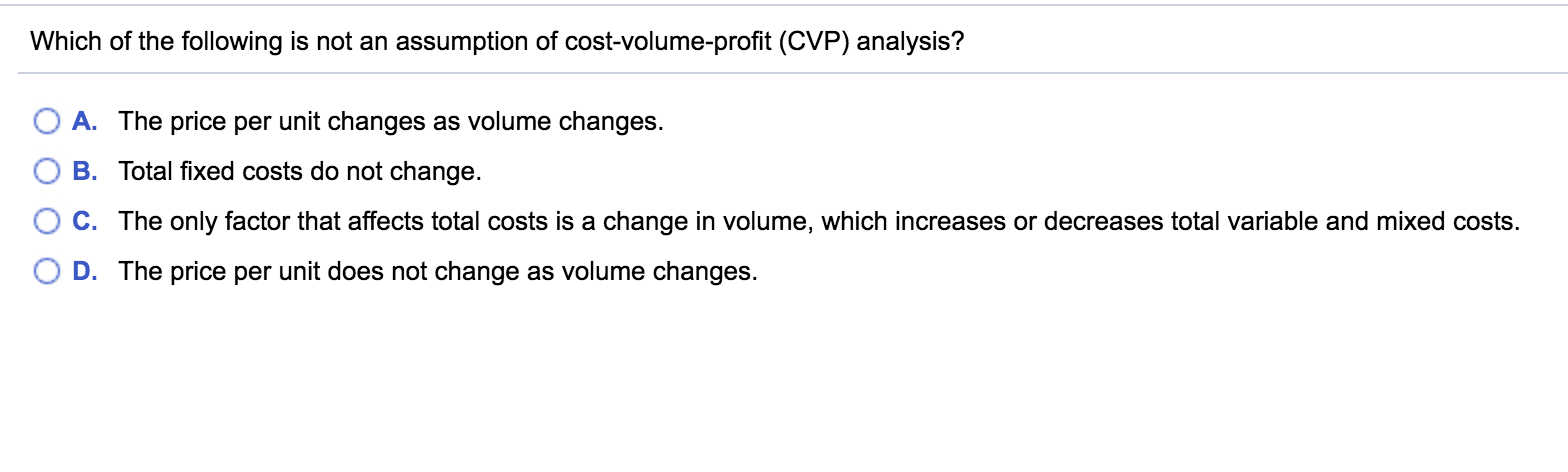

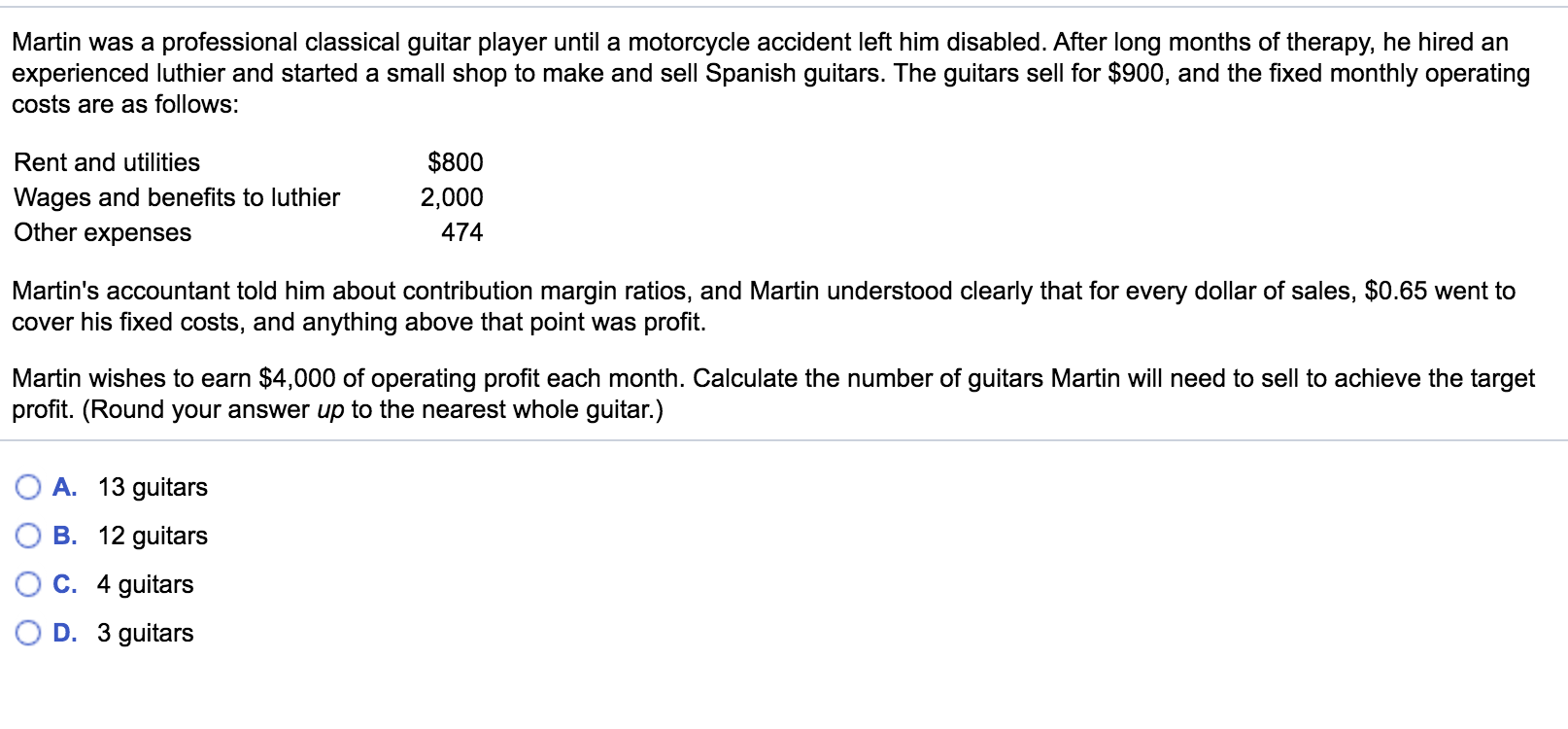

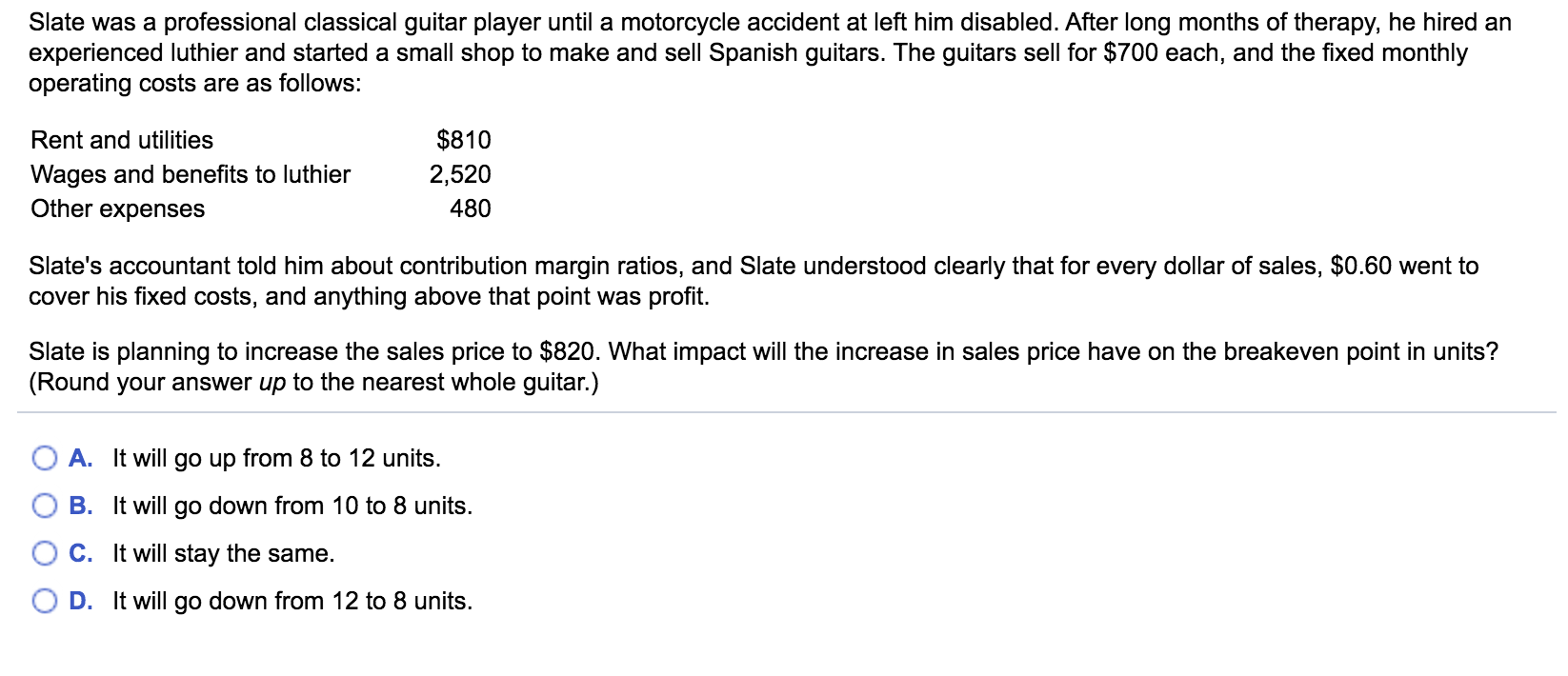

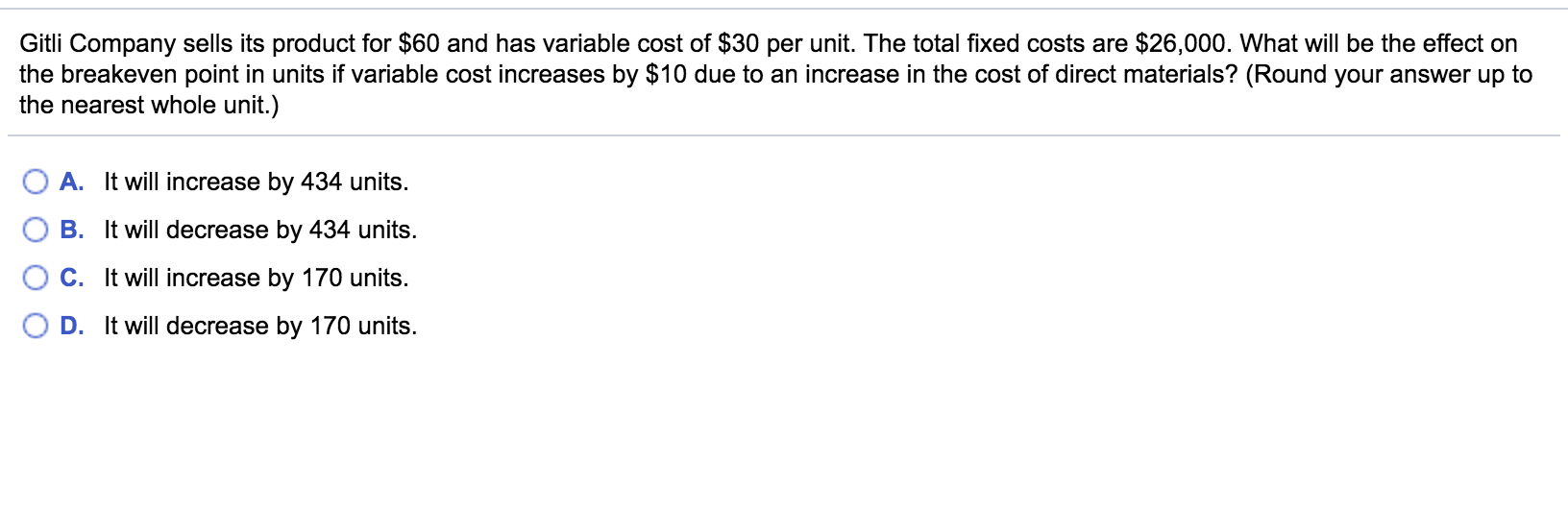

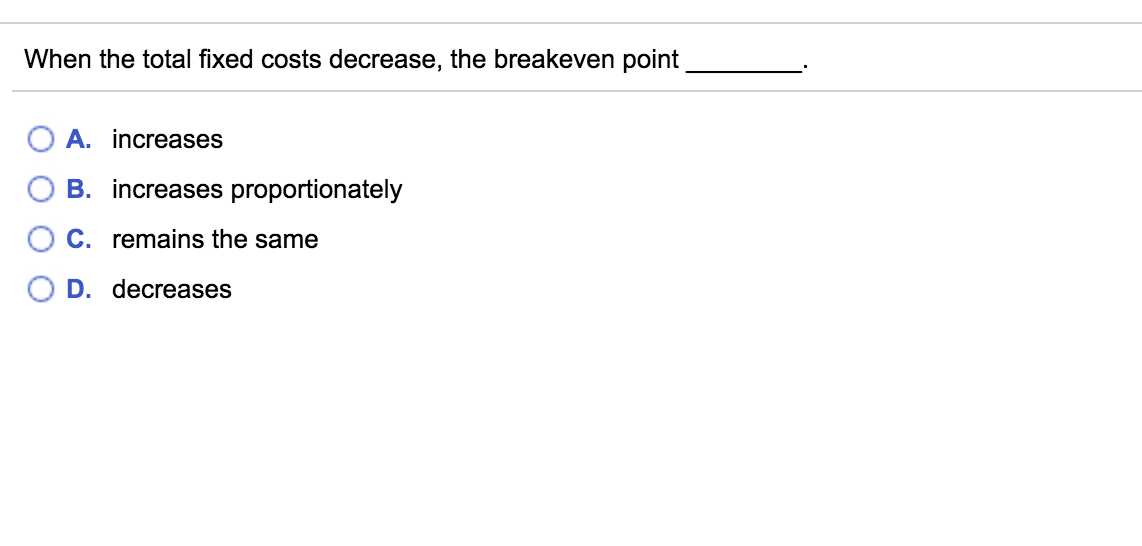

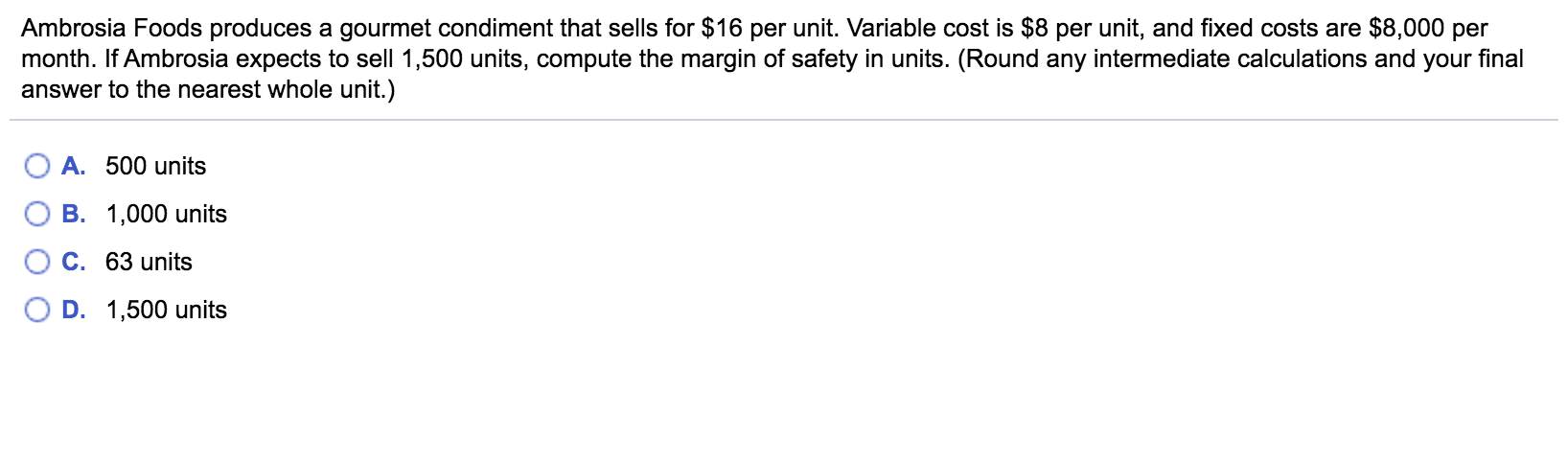

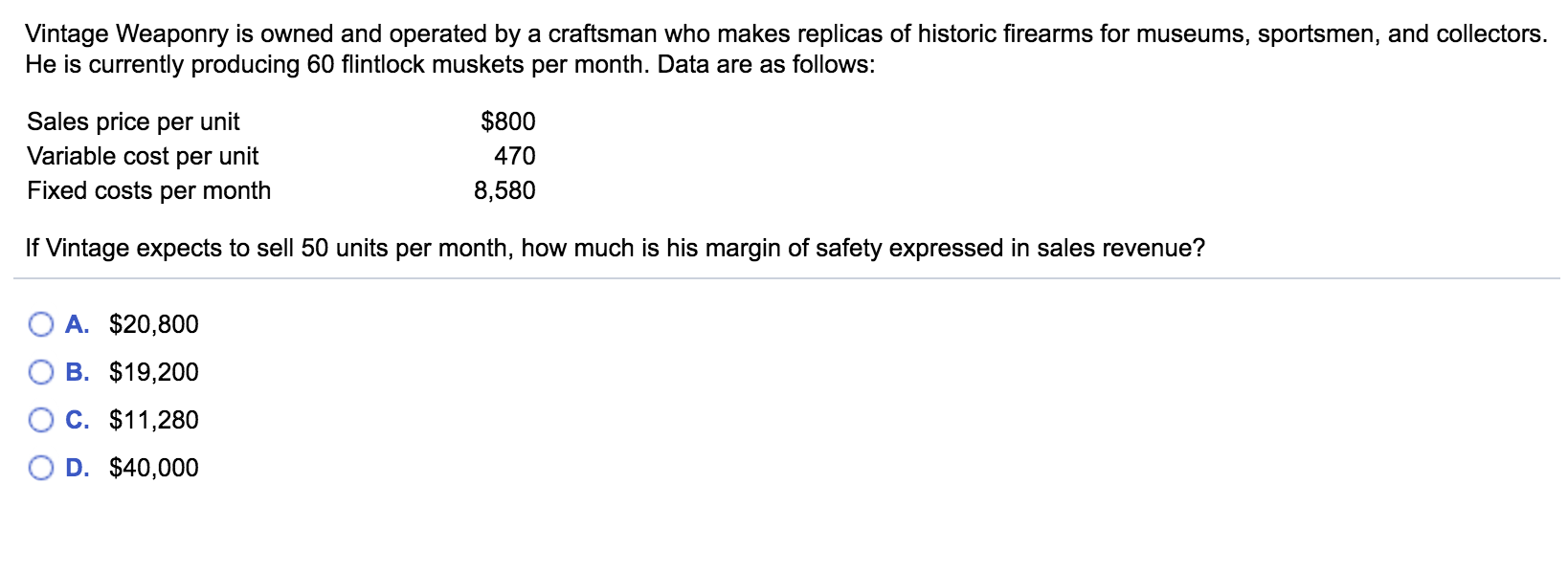

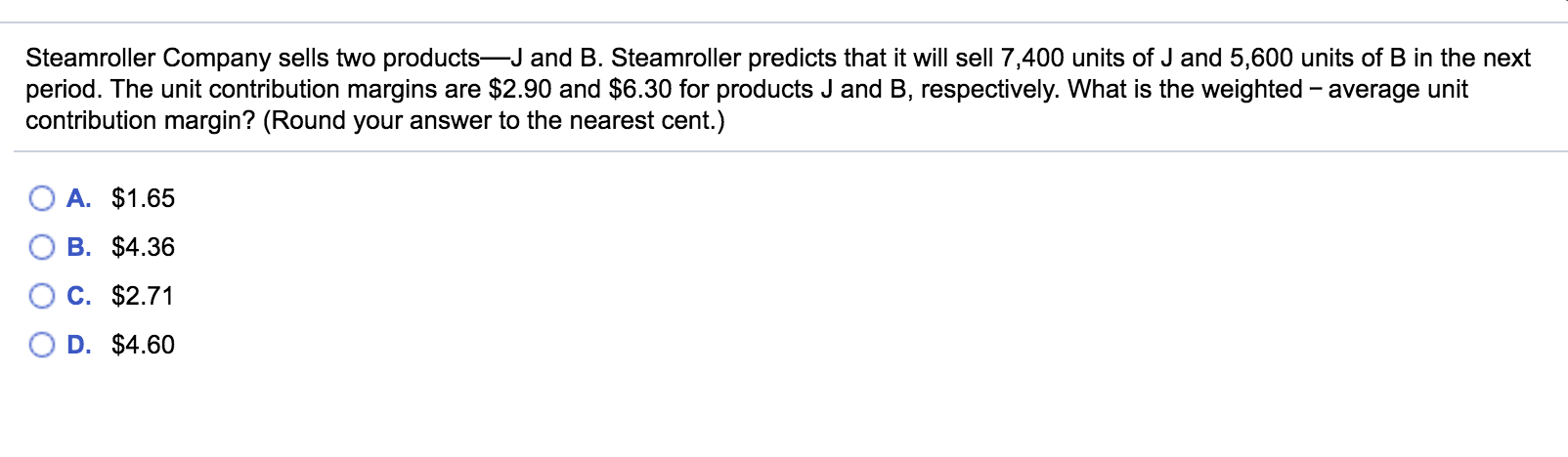

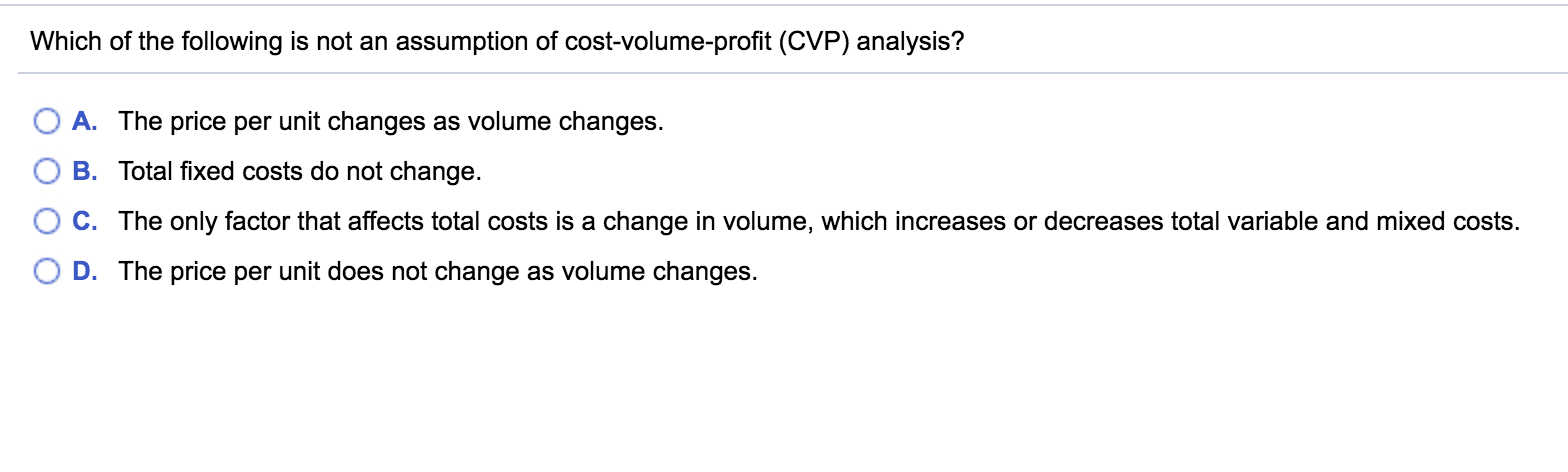

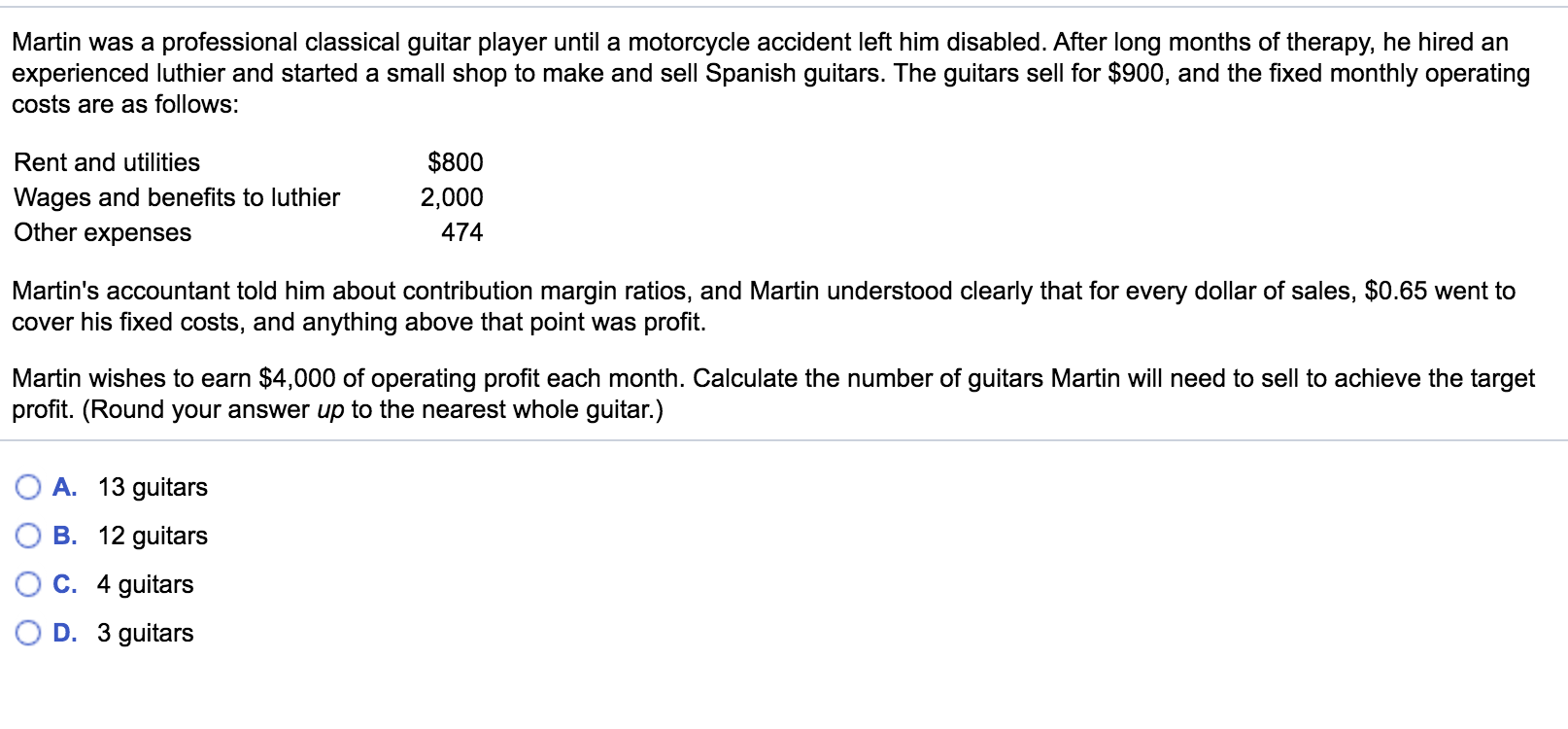

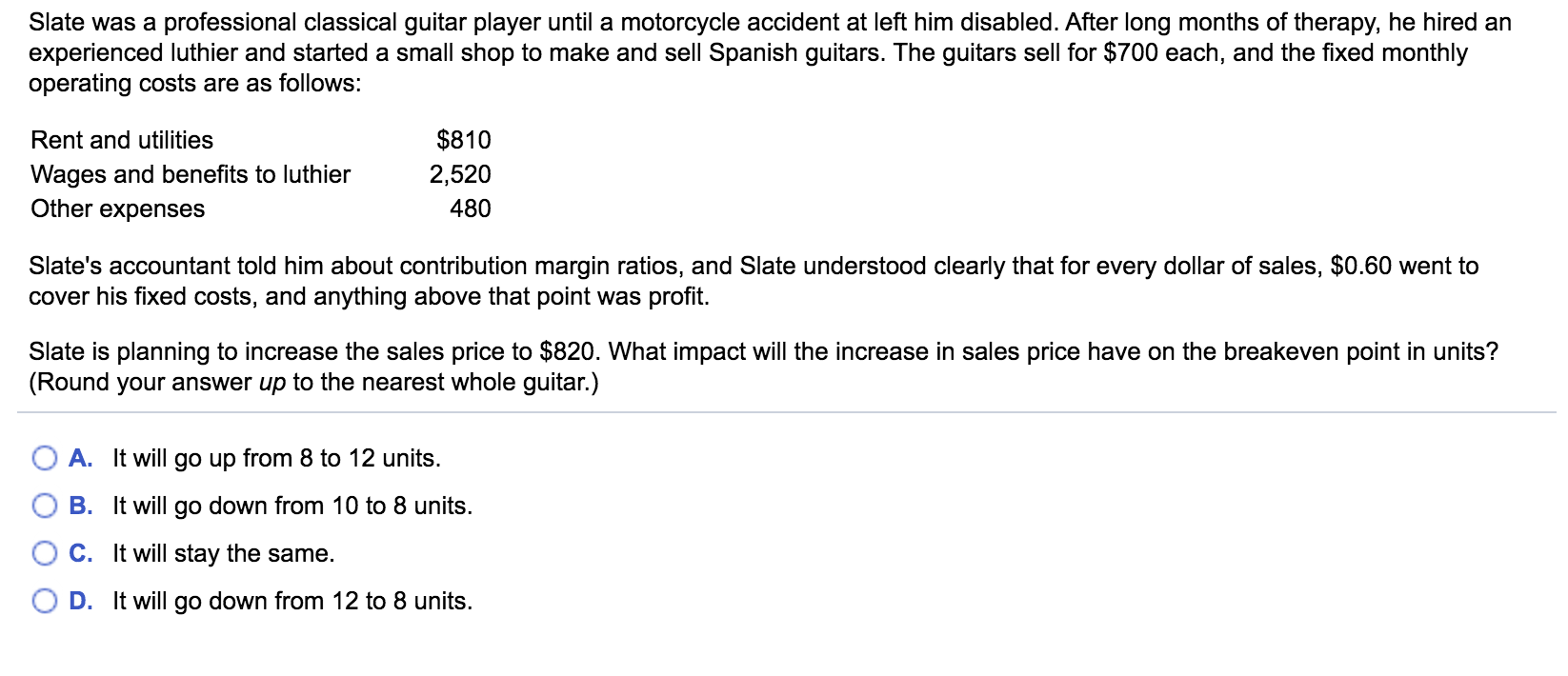

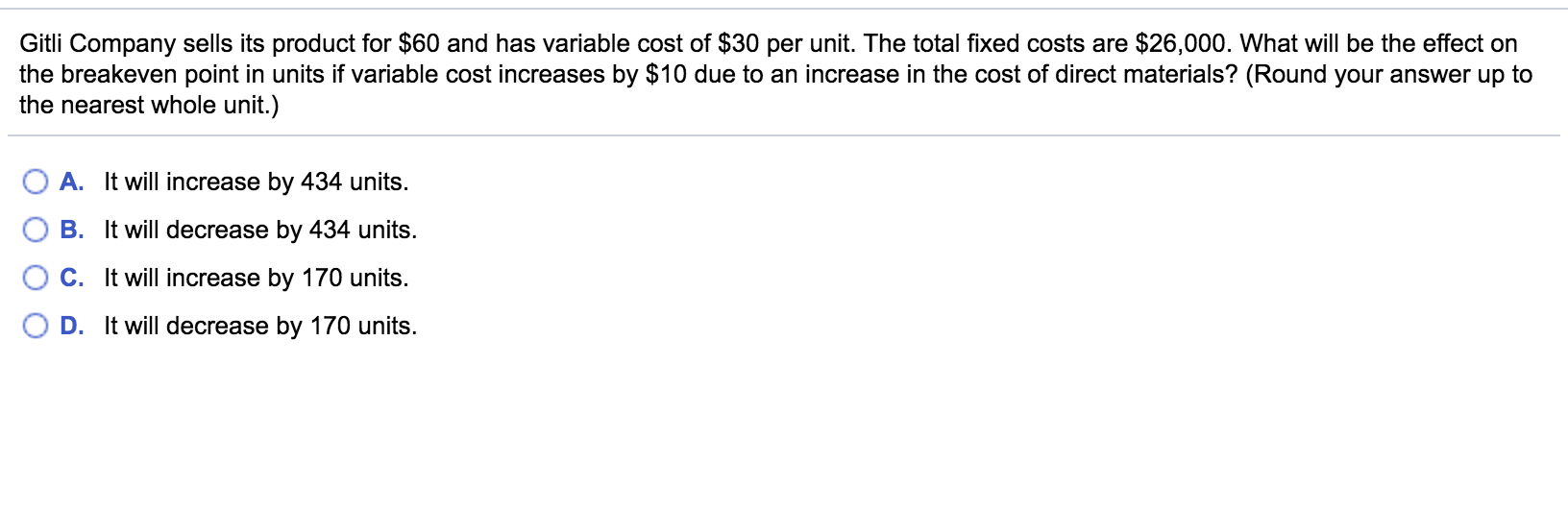

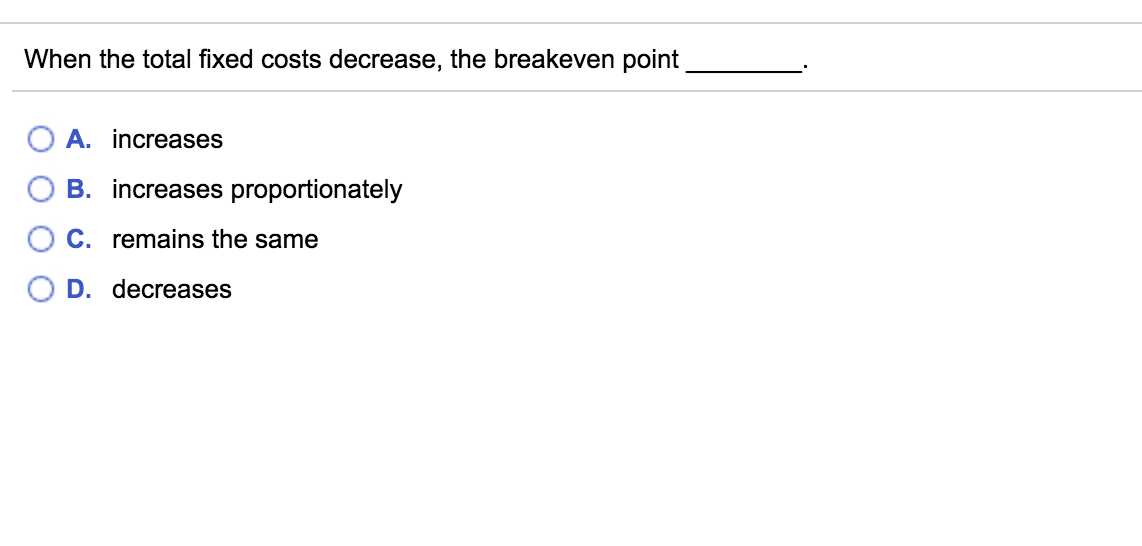

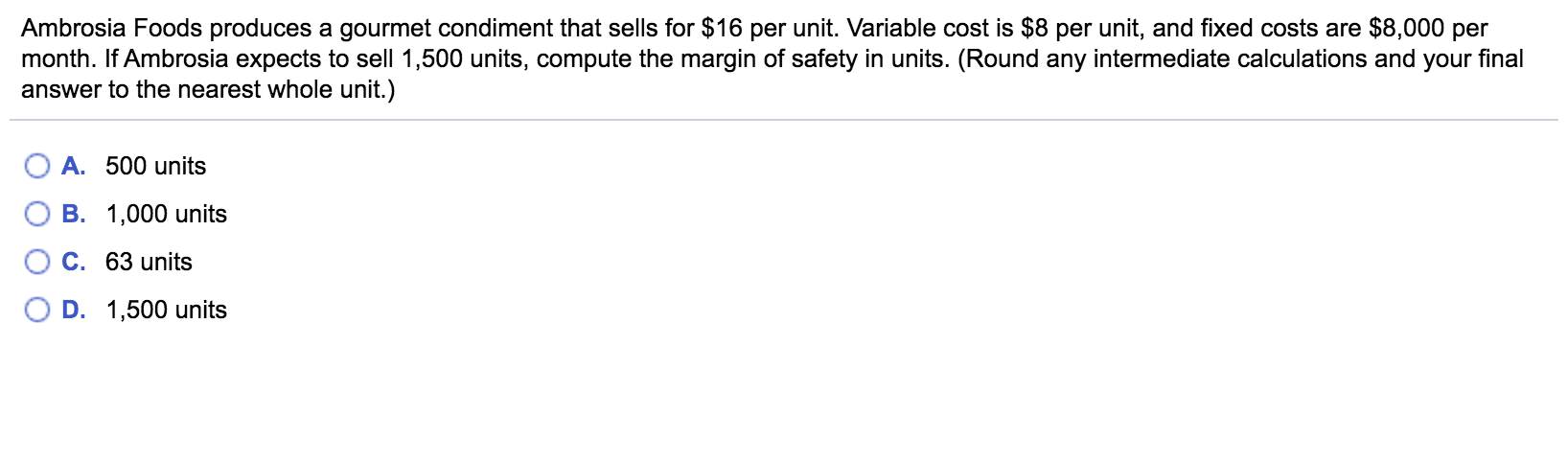

