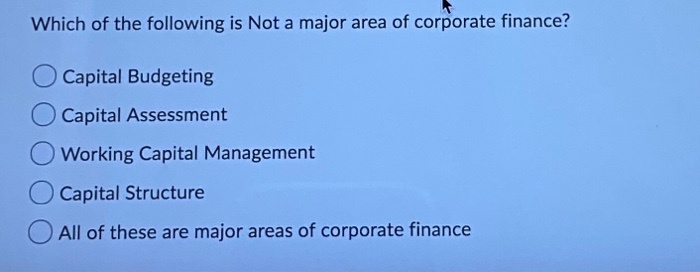

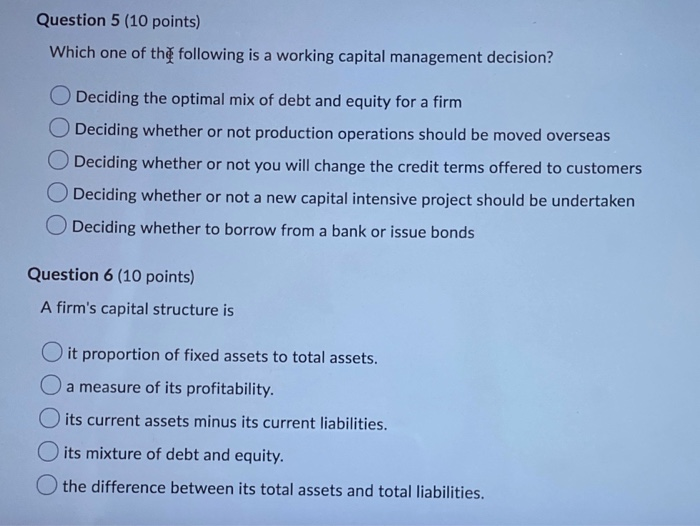

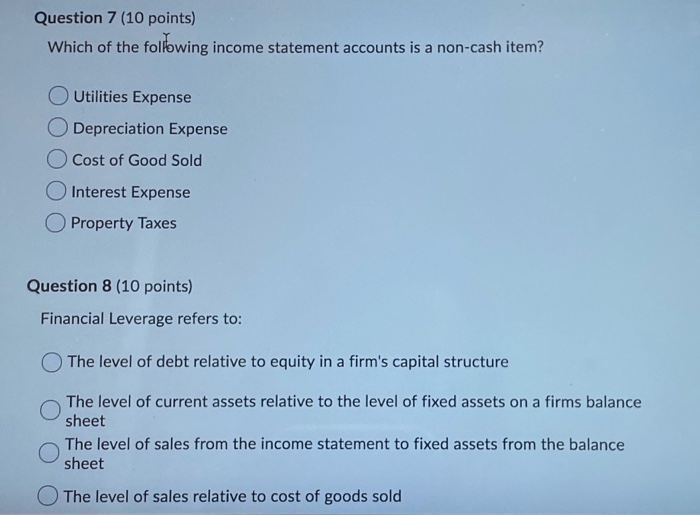

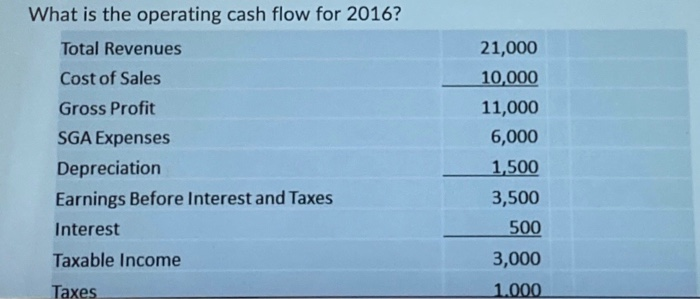

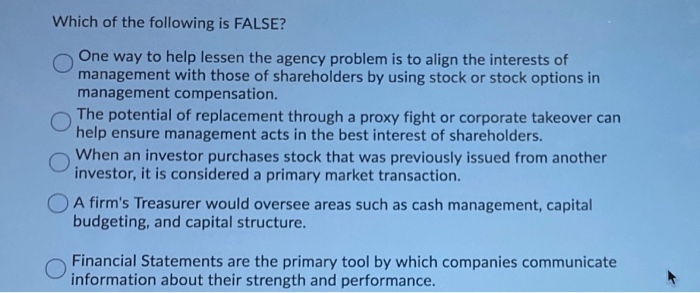

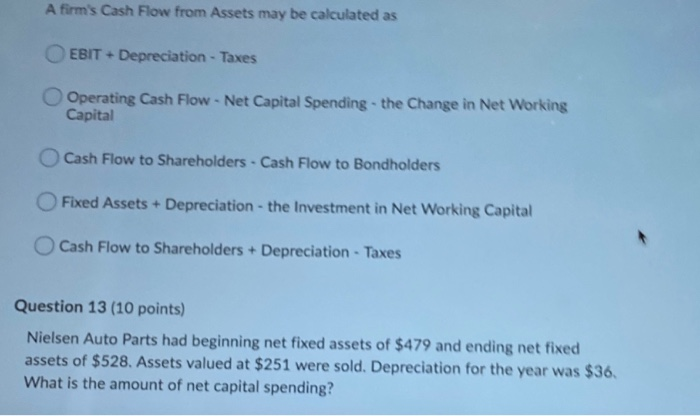

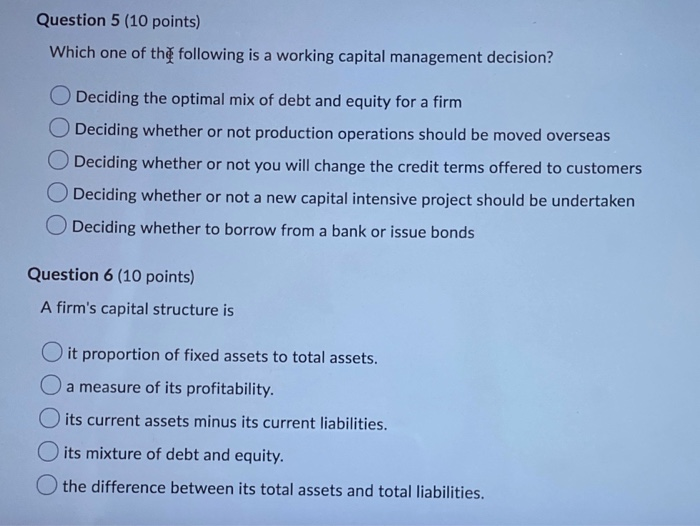

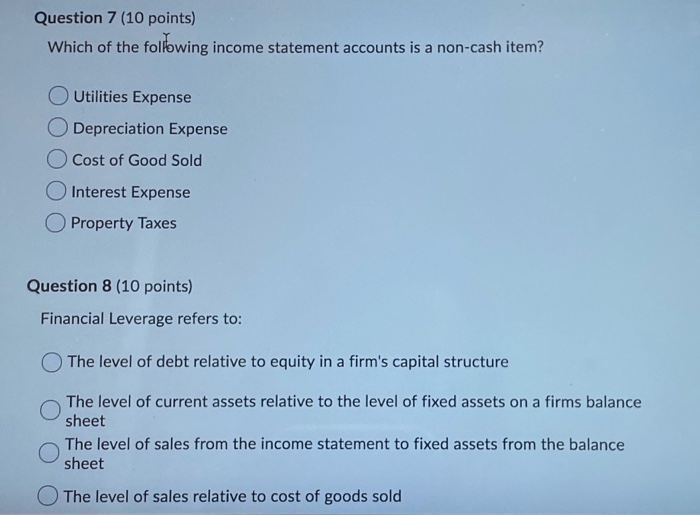

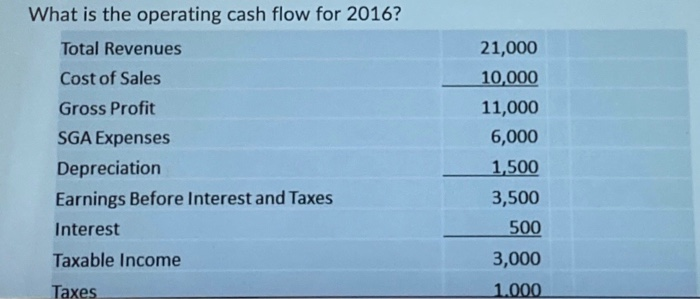

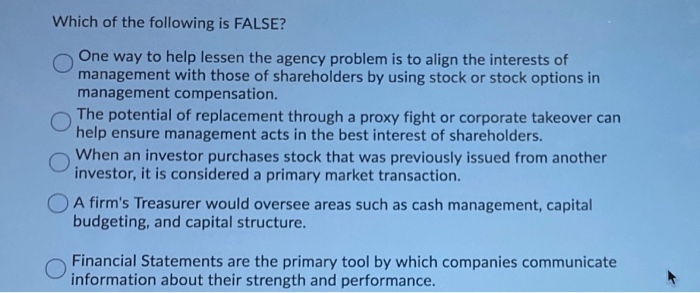

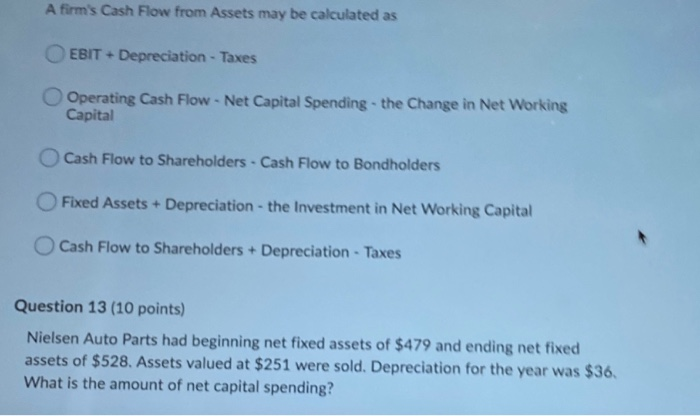

Which of the following is Not a major area of corporate finance? O Capital Budgeting O Capital Assessment O Working Capital Management O Capital Structure O All of these are major areas of corporate finance Question 5 (10 points) Which one of the following is a working capital management decision? O Deciding the optimal mix of debt and equity for a firm O Deciding whether or not production operations should be moved overseas O Deciding whether or not you will change the credit terms offered to customers Deciding whether or not a new capital intensive project should be undertaken Deciding whether to borrow from a bank or issue bonds Question 6 (10 points) A firm's