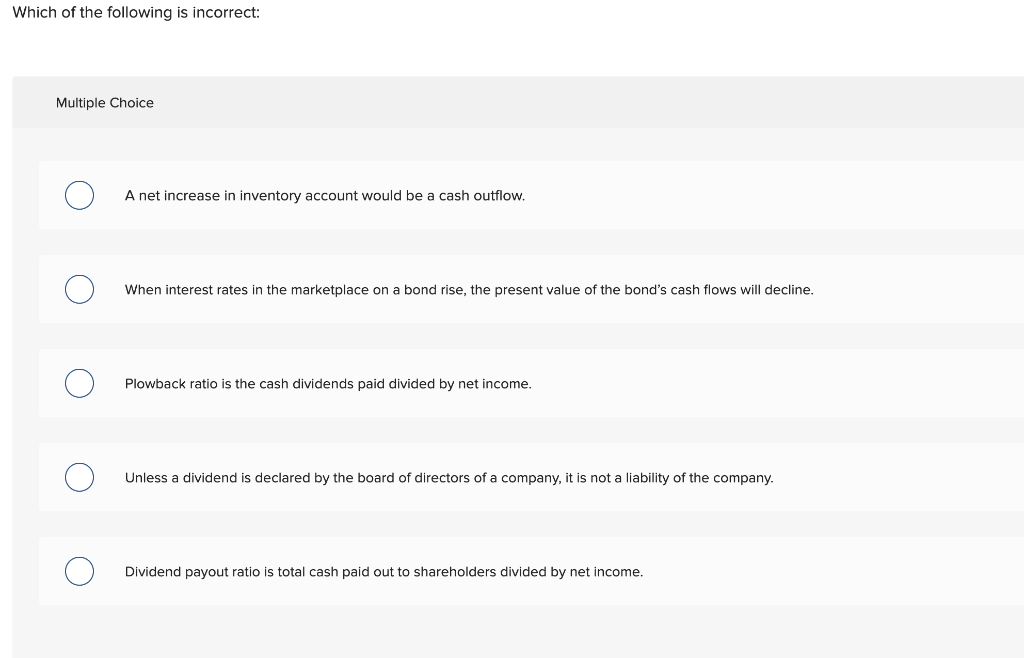

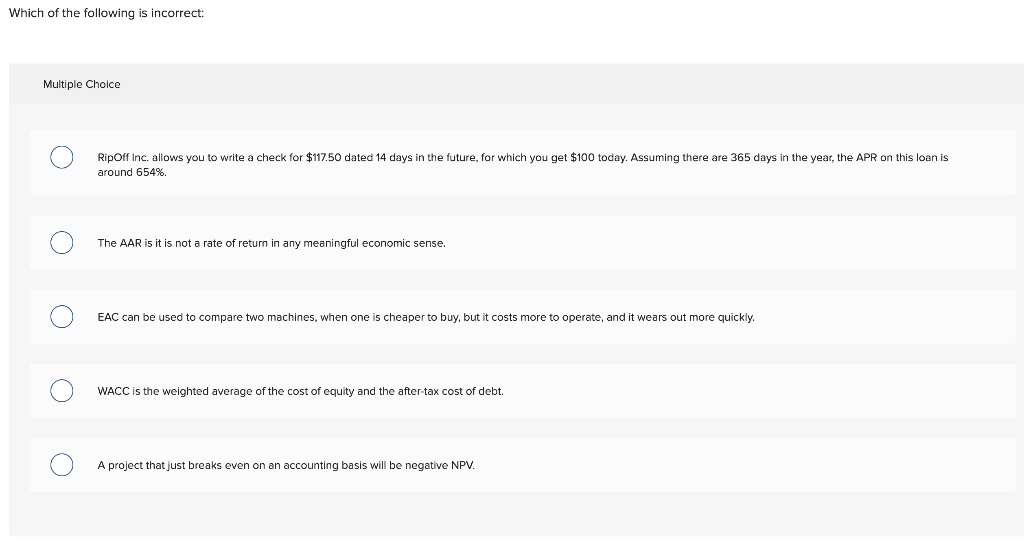

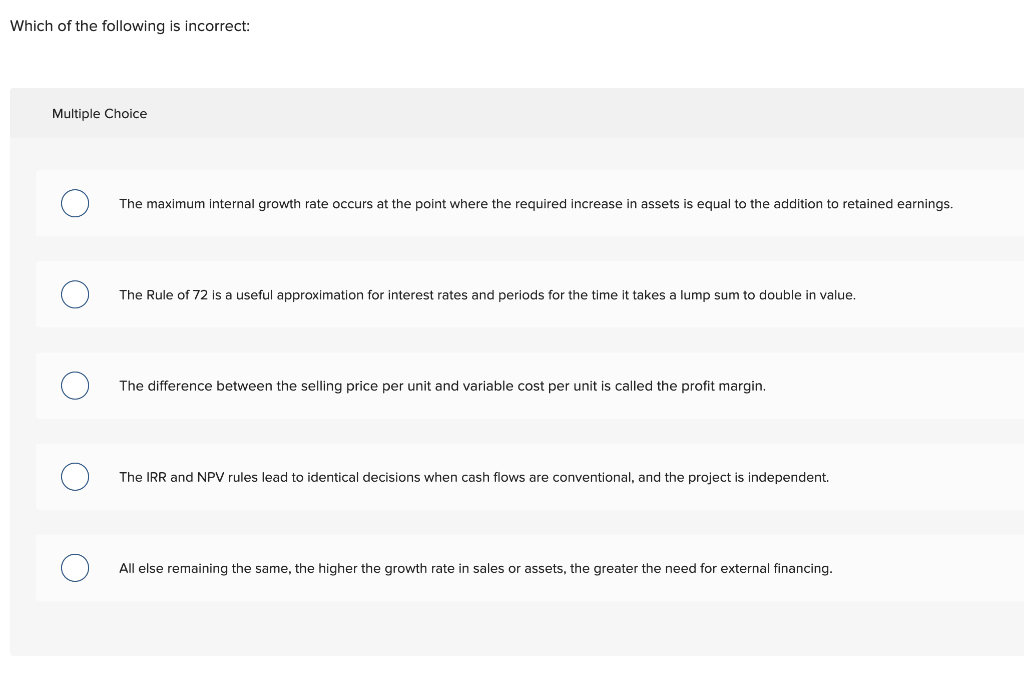

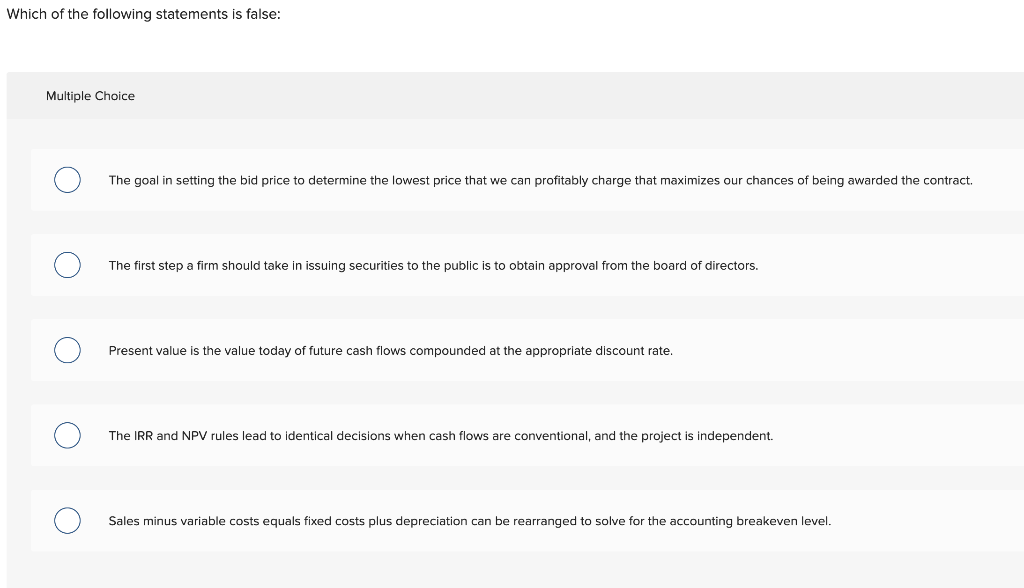

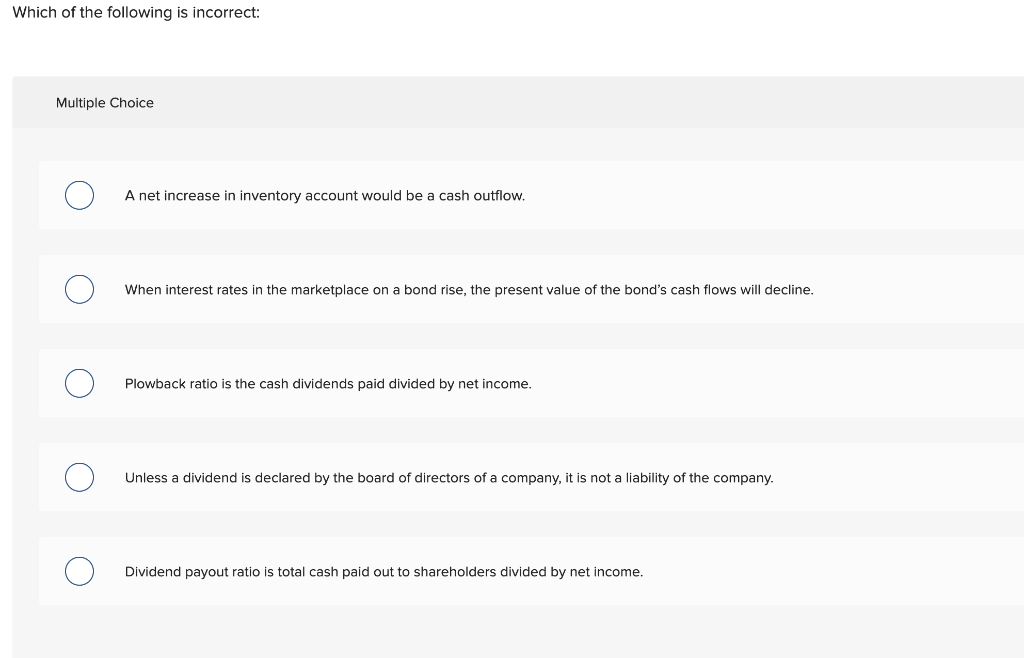

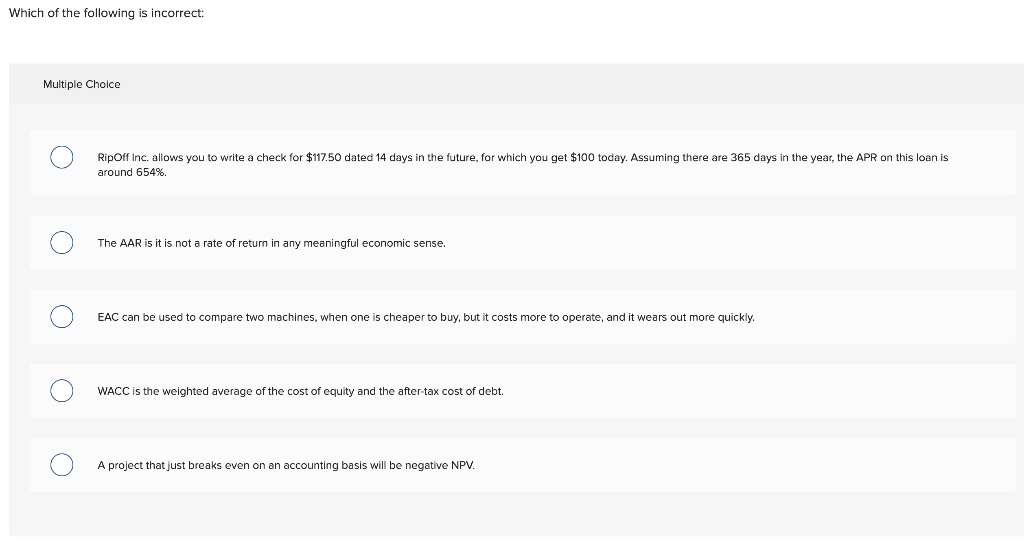

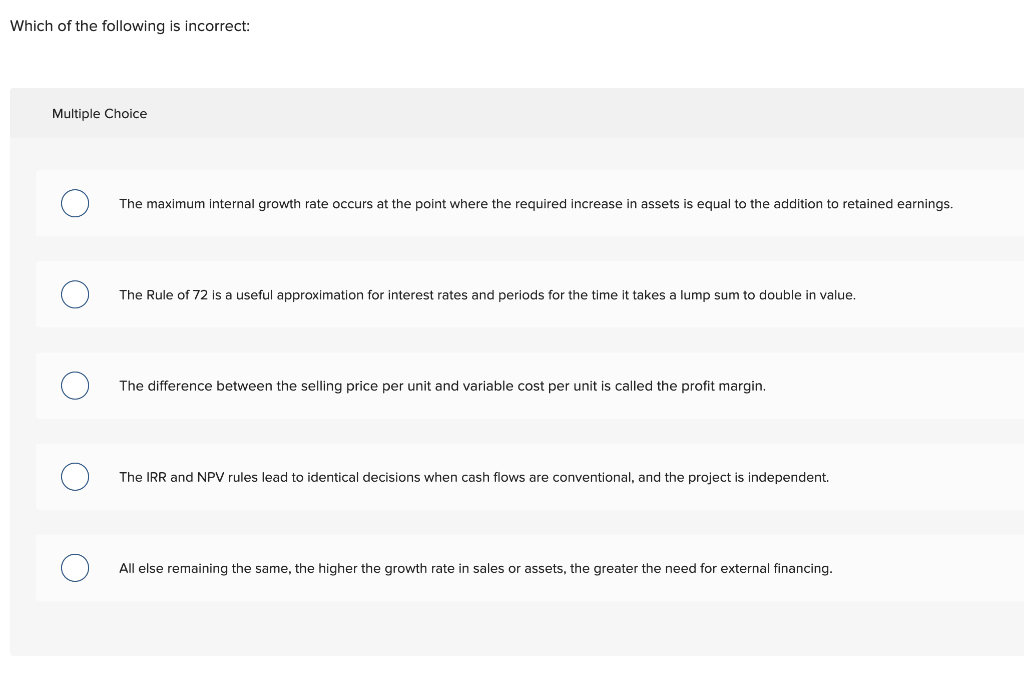

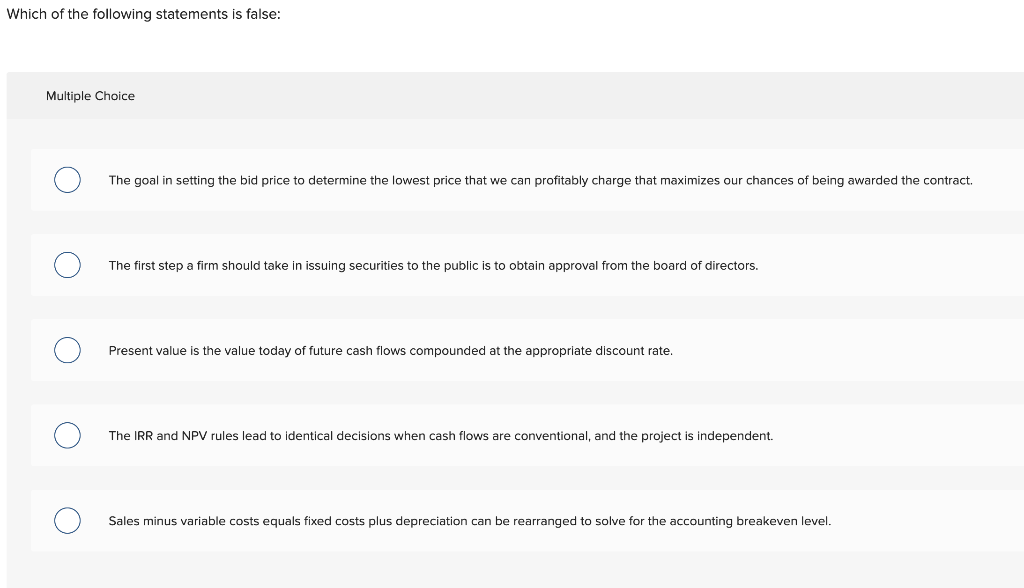

Which of the following is incorrect: Multiple Choice A net increase in inventory account would be a cash outflow. When interest rates in the marketplace on a bond rise, the present value of the bond's cash flows will decline. Plowback ratio is the cash dividends paid divided by net income. O Unless a dividend is declared by the board of directors of a