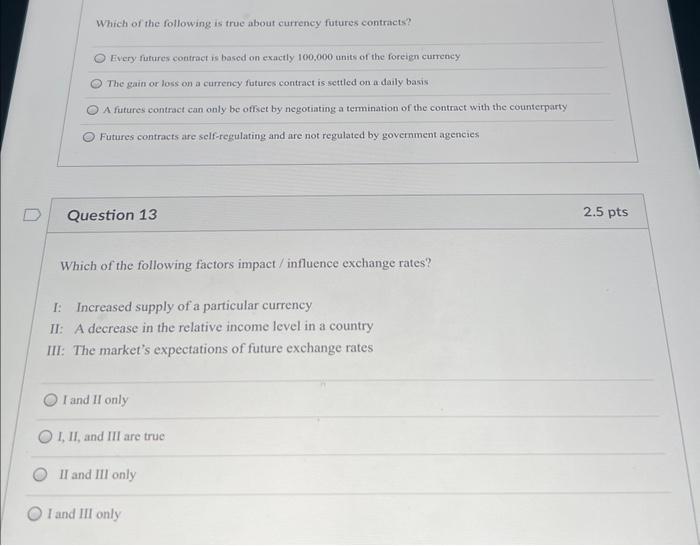

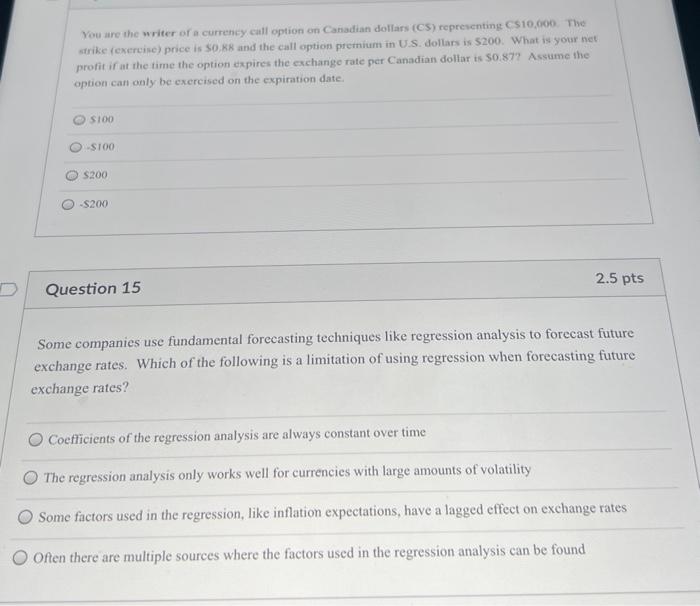

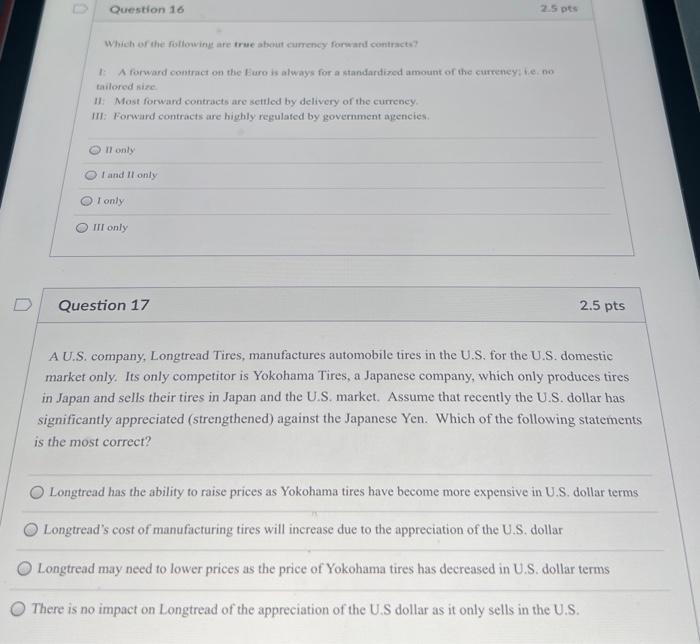

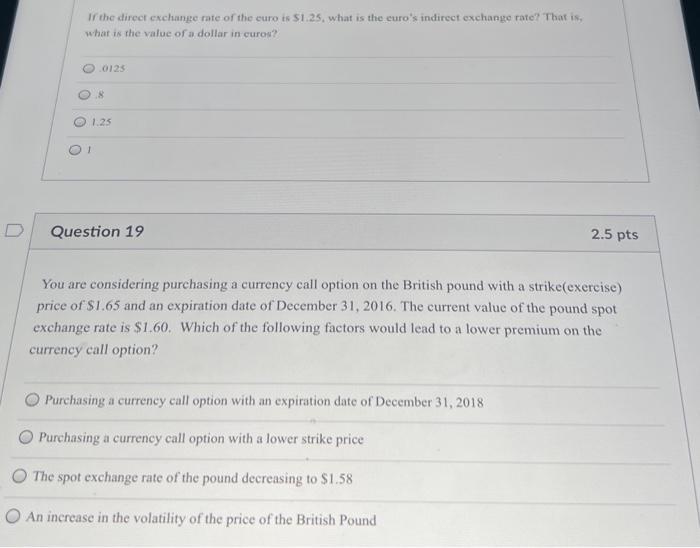

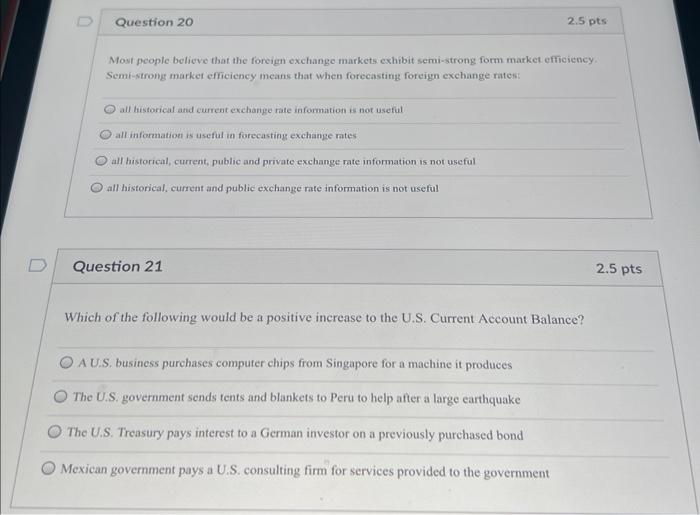

Which of the following is true about currency futures contracts? Fvery futures contract is based on exactly 100.000 units of the foreign currency The gain or loss on a currency futures contract is settled on a daily basis A futures contract can only be offset by negotiating a termination of the contract with the counterparty Futures contracts are self-regulating and are not regulated by government agencies Question 13 \\( 2.5 \\mathrm{p} \\) Which of the following factors impact/influence exchange rates? I: Increased supply of a particular currency II: A decrease in the relative income level in a country III: The market's expectations of future exchange rates \\( I \\) and \\( U \\) only I, II, and III are true II and III only I and III only You are the writer of a currency call option on Canadian dollars (CS) representing CS10,000. The strike (exercine) price is \\( \\$ 0, \\mathrm{k} .8 \\) and the call option premium in U.S. dollars is 5200 . What is your net profit if at the time the option expires the exchange rate per Canadian dollar is \\( 50.87 ? \\) Assume the option can only be exercised on the expiration date. \\( \\operatorname{sion} \\) \\( -5100 \\) \\( \\$ 200 \\) \\( -\\$ 200 \\) Question 15 2.5 pts Some companies use fundamental forecasting techniques like regression analysis to forecast future exchange rates. Which of the following is a limitation of using regression when forecasting future exchange rates? Coefficients of the regression analysis are always constant over time The regression analysis only works well for currencies with large amounts of volatility Some factors used in the regression, like inflation expectations, have a lagged effect on exchange rates Often there are multiple sources where the factors used in the regression analysis can be found Which or the foflowing are orue abcut cumency forsatal contracts? 1. A forward contract on the faro is always for a standartined amount of the currency: 6.0 , oo tailored nize. 11. Mast forward contracts are settled by delivery of the currency. III: Forward contracts are highly regulated by government agencies. 