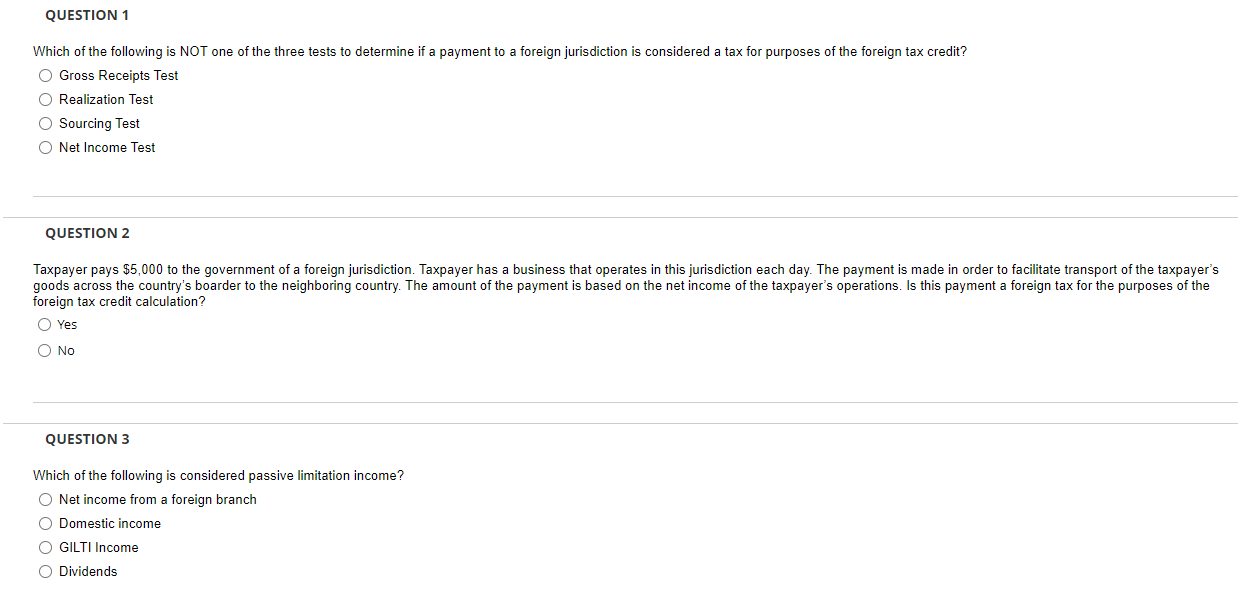

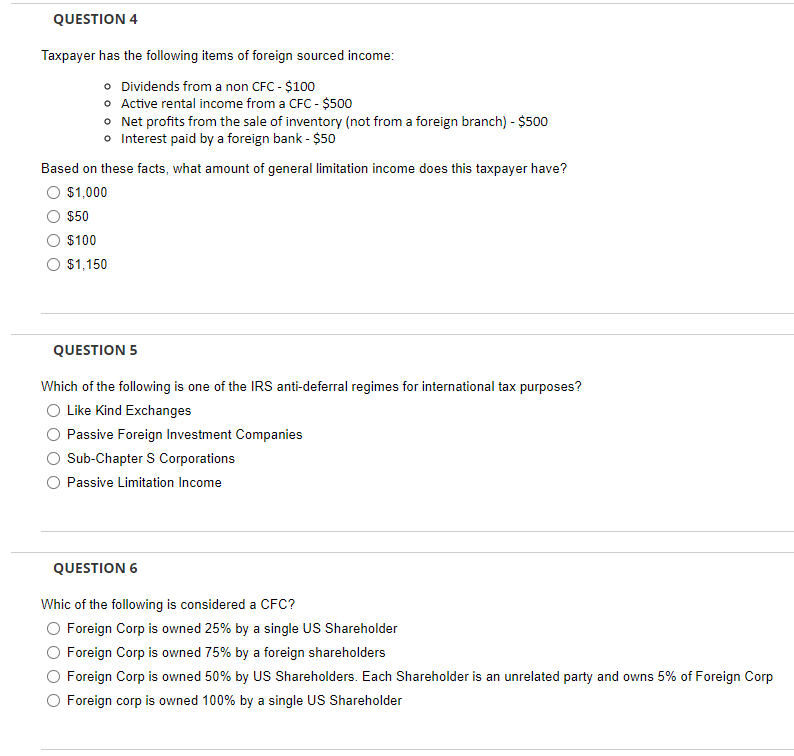

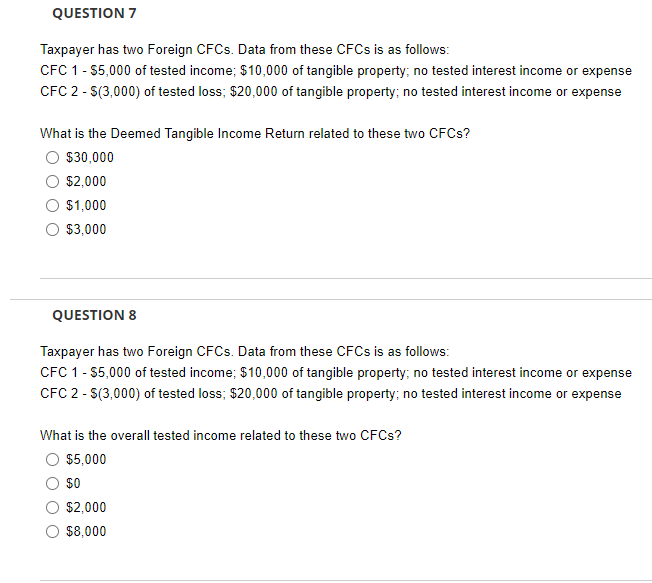

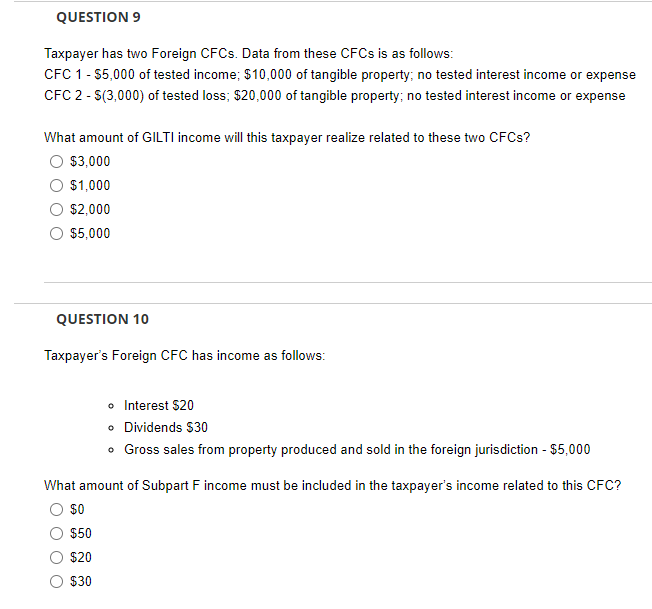

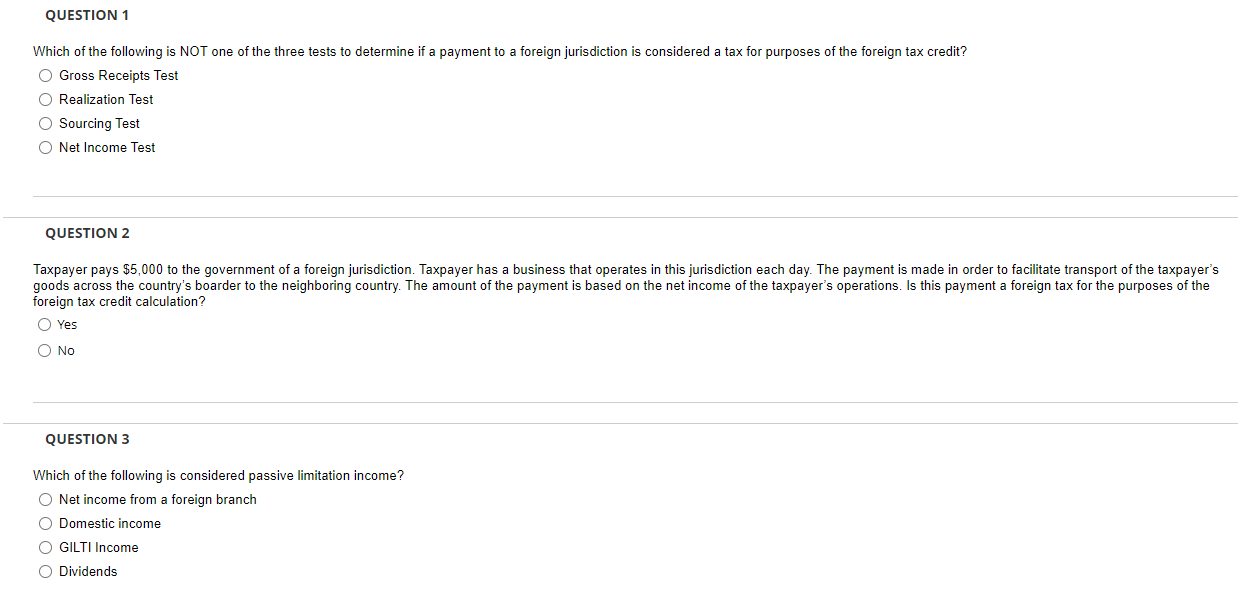

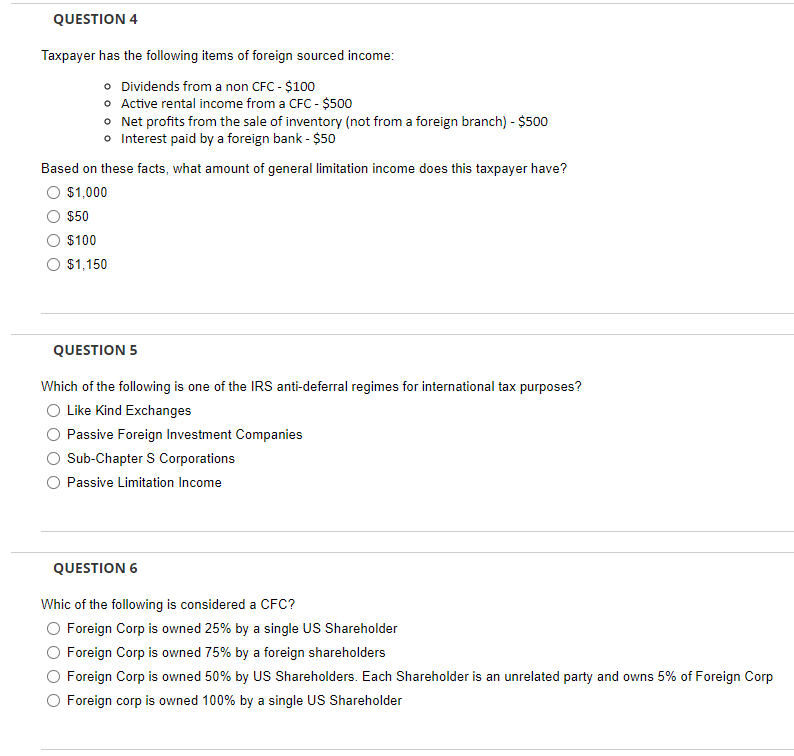

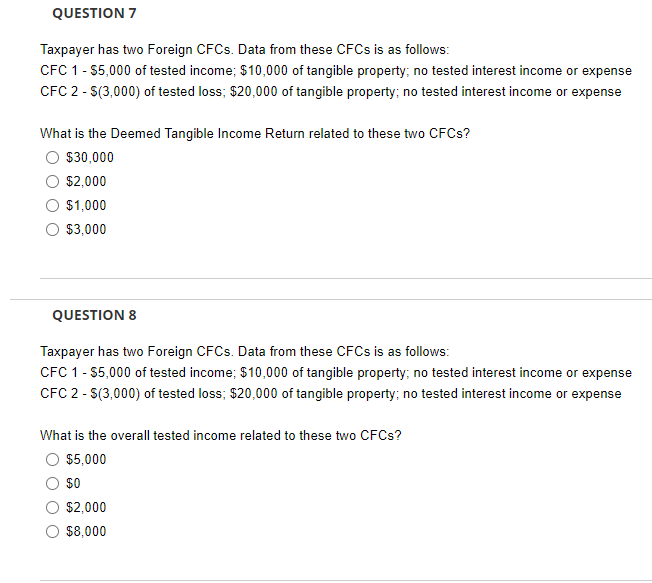

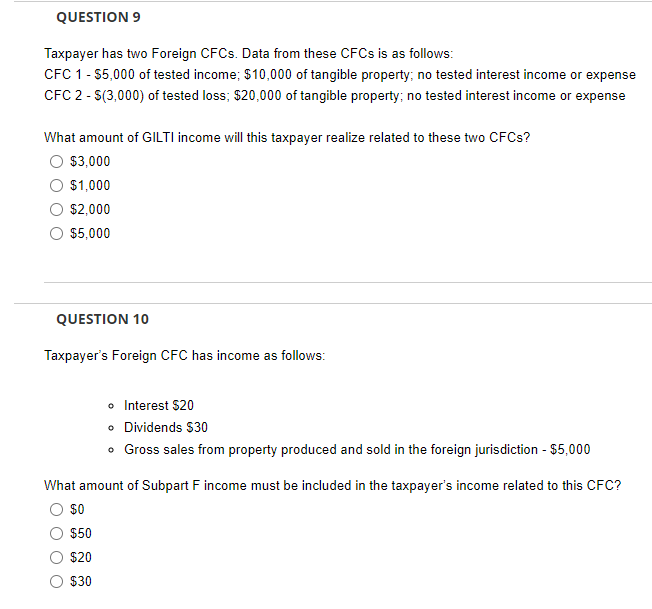

Which of the following is NOT one of the three tests to determine if a payment to a foreign jurisdiction is considered a tax for purposes of the foreign tax credit? Gross Receipts Test Realization Test Sourcing Test Net Income Test QUESTION 2 foreign tax credit calculation? Yes No QUESTION 3 Which of the following is considered passive limitation income? Net income from a foreign branch Domestic income GILTI Income