ This type of policy make the Fed more susceptible to the time-inconsistency problem. There is low transparency of policy. It relies on a stable money-inflation relationship. There is low accountability for central bankers. Using Taylor's rule, when the equilibrium real federal funds rate is 2 percent, there is no output gap, the actual inflation rate is zero, and the target inflation rate is 2 percent, the nominal federal funds rate should be Show answer choices 2 percent. B) 3 percent. 0 percent. 1 percent

Which of the following is a requirement in selecting a policy instrument? Show answer choices ^ (A) measurability B flexibility (C) predictability (D) controllability Question 13 Which of the following is an advantage of inflation targeting? Show answer choices ^ reduction of the time-inconsistency problem increased monetary policy transparency consistency with democratic principles D There is an immediate signal on the achievement of the target. Question 25 Which of the following is an element of inflation targeting? Show answer choices an institutional commitment to price stability as the primary long-run goal increased accountability of the central bank for attaining its inflation objectives a public announcement of medium-term numerical targets for inflation an information-inclusive approach in which only monetary aggregates are used in making decisions about monetary policy Which of the following is a disadvantage of the Fed's "just do it" approach to monetary policy? Show answer choices ^ This type of policy make the Fed more susceptible to the time-inconsistency problem. There is low transparency of policy. It relies on a stable money-inflation relationship. There is low accountability for central bankers. Using Taylor's rule, when the equilibrium real federal funds rate is 2 percent, there is no output gap, the actual inflation rate is zero, and the target inflation rate is 2 percent, the nominal federal funds rate should be Show answer choices 2 percent. B) 3 percent. 0 percent. 1 percent Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started