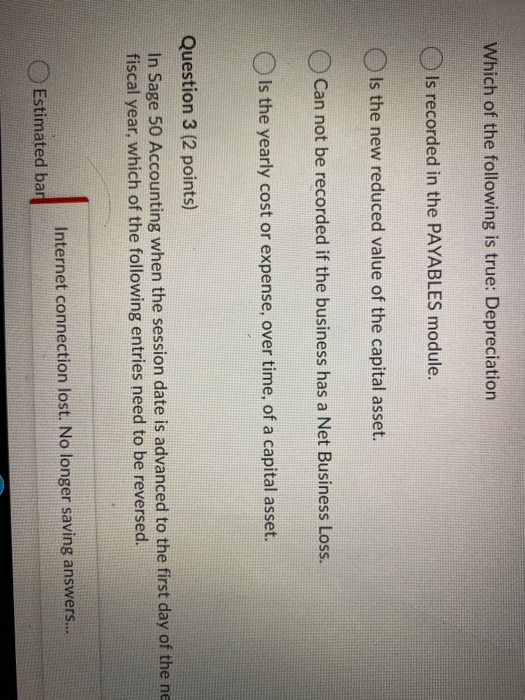

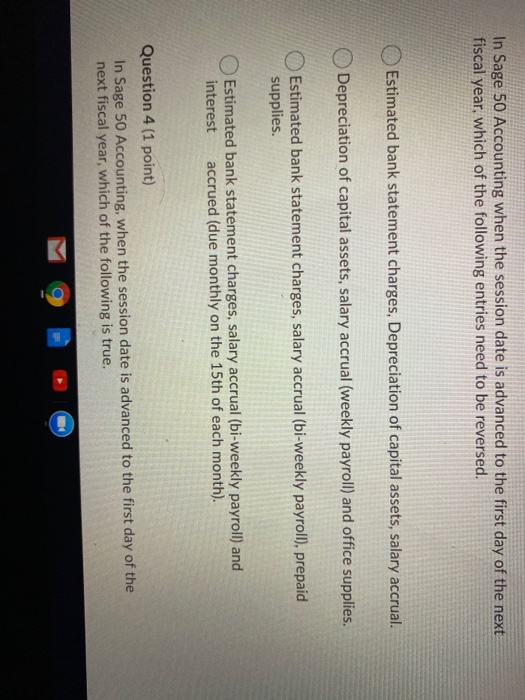

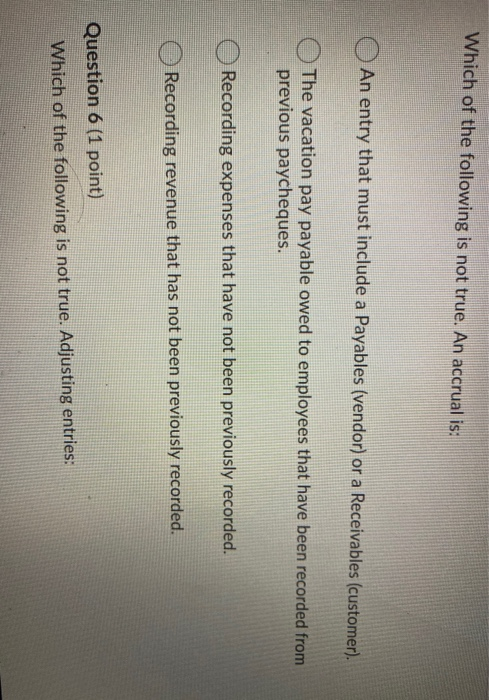

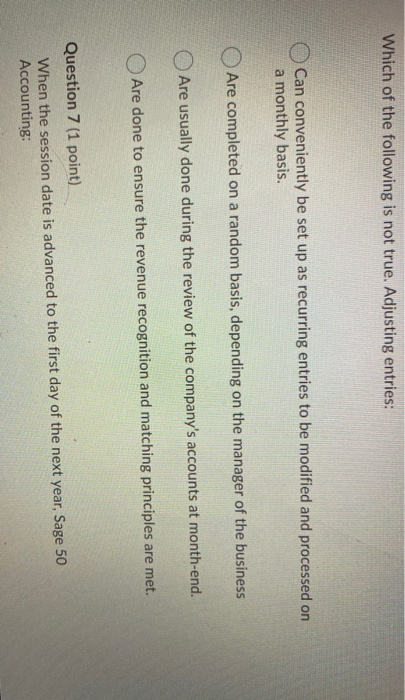

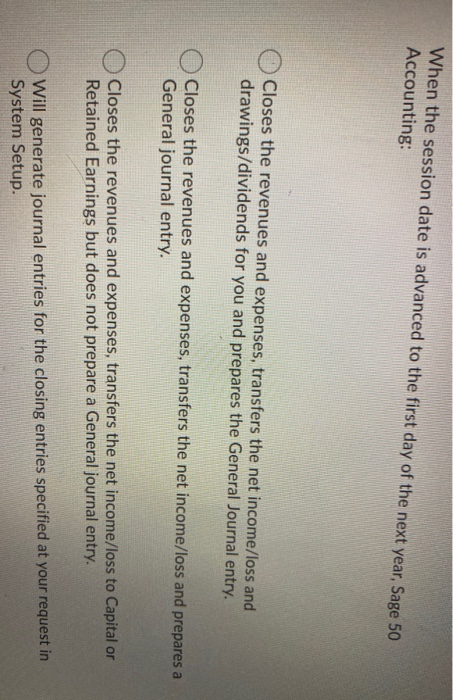

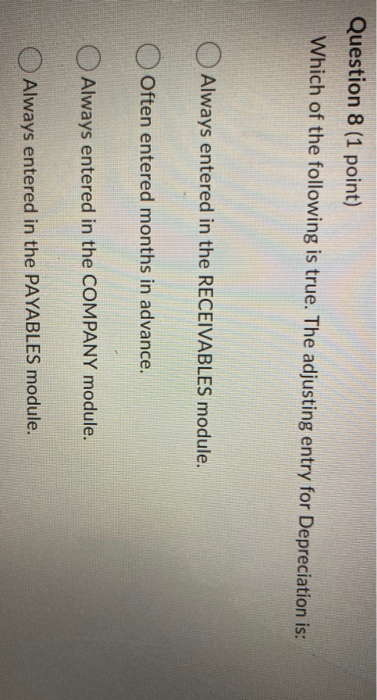

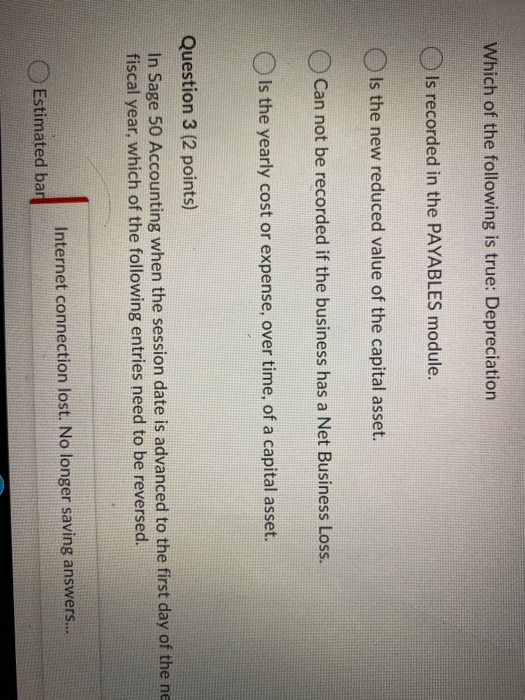

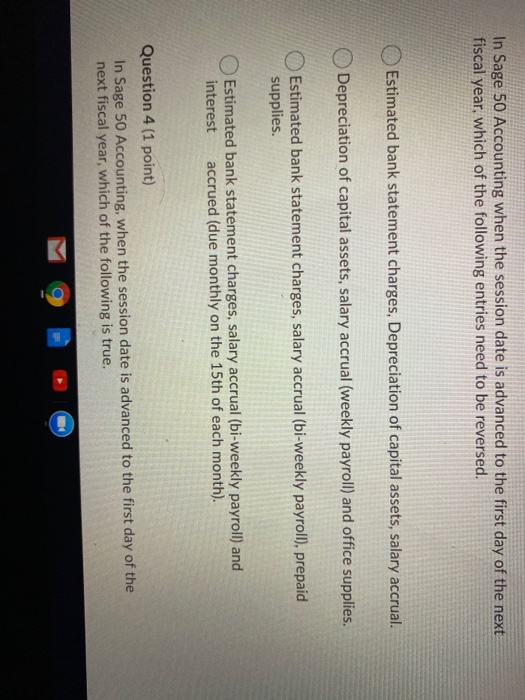

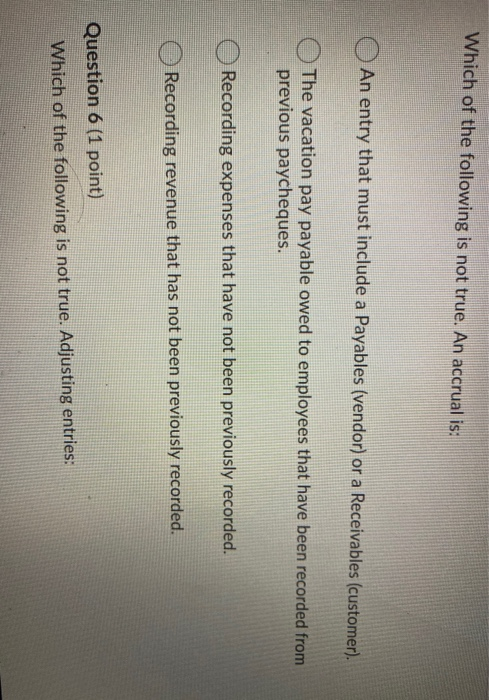

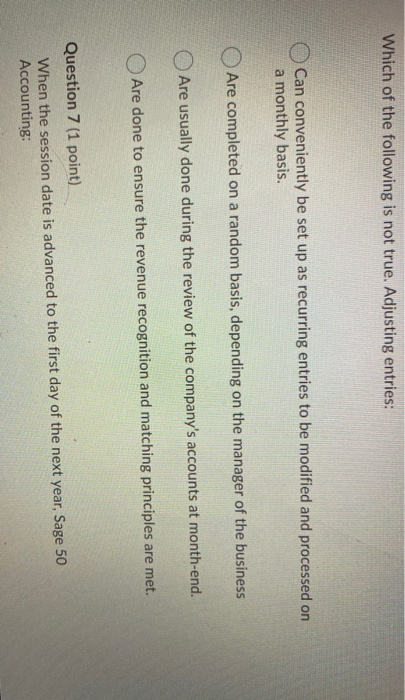

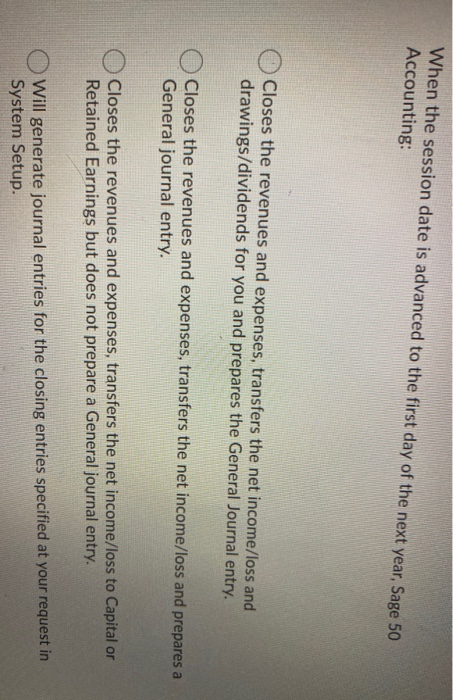

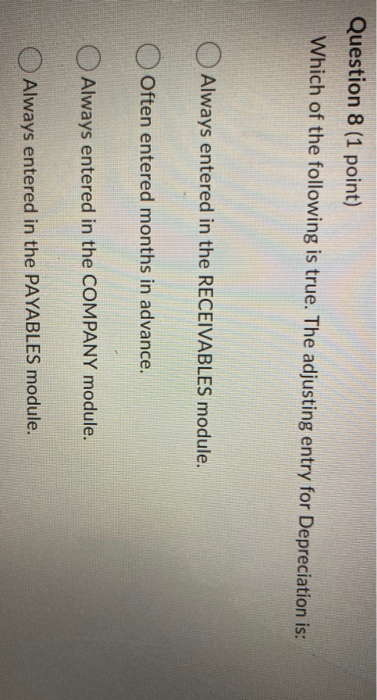

Which of the following is true: Depreciation Is recorded in the PAYABLES module. Is the new reduced value of the capital asset. Can not be recorded if the business has a Net Business Loss. Is the yearly cost or expense, over time, of a capital asset. Question 3 (2 points) In Sage 50 Accounting when the session date is advanced to the first day of the ne fiscal year, which of the following entries need to be reversed. Internet connection lost. No longer saving answers... Estimated bar In Sage 50 Accounting when the session date is advanced to the first day of the next fiscal year, which of the following entries need to