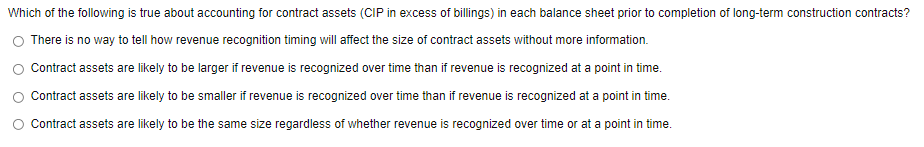

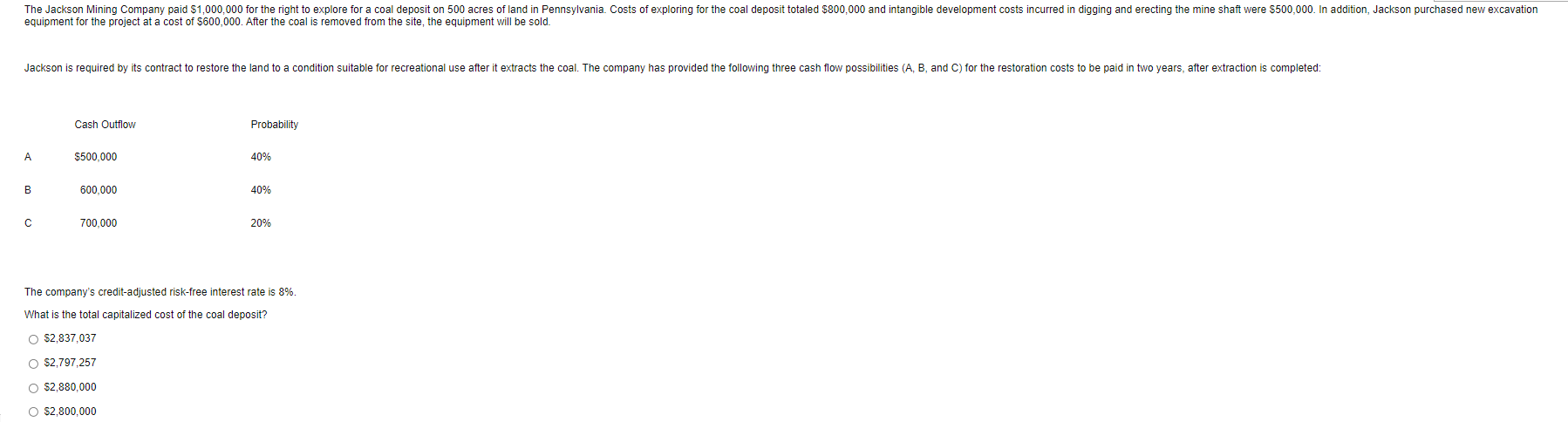

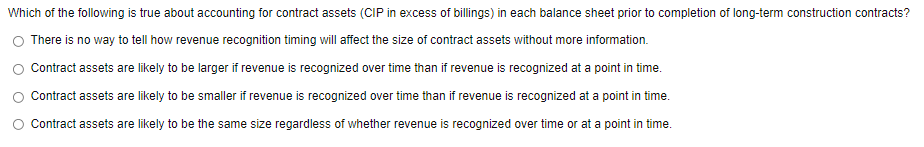

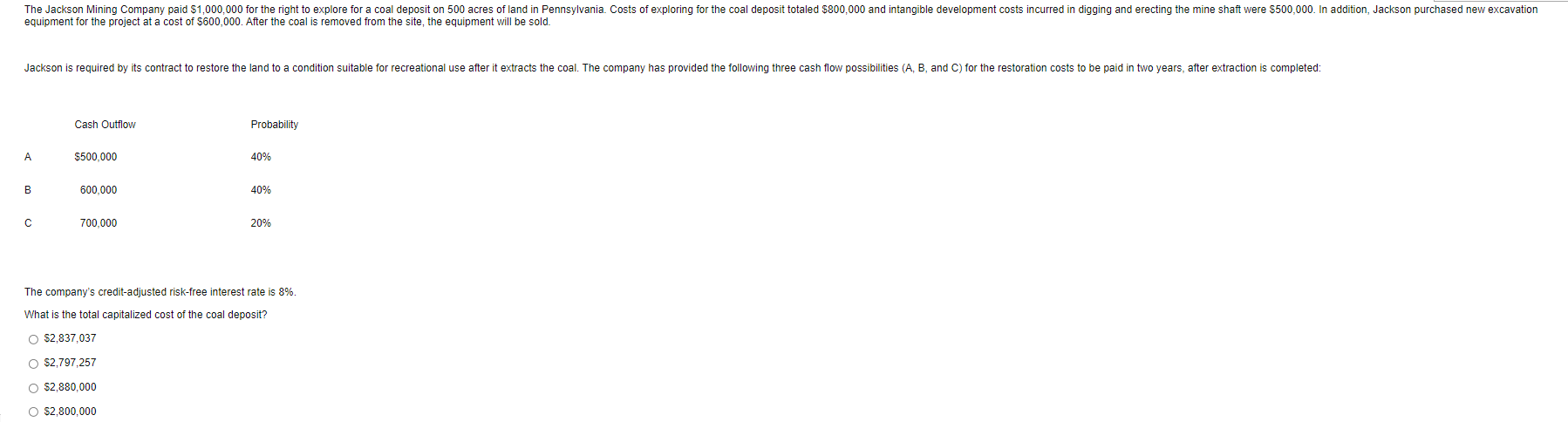

Which of the following is true about accounting for contract assets (CIP in excess of billings) in each balance sheet prior to completion of long-term construction contracts ? There is no way to tell how revenue recognition timing will affect the size of contract assets without more information Contract assets are likely to be larger if revenue is recognized over time than if revenue is recognized at a point in time. Contract assets are likely to be smaller if revenue is recognized over time than if revenue is recognized at a point in time. Contract assets are likely to be the same size regardless of whether revenue is recognized over time or at a point in time. The Jackson Mining Company paid $1,000,000 for the right to explore for a coal deposit on 500 acres of land in Pennsylvania. Costs of exploring for the coal deposit totaled $800,000 and intangible development costs incurred in digging and erecting the mine shaft were $500,000. In addition, Jackson purchased new excavation equipment for the project at a cost of $600,000. After the coal is removed from the site, the equipment will be sold. Jackson is required by its contract to restore the land to a condition suitable for recreational use after it extracts the coal. The company has provided the following three cash flow possibilities (A, B, and C) for the restoration costs to be paid in two years after extraction is completed: Cash Outflow Probability $500,000 40% B 600,000 40% 700,000 20% The company's credit-adjusted risk-free interest rate is 8%. What is the total