company, it is not a liability of the company. Dividend payout ratio is total cash paid out to shareholders divided by net income. Which of the following is incorrect: Multiple Choice RipOff Inc. allows you to write a check for $117.50 dated 14 days in the future, for which you get $100 today. Assuming there are 365 days in the year, the APR on this loan is around 654% The AAR is it is not a rate of return in any meaningful economic sense. a EAC can be used to compare two machines, when one is cheaper to buy, but it costs more to operate, and it wears out more quickly. a WACC is the weighted average of the cost of equity and the after-tax cost of debt. A project that just breaks even on an accounting basis will be negative NPV. Which of the following is incorrect: Multiple Choice The maximum internal growth rate occurs at the point where the required increase in assets is equal to the addition to retained earnings. The Rule of 72 is a useful approximation for interest rates and periods for the time it takes a lump sum to double in value. The difference between the selling price per unit and variable cost per unit is called the profit margin. O The IRR and NPV rules lead to identical decisions when cash flows are conventional, and the project is independent. O All else remaining the same, the higher the growth rate in sales or assets, the greater the need for external financing. Which of the following statements is false: Multiple Choice The goal in setting the bid price to determine the lowest price that we can profitably charge that maximizes our chances of being awarded the contract. O The first step a firm should take in issuing securities to the public is to obtain approval from the board of directors. Present value is the value today of future cash flows compounded at the appropriate discount rate. The IRR and NPV rules lead to identical decisions when cash flows are conventional, and the project is independent. Sales minus variable costs equals fixed costs plus depreciation can be rearranged to solve for the accounting breakeven level