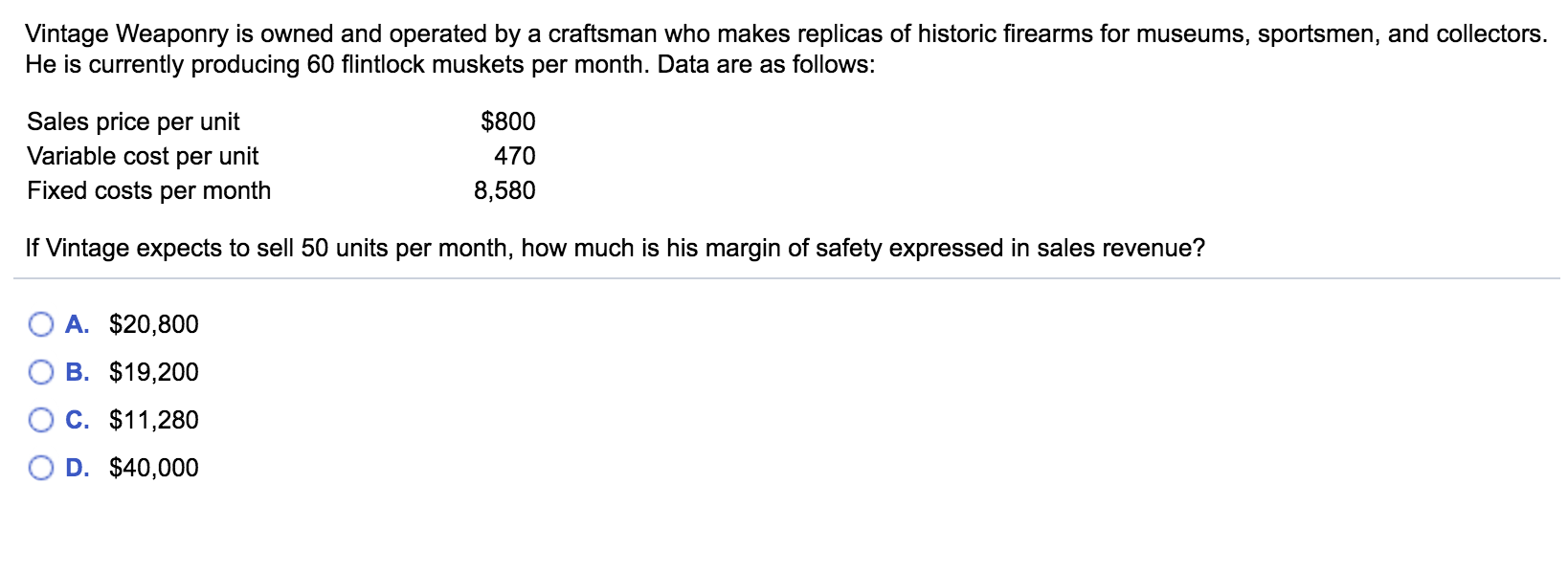

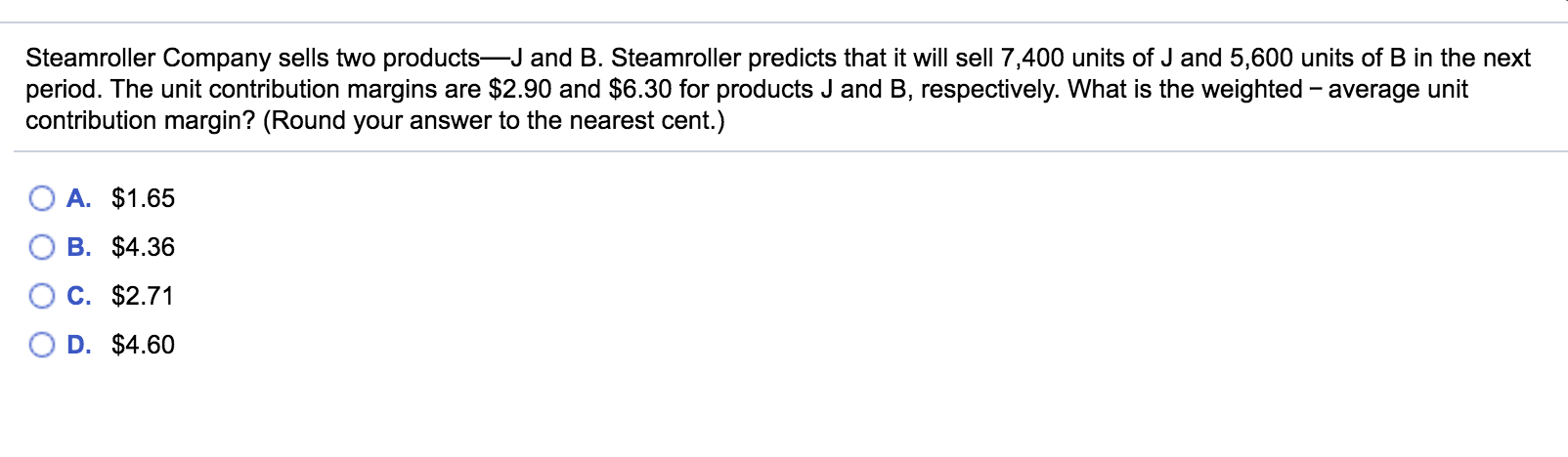

Which of the following is not an assumption of cost-volume-profit (CVP) analysis? O A. The price per unit changes as volume changes. O B. Total fixed costs do not change. O C. The only factor that affects total costs is a change in volume, which increases or decreases total variable and mixed costs. OD. The price per unit does not change as volume changes. Martin was a professional classical guitar player until a motorcycle accident left him disabled. After long months