11 only \\( t \\) and 11 only Ionly III only Question 17 \\( 2.5 \\mathrm{pts} \\) A U.S. company, Longtread Tires, manufactures automobile tires in the U.S. for the U.S. domestic market only. Its only competitor is Yokohama Tires, a Japanese company, which only produces tires in Japan and sells their tires in Japan and the U.S. market. Assume that recently the U.S. dollar has significantly appreciated (strengthened) against the Japanese Yen. Which of the following statements is the most correct? Longtread has the ability to raise prices as Yokohama tires have become more expensive in U.S. dollar terms Longtread's cost of manufacturing tires will increase due to the appreciation of the U.S. dollar Longtread may need to lower prices as the price of Yokohama tires has decreased in U.S. dollar terms There is no impact on Longtread of the appreciation of the U.S dollar as it only sells in the U.S. If the direct exchange rate of the euro is \\( \\$ 1.25 \\), what is the curo's indirect exchange rate? That is, what is the value of a dollar in curos? 0125 1.25 Question 19 \\( 2.5 \\mathrm{pts} \\) You are considering purchasing a currency call option on the British pound with a strike(exercise) price of \\( \\$ 1.65 \\) and an expiration date of December 31, 2016. The current value of the pound spot exchange rate is \\( \\$ 1.60 \\). Which of the following factors would lead to a lower premium on the currency call option? Purchasing a currency call option with an expiration date of December 31, 2018 Purchasing a currency call option with a lower strike price The spot exchange rate of the pound decreasing to \\( \\$ 1.58 \\) An inerease in the volatility of the price of the British Pound Most people believe that the foreign exchange markets exhibit semi-strong form market efficiency. Semi-strong market efficiency means that when forecasting foreign exchange rates: all tistorical and current excharige rate information is not useful all information is useful in forecasting exchange rates all historical, current, public and private exchange rate information is not useful all historical, current and public exchange rate information is not useful Question 21 Which of the following would be a positive increase to the U.S. Current Account Balance? A U.S. business purchases computer chips from Singapore for a machine it produces The U.S. government sends tents and blankets to Peru to help after a large earthquake The U.S. Treasury pays interest to a German investor on a previously purchased bond Mexican govermment pays a U.S. consulting firm for services provided to the government