Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following is NOT a potential problem when estimating and using betas, i.e., which statement is FALSE? O The beta coefficient of a

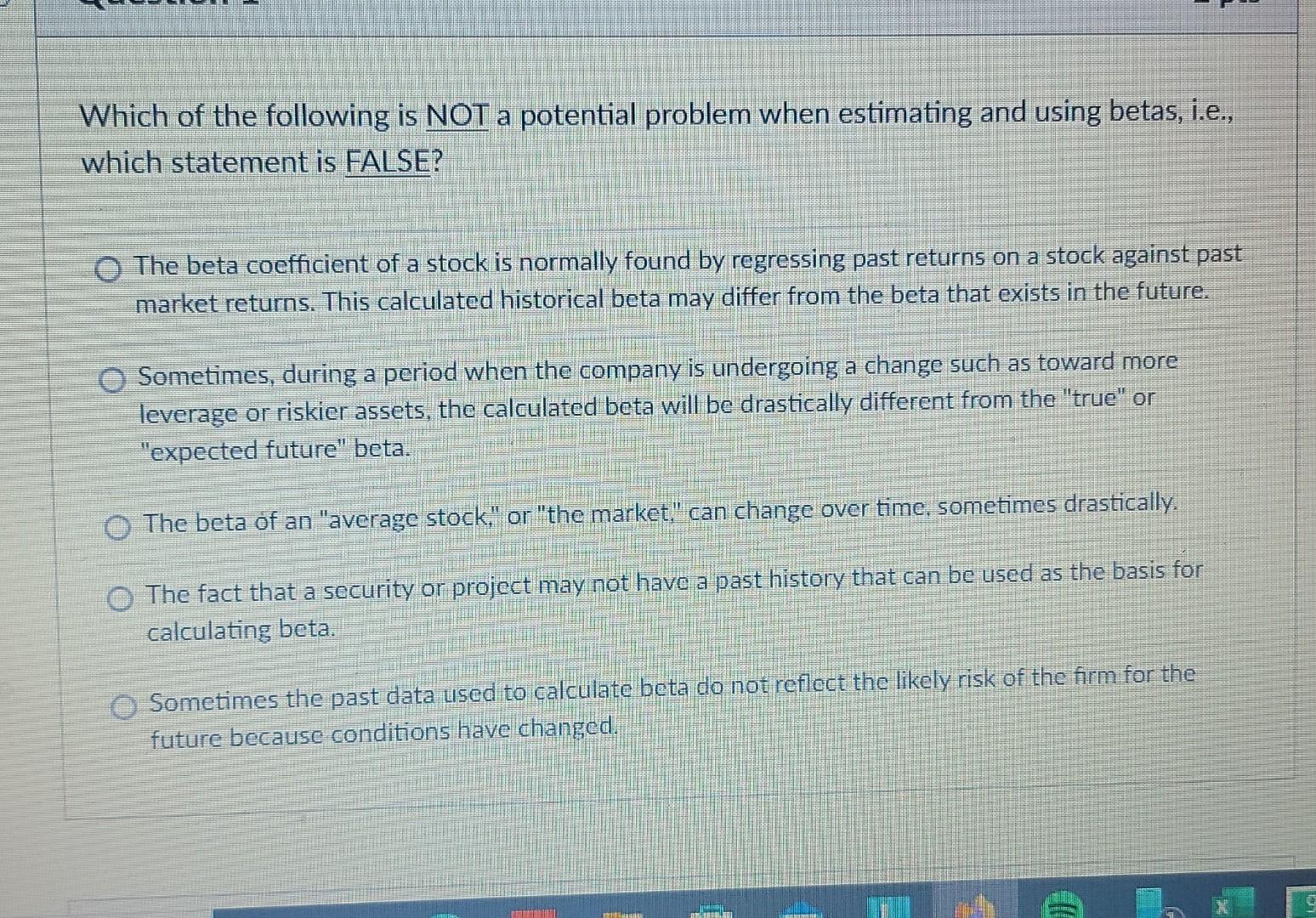

Which of the following is NOT a potential problem when estimating and using betas, i.e., which statement is FALSE? O The beta coefficient of a stock is normally found by regressing past returns on a stock against past market returns. This calculated historical beta may differ from the beta that exists in the future. Sometimes, during a period when the company is undergoing a change such as toward more leverage or riskier assets, the calculated beta will be drastically different from the "true" or "expected future" beta. O The beta of an "average stock," or "the market." can change over time, sometimes drastically. The fact that a security or project may not have a past history that can be used as the basis for calculating beta. Sometimes the past data used to calculate beta do not reflect the likely risk of the firm for the future because conditions have changed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started