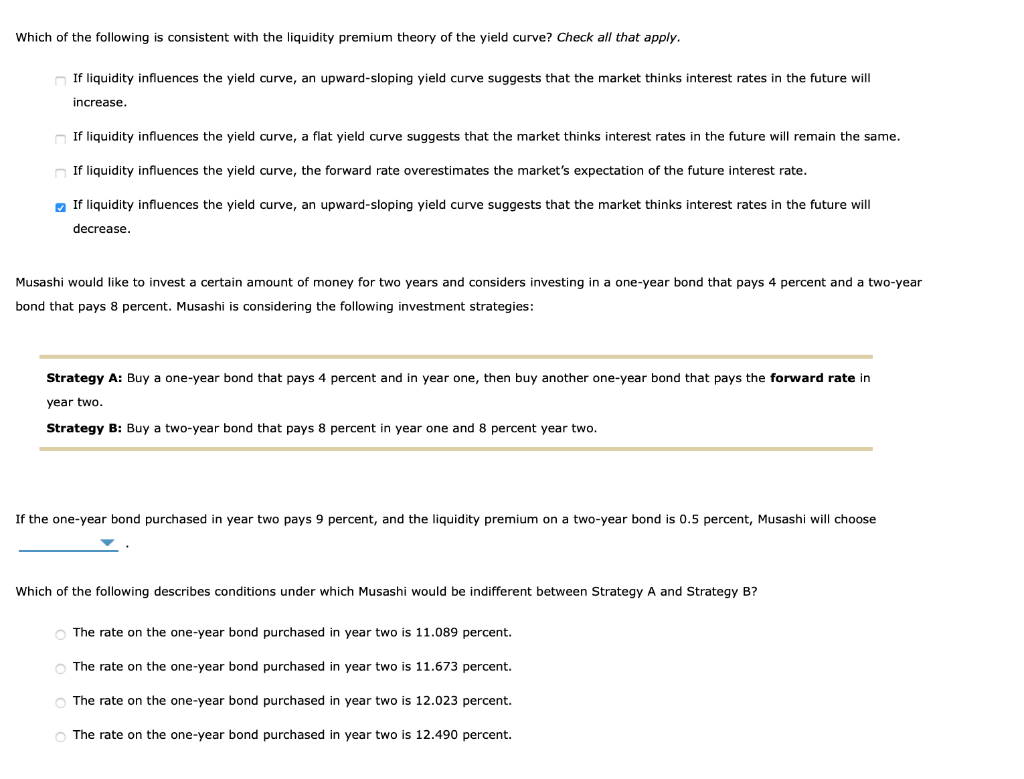

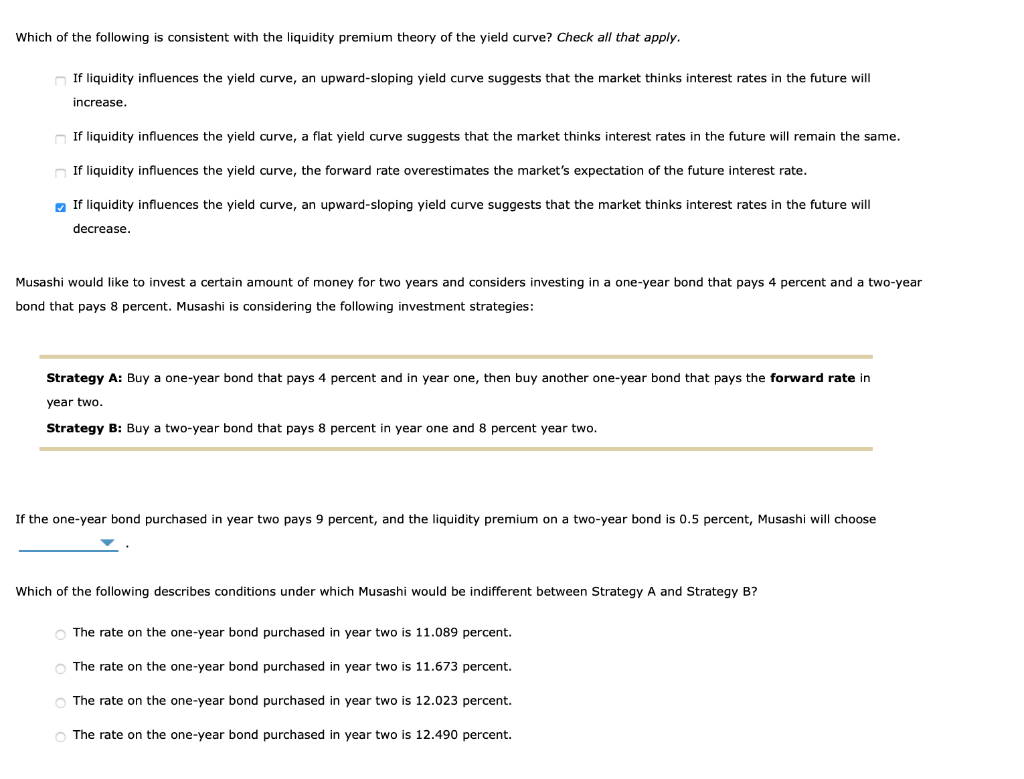

Which of the following is consistent with the liquidity premium theory of the yield curve? Check all that apply. If liquidity influences the yield curve, an upward-sloping yield curve suggests that the market thinks interest rates in the future will increase If liquidity influences the yield curve, a flat yield curve suggests that the market thinks interest rates in the future will remain the same. If liquidity influences the yield curve, the forward rate overestimates the market's expectation of the future interest rate. If liquidity influences the yield curve, an upward-sloping yield curve suggests that the market thinks interest rates in the future will decrease. percent and a two-year Musashi would like to invest a certain amount of money for two years and considers investing in a one-year bond that pays bond that pays 8 percent. Musashi is considering the following investment strategies: Strategy A: Buy a one-year bond that pays 4 percent and in year one, then buy another one-year bond that pays the forward rate in year two. Strategy B: Buy a two-year bond that pays 8 percent in year one and 8 percent year two. If the one-year bond purchased in year two pays 9 percent, and the liquidity premium on a two-year bond is 0.5 percent, Musashi will choose Which of the following describes conditions under which Musashi would be indifferent between Strategy A and Strategy B? The rate on the one-year bond purchased in year two is 11.089 percent. The rate on the one-year bond purchased in year two is 11.673 percent. The rate on the one-year bond purchased in year two is 12.023 percent. The rate on the one-year bond