Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following is true? An average collection period far above the industry norm may indicate that the firm's credit policy is hurting sales

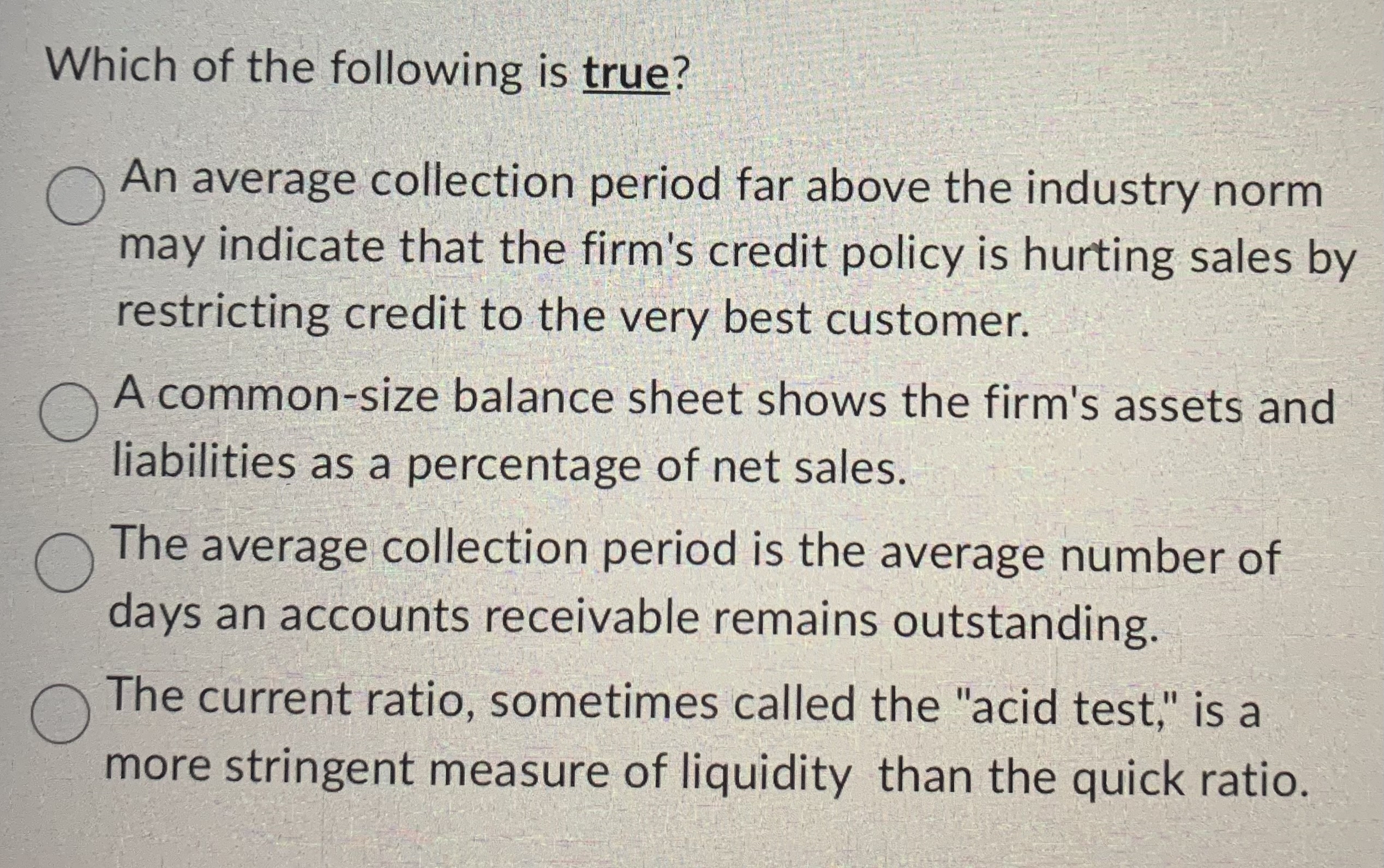

Which of the following is true?

An average collection period far above the industry norm

may indicate that the firm's credit policy is hurting sales by

restricting credit to the very best customer.

A commonsize balance sheet shows the firm's assets and

liabilities as a percentage of net sales.

The average collection period is the average number of

days an accounts receivable remains outstanding.

The current ratio, sometimes called the "acid test," is a

more stringent measure of liquidity than the quick ratio.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started