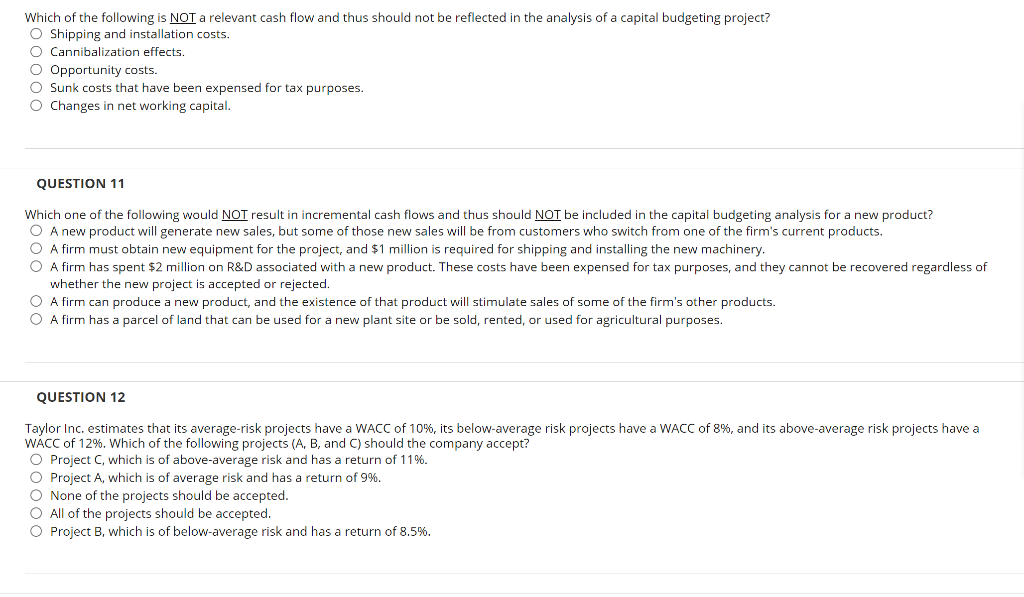

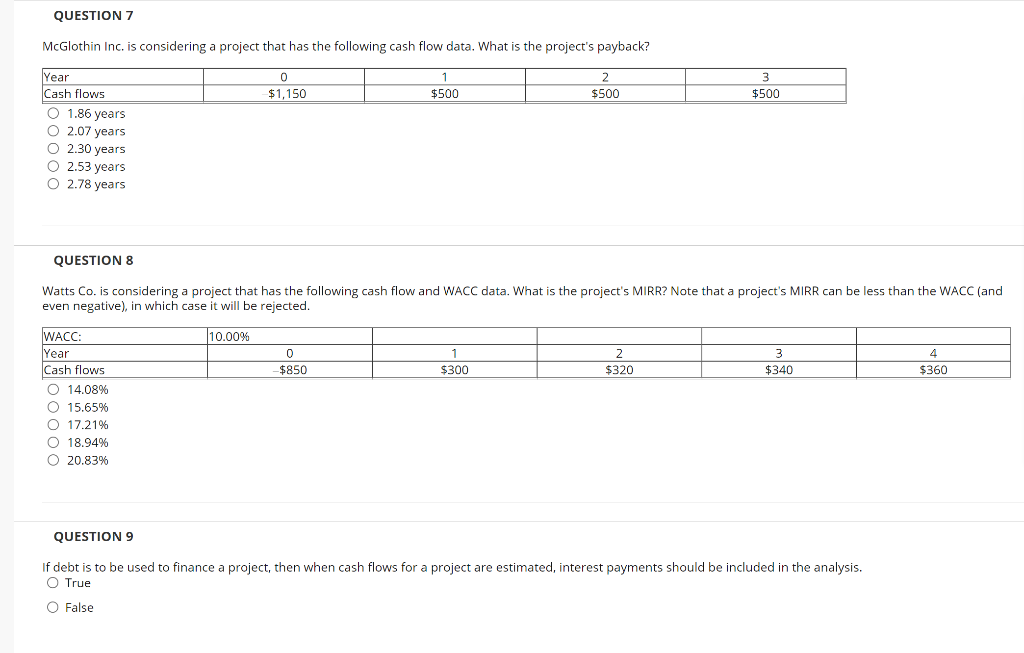

Which of the following is NOT a relevant cash flow and thus should not be reflected in the analysis of a capital budgeting project? O Shipping and installation costs. O Cannibalization effects. O Opportunity costs. O Sunk costs that have been expensed for tax purposes. Changes in net working capital. QUESTION 11 Which one of the following would NOT result in incremental cash flows and thus should NOT be included in the capital budgeting analysis for a new product? O A new product will generate new sales, but some of those new sales will be from customers who switch from one of the firm's current products, A firm must obtain new equipment for the project, and $1 million is required for shipping and installing the new machinery. O A firm has spent $2 million on R&D associated with a new product. These costs have been expensed for tax purposes, and they cannot be recovered regardless of whether the new project is accepted or rejected. A firm can produce a new product, and the existence of that product will stimulate sales of some of the firm's other products. A firm has a parcel of land that can be used for a new plant site or be sold, rented, or used for agricultural purposes. QUESTION 12 Taylor Inc. estimates that its average-risk projects have a WACC of 10%, its below-average risk projects have a WACC of 8%, and its above-average risk projects have a WACC of 12%. Which of the following projects (A, B, and C) should the company accept? O Project C, which is of above-average risk and has a return of 11%. O Project A, which is of average risk and has a return of 9%. None of the projects should be accepted. All of the projects should be accepted. Project B, which is of below-average risk and has a return of 8.5%. QUESTION 7 McGlothin Inc. is considering a project that has the following cash flow data. What is the project's payback? 0 $1,150 1 $500 2 $500 3 $500 Year Cash flows 1.86 years 02.07 years O 2.30 years O 2.53 years O 2.78 years QUESTION 8 Watts Co. is considering a project that has the following cash flow and WACC data. What is the project's MIRR? Note that a project's MIRR can be less than the WACC (and even negative), in which case it will be rejected. 10.00% 0 1 $300 2 $320 3 $340 $850 4 $360 WACC: Year Cash flows O 14.08% O 15.65% O 17.21% O 18.94% O 20.83% QUESTION 9 If debt is to be used to finance a project, then when cash flows for a project are estimated, interest payments should be included in the analysis. O True O False