capitalized cost of the coal deposit? O $2.837,037 $2,797,257 O $2,880,000 $2,800,000 Which of the following is true about accounting for contract assets (CIP in excess of billings) in each balance sheet prior to completion of long-term construction contracts ? There is no way to tell how revenue recognition timing will affect the size of contract assets without more information Contract assets are likely to be larger if revenue is recognized over time than if revenue is recognized at a point in time. Contract assets are likely to be smaller if revenue is recognized over time than if revenue is recognized at a point in time. Contract assets are likely to be the same size regardless of whether revenue is recognized over time or at a point in time. The Jackson Mining Company paid $1,000,000 for the right to explore for a coal deposit on 500 acres of land in Pennsylvania. Costs of exploring for the coal deposit totaled $800,000 and intangible development costs incurred in digging and erecting the mine shaft were $500,000. In addition, Jackson purchased new excavation equipment for the project at a cost of $600,000. After the coal is removed from the site, the equipment will be sold. Jackson is required by its contract to restore the land to a condition suitable for recreational use after it extracts the coal. The company has provided the following three cash flow possibilities (A, B, and C) for the restoration costs to be paid in two years after extraction is completed: Cash Outflow Probability $500,000 40% B 600,000 40% 700,000 20% The company's credit-adjusted risk-free interest rate is 8%. What is the total capitalized cost of the coal deposit? O $2.837,037 $2,797,257 O $2,880,000 $2,800,000