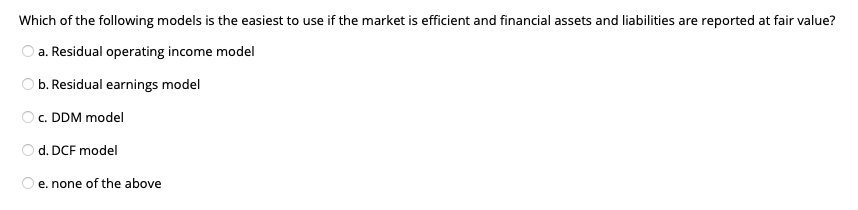

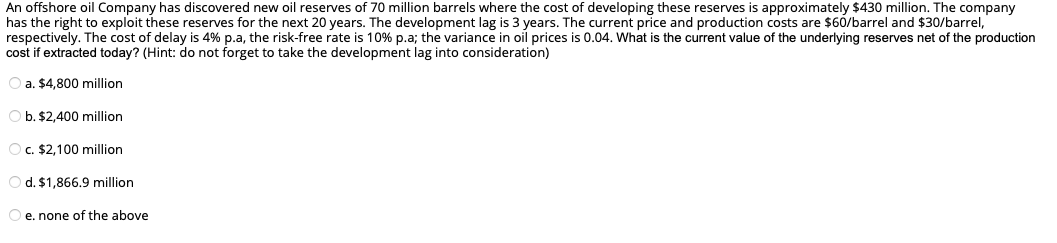

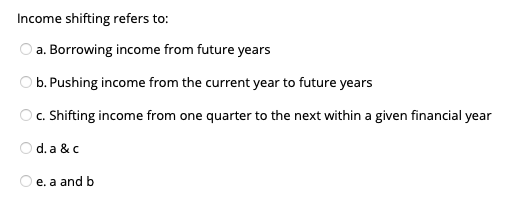

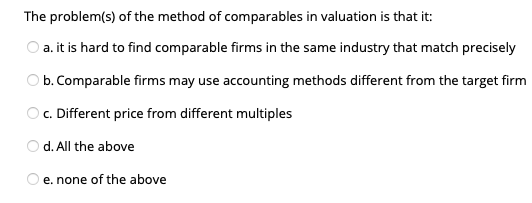

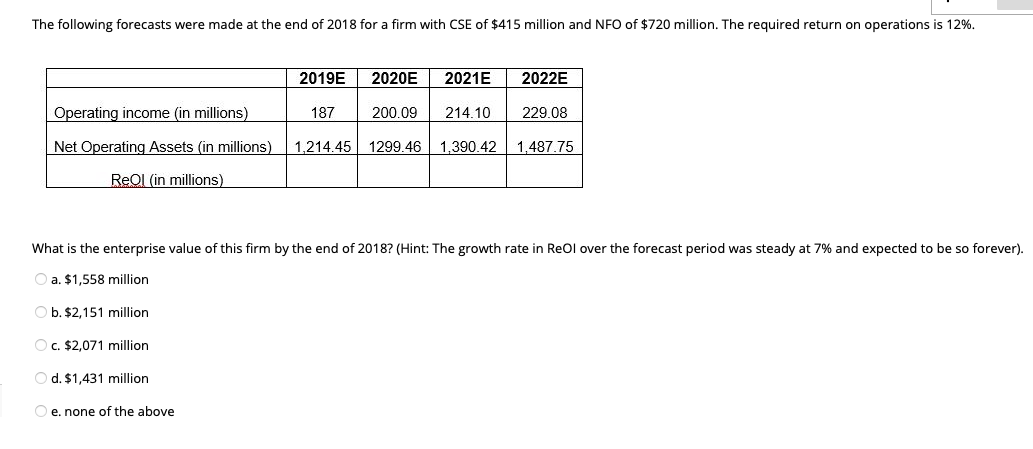

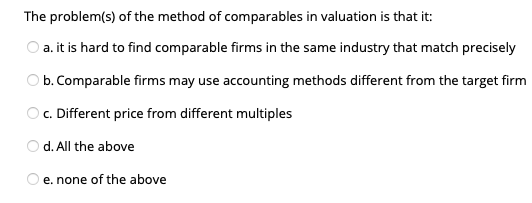

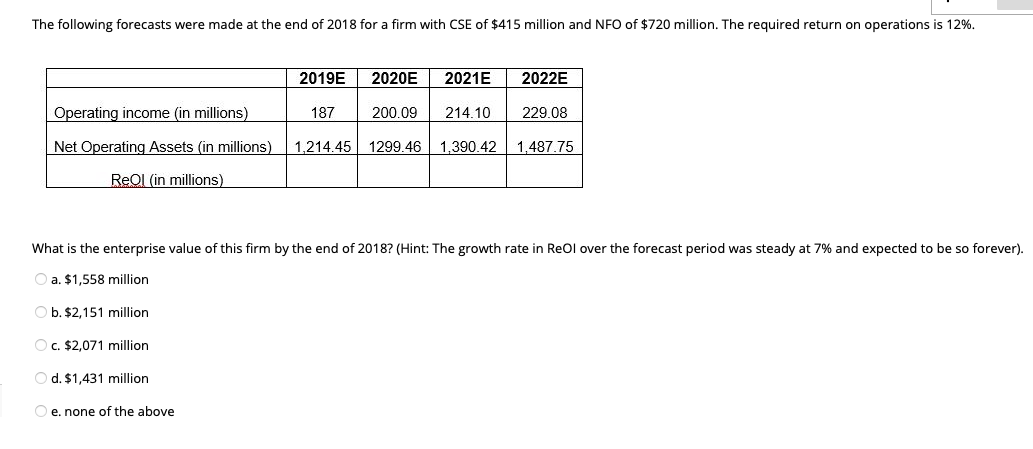

Which of the following models is the easiest to use if the market is efficient and financial assets and liabilities are reported at fair value? a. Residual operating income model b. Residual earnings model C. DDM model 0 d. DCF model e, none of the above An offshore oil Company has discovered new oil reserves of 70 million barrels where the cost of developing these reserves is approximately $430 million. The company has the right to exploit these reserves for the next 20 years. The development lag is 3 years. The current price and production costs are $60/barrel and $30/barrel, respectively. The cost of delay is 4% p.a, the risk-free rate is 10% p.a; the variance in oil prices is 0.04. What is the current value of the underlying reserves net of the production cost if extracted today? (Hint: do not forget to take the development lag into consideration) a. $4,800 million b. $2,400 million c. $2,100 million d. $1,866.9 million O e, none of the above Income shifting refers to: a. Borrowing income from future years b. Pushing income from the current year to future years c. Shifting income from one quarter to the next within a given financial year C. d. a &c e. a and b The problem(s) of the method of comparables in valuation is that it: a. it is hard to find comparable firms in the same industry that match precisely b. Comparable firms may use accounting methods different from the target firm c. Different price from different multiples d. All the above e. none of the above The following forecasts were made at the end of 2018 for a firm with CSE of $415 million and NFO of $720 million. The required return on operations is 12%. 2019E 2020E 2021E 2022E Operating income (in millions) 187 200.09 214.10 229.08 Net Operating Assets (in millions 1.214.45 1299.46 1,390.42 1,487.75 Reol (in millions) What is the enterprise value of this firm by the end of 2018? (Hint: The growth rate in Reol over the forecast period was steady at 7% and expected to be so forever). O a. $1,558 million O b. $2,151 million c. $2,071 million O d. $1,431 million O e. none of the above