purchased in year two is 12.490 percent. Which of the following is consistent with the liquidity premium theory of the yield curve? Check all that apply. If liquidity influences the yield curve, an upward-sloping yield curve suggests that the market thinks interest rates in the future will increase If liquidity influences the yield curve, a flat yield curve suggests that the market thinks interest rates in the future will remain the same. If liquidity influences the yield curve, the forward rate overestimates the market's expectation of the future interest rate. If liquidity influences the yield curve, an upward-sloping yield curve suggests that the market thinks interest rates in the future will decrease. percent and a two-year Musashi would like to invest a certain amount of money for two years and considers investing in a one-year bond that pays bond that pays 8 percent. Musashi is considering the following investment strategies: Strategy A: Buy a one-year bond that pays 4 percent and in year one, then buy another one-year bond that pays the forward rate in year two. Strategy B: Buy a two-year bond that pays 8 percent in year one and 8 percent year two. If the one-year bond purchased in year two pays 9 percent, and the liquidity premium on a two-year bond is 0.5 percent, Musashi will choose Which of the following describes conditions under which Musashi would be indifferent between Strategy A and Strategy B? The rate on the one-year bond purchased in year two is 11.089 percent. The rate on the one-year bond purchased in year two is 11.673 percent. The rate on the one-year bond purchased in year two is 12.023 percent. The rate on the one-year bond purchased in year two is 12.490 percent