of therapy, he hired an experienced luthier and started a small shop to make and sell Spanish guitars. The guitars sell for $900, and the fixed monthly operating costs are as follows: Rent and utilities Wages and benefits to luthier Other expenses $800 2,000 474 Martin's accountant told him about contribution margin ratios, and Martin understood clearly that for every dollar of sales, $0.65 went to cover his fixed costs, and anything above that point was profit. Martin wishes to earn $4,000 of operating profit each month. Calculate the number of guitars Martin will need to sell to achieve the target profit. (Round your answer up to the nearest whole guitar.) O A. 13 guitars OB. 12 guitars O C. 4 guitars OD. 3 guitars Slate was a professional classical guitar player until a motorcycle accident at left him disabled. After long months of therapy, he hired an experienced luthier and started a small shop to make and sell Spanish guitars. The guitars sell for $700 each, and the fixed monthly operating costs are as follows: Rent and utilities Wages and benefits to luthier Other expenses $810 2,520 480 Slate's accountant told him about contribution margin ratios, and Slate understood clearly that for every dollar of sales, $0.60 went to cover his fixed costs, and anything above that point was profit. Slate is planning to increase the sales price to $820. What impact will the increase in sales price have on the breakeven point in units? (Round your answer up to the nearest whole guitar.) O A. It will go up from 8 to 12 units. O B. It will go down from 10 to 8 units. OC. It will stay the same. OD. It will go down from 12 to 8 units. Gitli Company sells its product for $60 and has variable cost