be reversed. Estimated bank statement charges, Depreciation of capital assets, salary accrual. Depreciation of capital assets, salary accrual (weekly payroll) and office supplies. Estimated bank statement charges, salary accrual (bi-weekly payroll), prepaid supplies. Estimated bank statement charges, salary accrual (bi-weekly payroll) and interest accrued (due monthly on the 15th of each month). Question 4 (1 point) In Sage 50 Accounting, when the session date is advanced to the first day of the next fiscal year, which of the following is true. Which of the following is not true. An accrual is: An entry that must include a Payables (vendor) or a Receivables (customer). The vacation pay payable owed to employees that have been recorded from previous paycheques. Recording expenses that have not been previously recorded. Recording revenue that has not been previously recorded. Question 6 (1 point) Which of the following is not true. Adjusting entries: Which of the following is not true. Adjusting entries: Can conveniently be set up as recurring entries to be modified and processed on a monthly basis. Are completed on a random basis, depending on the manager of the business Are usually done during the review of the company's accounts at month-end. Are done to ensure the revenue recognition and matching principles are met. Question 7 (1 point) When the session date is advanced to the first day of the next year, Sage 50 Accounting: When the session date is advanced to the first day of the next year, Sage 50 Accounting: Closes the revenues and expenses, transfers the net income/loss and drawings/dividends for you and prepares the General Journal entry. Closes the revenues and expenses, transfers the net income/loss and prepares a General journal entry. Closes the revenues and expenses, transfers the net income/loss to Capital or Retained Earnings but does not prepare a General journal entry. Will generate journal entries for the closing entries specified at your request in System Setup. Question 8 (1 point) Which of the following is true. The adjusting entry for Depreciation is: Always entered in the RECEIVABLES module. Often entered months in advance. Always entered in the COMPANY module. Always entered in the PAYABLES module