Dividends Taxpayer has the following items of foreign sourced income: - Dividends from a non CFC - $100 - Active rental income from a CFC - $500 Net profits from the sale of inventory (not from a foreign branch) - $500 - Interest paid by a foreign bank - \$50 Based on these facts, what amount of general limitation income does this taxpayer have? $1,000$50$100$1,150 QUESTION 5 Which of the following is one of the IRS anti-deferral regimes for international tax purposes? Like Kind Exchanges Passive Foreign Investment Companies Sub-Chapter S Corporations Passive Limitation Income QUESTION 6 Whic of the following is considered a CFC? Foreign Corp is owned 25% by a single US Shareholder Foreign Corp is owned 75% by a foreign shareholders Foreign Corp is owned 50% by US Shareholders. Each Shareholder is an unrelated party and owns 5% of Foreign Corp Foreign corp is owned 100% by a single US Shareholder Taxpayer has two Foreign CFCs. Data from these CFCs is as follows: CFC 1 - $5,000 of tested income; $10,000 of tangible property; no tested interest income or expense CFC 2$(3,000) of tested loss; $20,000 of tangible property; no tested interest income or expense What is the Deemed Tangible Income Return related to these two CFCs? $30,000$2,000$1,000$3,000 QUESTION 8 Taxpayer has two Foreign CFCs. Data from these CFCs is as follows: CFC 1 - $5,000 of tested income; $10,000 of tangible property; no tested interest income or expense CFC 2$(3,000) of tested loss; $20,000 of tangible property; no tested interest income or expense What is the overall tested income related to these two CFCs? $5,000$0$2,000$8,000 Taxpayer has two Foreign CFCs. Data from these CFCs is as follows: CFC 1 - $5,000 of tested income; $10,000 of tangible property; no tested interest income or expense CFC 2 - $(3,000) of tested loss; $20,000 of tangible property; no tested interest income or expense What amount of GILTI income will this taxpayer realize related to these two CFCs? $3,000$1,000$2,000$5,000 QUESTION 10 Taxpayer's Foreign CFC has income as follows: - Interest $20 - Dividends $30 - Gross sales from property produced and sold in the foreign jurisdiction - $5,000 What amount of Subpart F income must be included in the taxpayer's income related to this CFC? $0 $50 $20 $30