of $30 per unit. The total fixed costs are $26,000. What will be the effect on the breakeven point in units if variable cost increases by $10 due to an increase in the cost of direct materials? (Round your answer up to the nearest whole unit.) O A. It will increase by 434 units. OB. It will decrease by 434 units. O C. It will increase by 170 units. OD. It will decrease by 170 units. When the total fixed costs decrease, the breakeven point O A. increases O B. increases proportionately O C. remains the same OD. decreases Ambrosia Foods produces a gourmet condiment that sells for $16 per unit. Variable cost is $8 per unit, and fixed costs are $8,000 per month. If Ambrosia expects to sell 1,500 units, compute the margin of safety in units. (Round any intermediate calculations and your final answer to the nearest whole unit.) O A. 500 units O B. 1,000 units OC. 63 units OD. 1,500 units Vintage Weaponry is owned and operated by a craftsman who makes replicas of historic firearms for museums, sportsmen, and collectors. He is currently producing 60 flintlock muskets per month. Data are as follows: Sales price per unit Variable cost per unit Fixed costs per month $800 470 8,580 If Vintage expects to sell 50 units per month, how much is his margin of safety expressed in sales revenue? O A. $20,800 OB. $19,200 OC. $11,280 OD. $40,000 Steamroller Company sells two productsJ and B. Steamroller predicts that it will sell 7,400 units of J and 5,600 units of B in the next period. The unit contribution margins are $2.90 and $6.30 for products J and B, respectively. What is the weighted - average unit contribution margin? (Round your answer to the nearest cent.) O A. $1.65 O B. $4.36 OC. $2.71 O D. $4.60