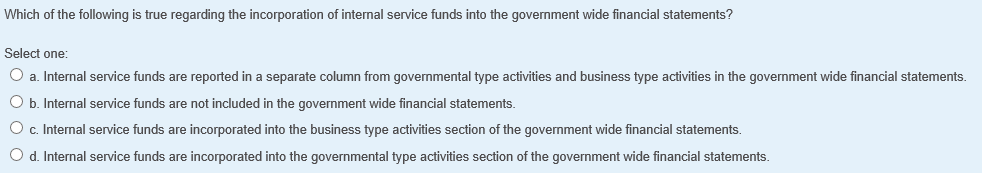

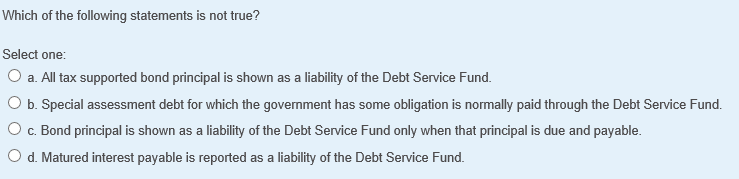

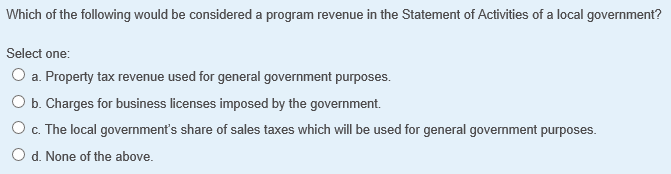

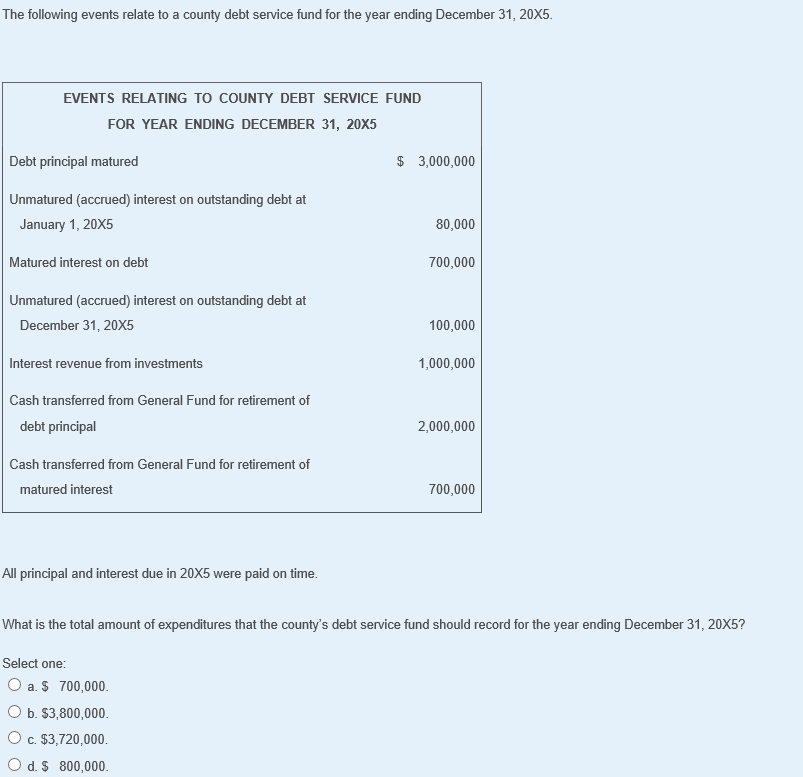

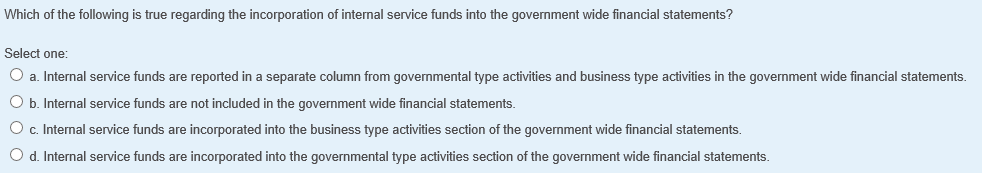

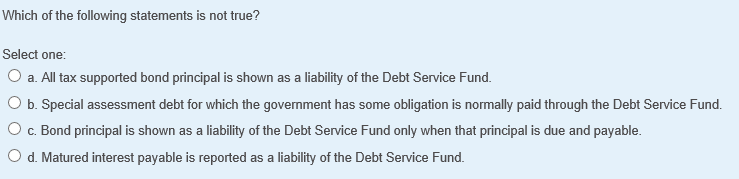

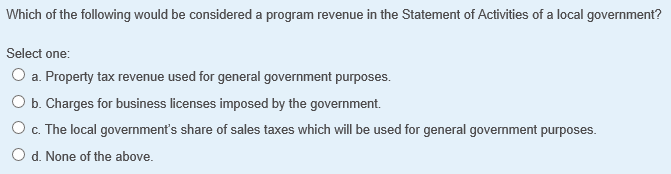

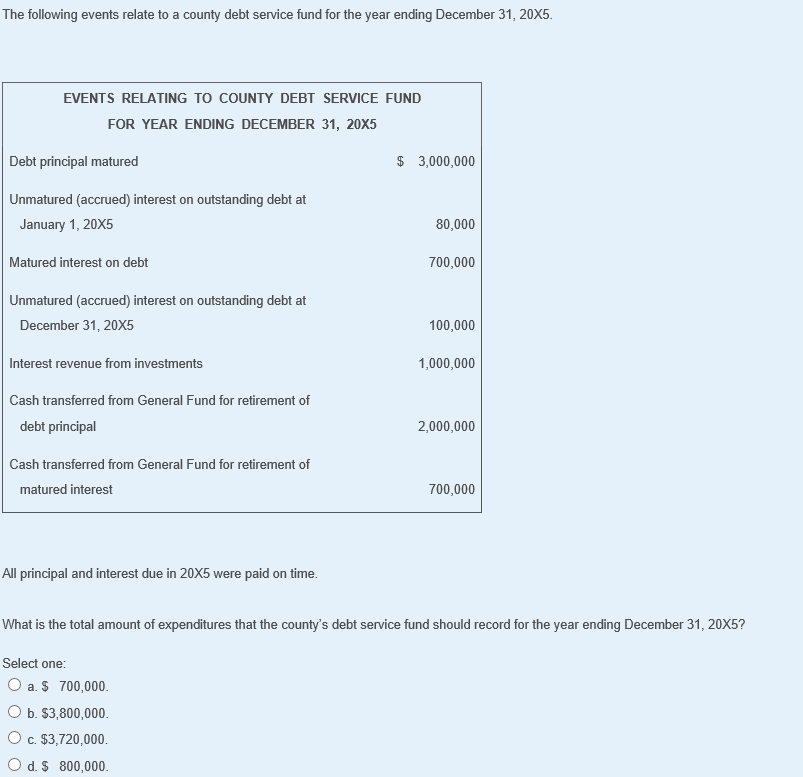

Which of the following is true regarding the incorporation of internal service funds into the government wide financial statements? Select one O a. Internal service funds are reported in a separate column from governmental type activities and business type activities in the government wide financial statements. b. Internal service funds are not included in the government wide financial statements Oc. Internal service funds are incorporated into the business type activities section of the government wide financial statements Od. Internal service funds are incorporated into the governmental type activities section of the government wide financial statements Which of the following statements is not true? Select one: O a. All tax supported bond principal is shown as a liability of the Debt Service Fund. O b. Special assessment debt for which the government has some obligation is normally paid through the Debt Service Fund O c. Bond principal is shown as a liability of the Debt Service Fund only when that principal is due and payable. Od. Matured interest payable is reported as a liability of the Debt Service Fund. Which of the following would be considered a program revenue in the Statement of Activities of a local government? Select one: O a. Property tax revenue used for general government purposes. b. Charges for business licenses imposed by the government. O c. The local government's share of sales taxes which will be used for general govenment purposes. O d. None of the above. The following events relate to a county debt service fund for the year ending December 31, 20X5 EVENTS RELATING TO COUNTY DEBT SERVICE FUND FOR YEAR ENDING DECEMBER 31, 20X5 Debt principal matured $ 3,000,000 Unmatured (accrued) interest on outstanding debt at January 1, 20X5 80,000 Matured interest on debt 700,000 Unmatured (accrued) interest on outstanding debt at December 31, 20X5 100,000 Interest revenue from investments 1,000,000 Cash transferred from General Fund for retirement of debt principal 2,000,000 Cash transferred from General Fund for retirement of matured interest 700,000 All principal and interest due in 20X5 were paid on time What is the total amount of expenditures that the county's debt service fund should record for the year ending December 31, 20X5? Select one: a. $ 700,000 O b. $3,800,000 C. $3,720,000 Od. $ 800,000