Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following represents a taxable temporary difference? An entity receives a non - taxable government grant of 1 , 0 0 0 ,

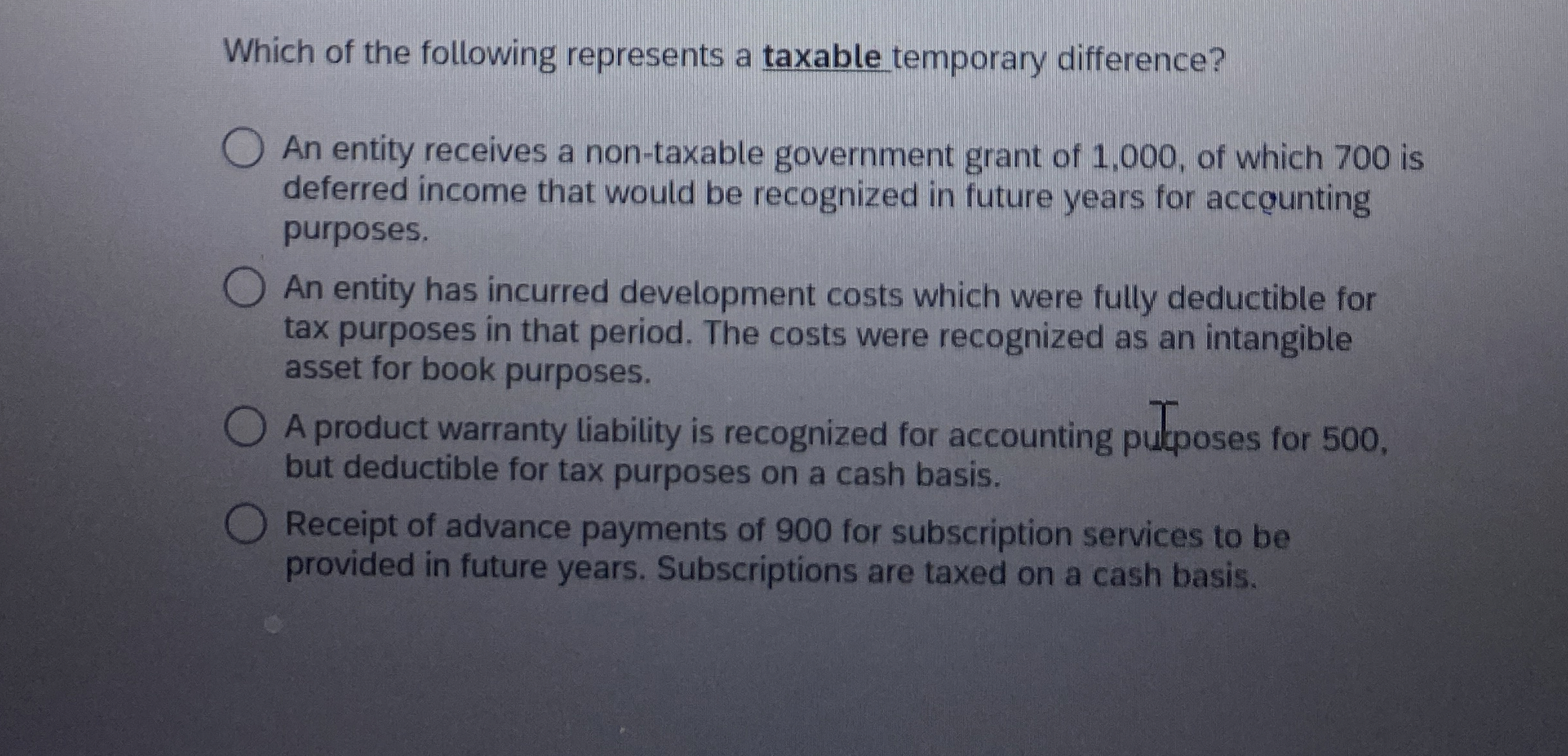

Which of the following represents a taxable temporary difference?

An entity receives a nontaxable government grant of of which is

deferred income that would be recognized in future years for accounting

purposes.

An entity has incurred development costs which were fully deductible for

tax purposes in that period. The costs were recognized as an intangible

asset for book purposes.

A product warranty liability is recognized for accounting putposes for

but deductible for tax purposes on a cash basis.

Receipt of advance payments of for subscription services to be

provided in future years. Subscriptions are taxed on a cash basis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started