Which of the following items are considered accounts receivable? Is it the Store operating expense and general and administrative expense?

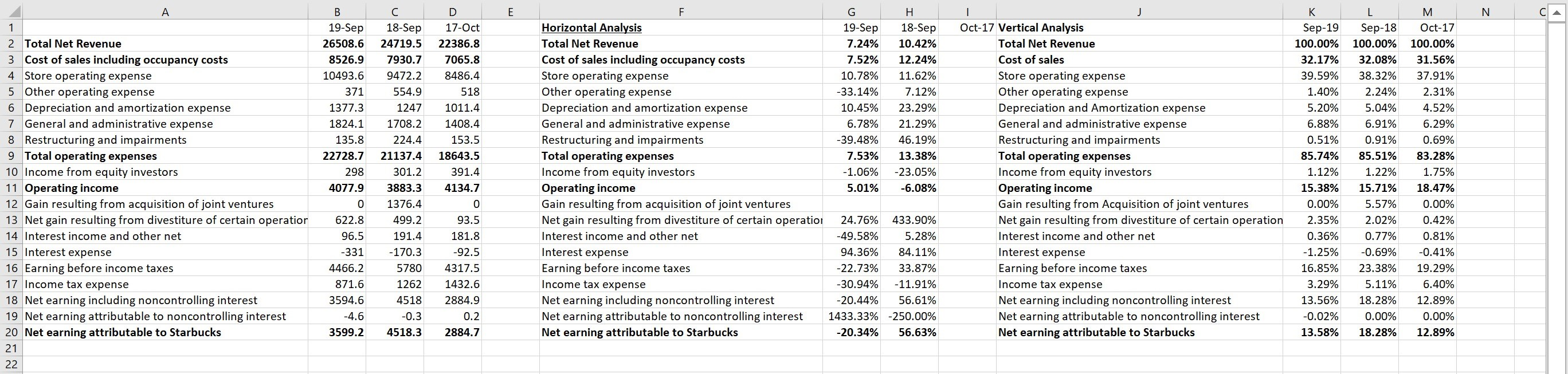

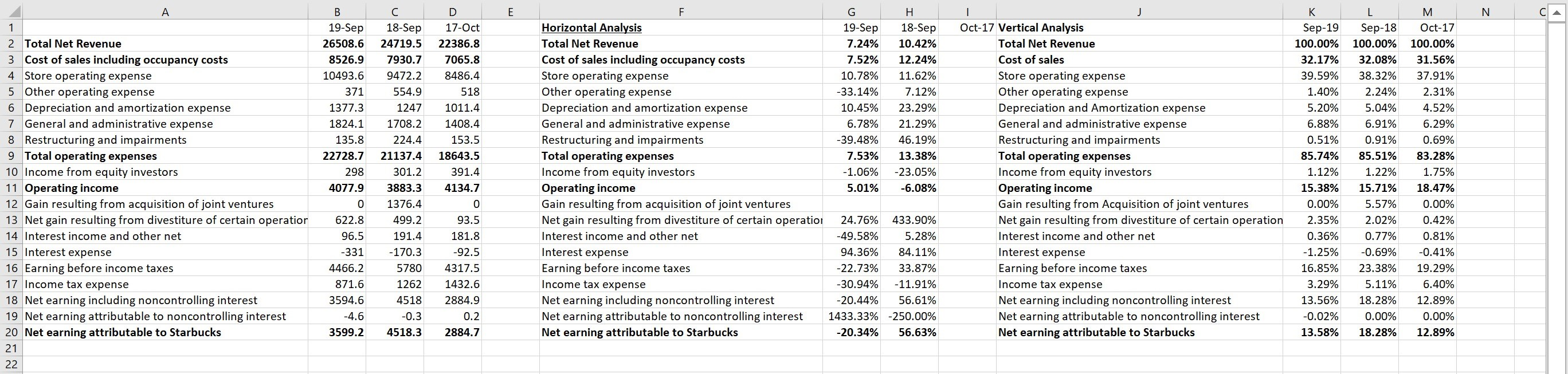

A E J L N. 1 2 Total Net Revenue 3 Cost of sales including occupancy costs 4 Store operating expense 5 Other operating expense 6 Depreciation and amortization expense 7 General and administrative expense 8 Restructuring and impairments 9 Total operating expenses 10 Income from equity investors 11 Operating income 12 Gain resulting from acquisition of joint ventures 13 Net gain resulting from divestiture of certain operation 14 Interest income and other net 15 Interest expense 16 Earning before income taxes 17 Income tax expense 18 Net earning including noncontrolling interest 19 Net earning attributable to noncontrolling interest 20 Net earning attributable to Starbucks 21 22 B 19-Sep 26508.6 8526.9 10493.6 371 1377.3 1824.1 135.8 22728.7 298 4077.9 0 622.8 96.5 -331 4466.2 871.6 3594.6 -4.6 3599.2 18-Sep 24719.5 7930.7 9472.2 554.9 1247 1708.2 224.4 21137.4 301.2 3883.3 1376.4 499.2 191.4 -170.3 5780 1262 4518 -0.3 4518.3 D 17-Oct 22386.8 7065.8 8486.4 518 1011.4 1408.4 153.5 18643.5 391.4 4134.7 0 93.5 181.8 -92.5 4317.5 1432.6 2884.9 0.2 2884.7 F G H Horizontal Analysis 19-Sep 18-Sep Total Net Revenue 7.24% 10.42% Cost of sales including occupancy costs 7.52% 12.24% Store operating expense 10.78% 11.62% Other operating expense -33.14% 7.12% Depreciation and amortization expense 10.45% 23.29% General and administrative expense 6.78% 21.29% Restructuring and impairments -39.48% 46.19% Total operating expenses 7.53% 13.38% Income from equity investors -1.06% -23.05% Operating income 5.01% -6.08% Gain resulting from acquisition of joint ventures Net gain resulting from divestiture of certain operation 24.76% 433.90% Interest income and other net -49.58% 5.28% Interest expense 94.36% 84.11% Earning before income taxes -22.73% 33.87% Income tax expense -30.94% - 11.91% Net earning including noncontrolling interest -20.44% 56.61% Net earning attributable to noncontrolling interest 1433.33% -250.00% Net earning attributable to Starbucks -20.34% 56.63% Oct-17 Vertical Analysis Total Net Revenue Cost of sales Store operating expense Other operating expense Depreciation and Amortization expense General and administrative expense Restructuring and impairments Total operating expenses Income from equity investors Operating income Gain resulting from Acquisition of joint ventures Net gain resulting from divestiture of certain operation Interest income and other net Interest expense Earning before income taxes Income tax expense Net earning including noncontrolling interest Net earning attributable to noncontrolling interest Net earning attributable to Starbucks K Sep-19 100.00% 32.17% 39.59% 1.40% 5.20% 6.88% 0.51% 85.74% 1.12% 15.38% 0.00% 2.35% 0.36% -1.25% 16.85% 3.29% 13.56% -0.02% 13.58% M Sep-18 Oct-17 100.00% 100.00% 32.08% 31.56% 38.32% 37.91% 2.24% 2.31% 5.04% 4.52% 6.91% 6.29% 0.91% 0.69% 85.51% 83.28% 1.22% 1.75% 15.71% 18.47% 5.57% 0.00% 2.02% 0.42% 0.77% 0.81% -0.69% -0.41% 23.38% 19.29% 5.11% 6.40% 18.28% 12.89% 0.00% 0.00% 18.28% 12.89%