which of the following is not an asset

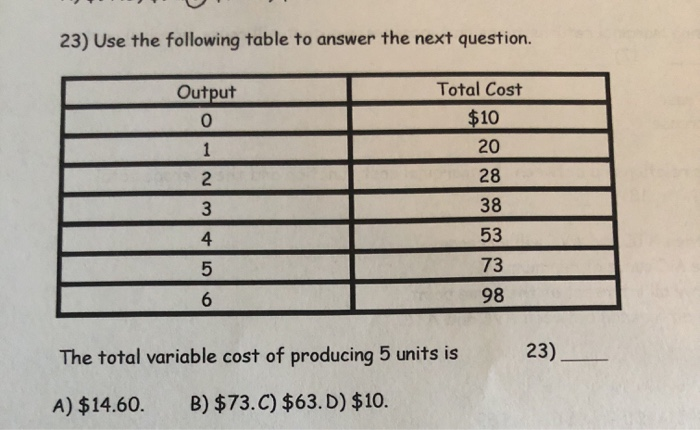

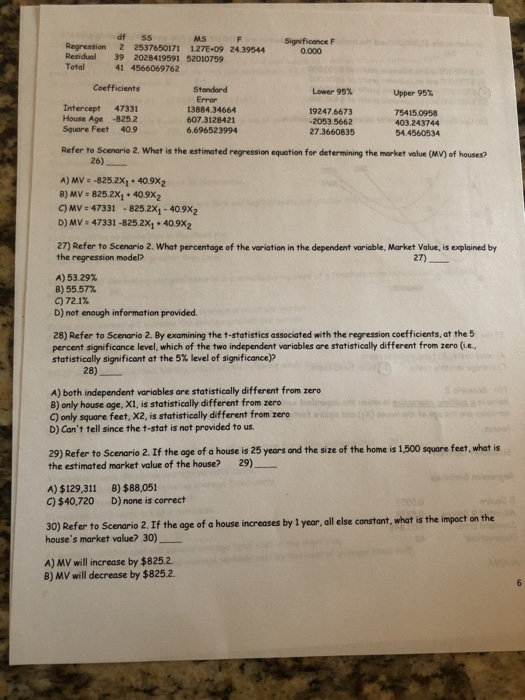

23) Use the following table to answer the next question. Output 0 Total Cost $10 20 1 2 28 3 38 4 53 5 73 98 6 The total variable cost of producing 5 units is 23). A) $14.60. B) $73.C) $63.D) $10. df SS MSF 2 2537650171 127E-09 24.39544 39 2028419591 52010759 41 4566069762 Regression Residual Total Significance F 0.000 Coefficients Standard Lower 95% Upper 95% Error Intercept 47331 13884.34664 19247,6673 75415.0958 House Age-825.2 607.3128421 -2053.5662 403.243744 Square Feet 40.9 6.696523994 27.3660835 54.4560534 Refer to Scenario 2. What is the estimated regression equation for determining the market value (MV) of houses? 26) A) MV -825.2%,. 40.9X2 B) MV825.2X1 40.9X2 C) MV =47331 - 825.2X1 - 40.9X2 D) MV.47331 -825,2X1. 40.9X2 27) Refer to Scenario 2. What percentage of the variation in the dependent variable, Market Value, is explained by the regression model 27) A) 53.29% B) 55.57% C) 72.1% D) not enough information provided. 28) Refer to Scenario 2. By examining the t-statistics associated with the regression coefficients at the 5 percent significance level, which of the two independent variables are statistically different from zero (ie.. statistically significant at the 5% level of significance)? 28) A) both independent variables are statistically different from zero B) only house age, X1, is statistically different from zero only square feet, X2, is statistically different from zero D) Can't tell since the t-stat is not provided to us. 29) Refer to Scenario 2. If the age of a house is 25 years and the size of the home is 1,500 square feet, what is the estimated market value of the house? 29) A) $129,311 C) $40,720 B) $88,051 D) none is correct 30) Refer to Scenario 2. If the age of a house increases by 1 year, all else constant, what is the impact on the house's market value? 30) A) MV will increase by $825.2. B) MV will decrease by $825.2. 6 23) Use the following table to answer the next question. Output 0 Total Cost $10 20 1 2 28 3 38 4 53 5 73 98 6 The total variable cost of producing 5 units is 23). A) $14.60. B) $73.C) $63.D) $10. df SS MSF 2 2537650171 127E-09 24.39544 39 2028419591 52010759 41 4566069762 Regression Residual Total Significance F 0.000 Coefficients Standard Lower 95% Upper 95% Error Intercept 47331 13884.34664 19247,6673 75415.0958 House Age-825.2 607.3128421 -2053.5662 403.243744 Square Feet 40.9 6.696523994 27.3660835 54.4560534 Refer to Scenario 2. What is the estimated regression equation for determining the market value (MV) of houses? 26) A) MV -825.2%,. 40.9X2 B) MV825.2X1 40.9X2 C) MV =47331 - 825.2X1 - 40.9X2 D) MV.47331 -825,2X1. 40.9X2 27) Refer to Scenario 2. What percentage of the variation in the dependent variable, Market Value, is explained by the regression model 27) A) 53.29% B) 55.57% C) 72.1% D) not enough information provided. 28) Refer to Scenario 2. By examining the t-statistics associated with the regression coefficients at the 5 percent significance level, which of the two independent variables are statistically different from zero (ie.. statistically significant at the 5% level of significance)? 28) A) both independent variables are statistically different from zero B) only house age, X1, is statistically different from zero only square feet, X2, is statistically different from zero D) Can't tell since the t-stat is not provided to us. 29) Refer to Scenario 2. If the age of a house is 25 years and the size of the home is 1,500 square feet, what is the estimated market value of the house? 29) A) $129,311 C) $40,720 B) $88,051 D) none is correct 30) Refer to Scenario 2. If the age of a house increases by 1 year, all else constant, what is the impact on the house's market value? 30) A) MV will increase by $825.2. B) MV will decrease by $825.2. 6