Answered step by step

Verified Expert Solution

Question

1 Approved Answer

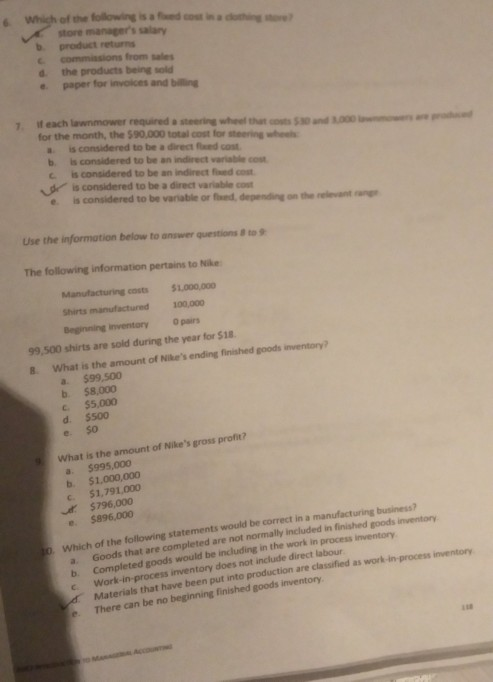

Which of the following is afectado product returns commissions from wes the products being sold paper for invoices and big d 1 Weach lawnmower required

Which of the following is afectado product returns commissions from wes the products being sold paper for invoices and big d 1 Weach lawnmower required a string where that for the month, the 590,000 total cost for s ingh is considered to be a direct feed cost b is considered to be an indirect vari os is considered to be an indirected cost de is considered to be a direct variable cost considered to be able or feed down the Use the information below to answer questions to The following information pertains to Nike Manufacturing costs 51.000.000 Shirts manufactured 100.000 Beginning inventory 99,500 shirts are sold during the year for $18. What is the amount of Nike's ending finished goods inventory? $99,500 b. 58.000 $5,000 d. $500 e. So What is the amount of Nike's gross profit? a $995,000 b. $1,000,000 C. 51,791,000 $796,000 $896,000 of the chat reds wou Which of the following statements would be correct in a manufacturing Goods that are completed are not normally included in finished roodsinvento Completed goods would be including in the work in process inventory Work-in-process inventory does not include direct labour Materials that have been put into production are classified as work-in-process inventory There can be no beginning finished goods inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started