Answered step by step

Verified Expert Solution

Question

1 Approved Answer

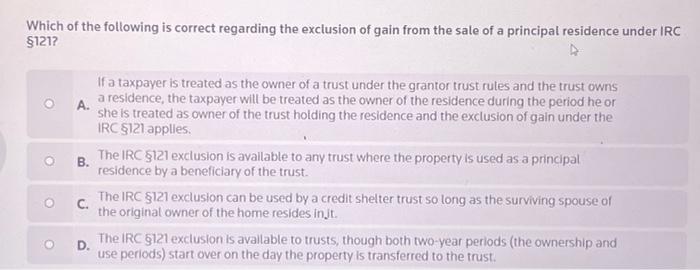

Which of the following is correct regarding the exclusion of gain from the sale of a principal residence under IRC 121? O O O A.

Which of the following is correct regarding the exclusion of gain from the sale of a principal residence under IRC 121? O O O A. If a taxpayer is treated as the owner of a trust under the grantor trust rules and the trust owns a residence, the taxpayer will be treated as the owner of the residence during the period he or she is treated as owner of the trust holding the residence and the exclusion of gain under the IRC 121 applies. B. The IRC 121 exclusion is available to any trust where the property is used as a principal residence by a beneficiary of the trust. C. The IRC 121 exclusion can be used by a credit shelter trust so long as the surviving spouse of the original owner of the home resides in it. D. The IRC 121 exclusion is available to trusts, though both two-year periods (the ownership and use periods) start over on the day the property is transferred to the trust.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started