Question

Which of the following is true? a. If using the double-declining-balance the total amount of depreciation expense during the life of the asset will be

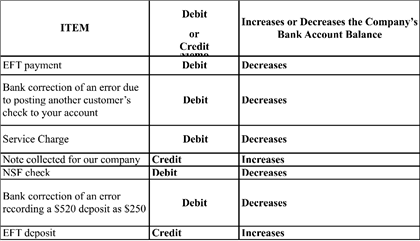

Which of the following is true? a. If using the double-declining-balance the total amount of depreciation expense during the life of the asset will be the highest. b. If using the units-of-production method, it is possible to depreciate more than the depreciable cost. c. If using the straight line method, the amount of depreciation expense during the first year is higher than that of the double-declining-balance. d. Regardless of the depreciation method, the amount of total depreciation expense during the life of the asset will be the same. ANS: A 11. You are trying to explain debit and credit memos that appear on bank statements and whether these will increase or decrease your companys bank account balance. Complete the following table to help your new staff understand.

ans:

12. Equipment was acquired at the beginning of the year at a cost of $75,000. The equipment was depreciated using the straight-line method based upon an estimated useful life of 6 years and an estimated residual value of $7,500. a) What was the depreciation expense for the first year? b) Assuming the equipment was sold at the end of the second year for $59,000, determine the gain or loss on sale of the equipment. c) Journalize the entry to record the sale. ANS: A/ ($75,000-$7,500) / 6 = $11,250 B/ Loss $6500{59,000- [$75,000 (11,250 X 2)]} C/ Cash .....................................................$59,000 Accumulated Depreciation- equipment..............$22,500 Equipment...................................................................$75,000 Loss on sale of equipment.................................................$6,500

12. Equipment was acquired at the beginning of the year at a cost of $75,000. The equipment was depreciated using the straight-line method based upon an estimated useful life of 6 years and an estimated residual value of $7,500. a) What was the depreciation expense for the first year? b) Assuming the equipment was sold at the end of the second year for $59,000, determine the gain or loss on sale of the equipment. c) Journalize the entry to record the sale. ANS: A/ ($75,000-$7,500) / 6 = $11,250 B/ Loss $6500{59,000- [$75,000 (11,250 X 2)]} C/ Cash .....................................................$59,000 Accumulated Depreciation- equipment..............$22,500 Equipment...................................................................$75,000 Loss on sale of equipment.................................................$6,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started