capital structure is O it proportion of fixed assets to total assets. O a measure of its profitability. O its current assets minus its current liabilities. O its mixture of debt and equity. the difference between its total assets and total liabilities. Question 7 (10 points) Which of the following income statement accounts is a non-cash item? Utilities Expense Depreciation Expense Cost of Good Sold Interest Expense Property Taxes Question 8 (10 points) Financial Leverage refers to: The level of debt relative to equity in a firm's capital structure The level of current assets relative to the level of fixed assets on a firms balance sheet The level of sales from the income statement to fixed assets from the balance sheet The level of sales relative to cost of goods sold What is the operating cash flow for 2016? Total Revenues Cost of Sales Gross Profit SGA Expenses Depreciation Earnings Before Interest and Taxes Interest Taxable income Taxes 21,000 10,000 11,000 6,000 1,500 3,500 500 3,000 1.000 Which of the following is FALSE? One way to help lessen the agency problem is to align the interests of management with those of shareholders by using stock or stock options in management compensation. The potential of replacement through a proxy fight or corporate takeover can help ensure management acts in the best interest of shareholders. When an investor purchases stock that was previously issued from another investor, it is considered a primary market transaction. A firm's Treasurer would oversee areas such as cash management, capital budgeting, and capital structure. O Financial Statements are the primary tool by which companies communicate information about their strength and performance. A firm's Cash Flow from Assets may be calculated as EBIT + Depreciation - Taxes Operating Cash Flow - Net Capital Spending - the Change in Net Working Capital Cash Flow to Shareholders - Cash Flow to Bondholders Fixed Assets + Depreciation - the Investment in Net Working Capital Cash Flow to Shareholders + Depreciation - Taxes Question 13 (10 points) Nielsen Auto Parts had beginning net fixed assets of $479 and ending net fixed assets of $528. Assets valued at $251 were sold. Depreciation for the year was $36. What is the amount of net capital spending