Answered step by step

Verified Expert Solution

Question

1 Approved Answer

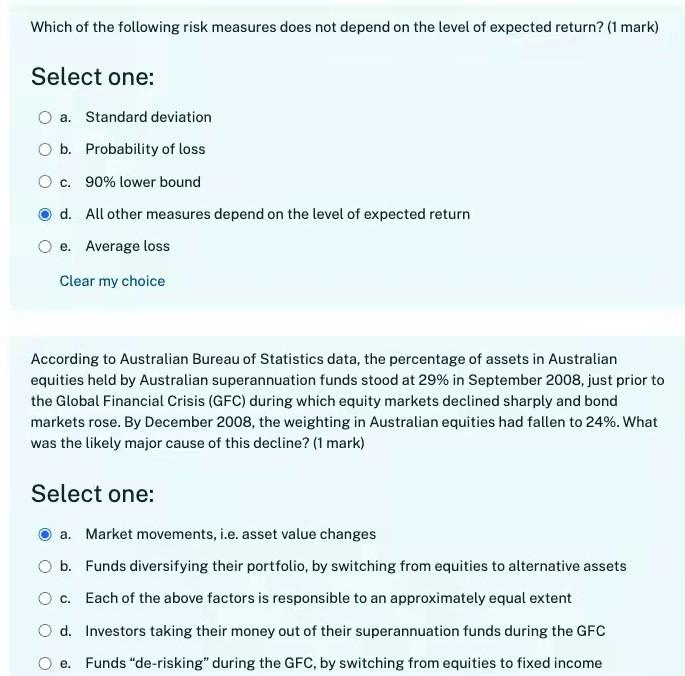

Which of the following risk measures does not depend on the level of expected return? (1 mark) Select one: O a. Standard deviation O b.

Which of the following risk measures does not depend on the level of expected return? (1 mark) Select one: O a. Standard deviation O b. Probability of loss O c. 90% lower bound d. All other measures depend on the level of expected return e. Average loss Clear my choice According to Australian Bureau of Statistics data, the percentage of assets in Australian equities held by Australian superannuation funds stood at 29% in September 2008, just prior to the Global Financial Crisis (GFC) during which equity markets declined sharply and bond markets rose. By December 2008, the weighting in Australian equities had fallen to 24%. What was the likely major cause of this decline? (1 mark) Select one: a. Market movements, i.e. asset value changes O b. Funds diversifying their portfolio, by switching from equities to alternative assets O c. Each of the above factors is responsible to an approximately equal extent Od. Investors taking their money out of their superannuation funds during the GFC O e. Funds "de-risking" during the GFC, by switching from equities to fixed income Which of the following risk measures does not depend on the level of expected return? (1 mark) Select one: O a. Standard deviation O b. Probability of loss O c. 90% lower bound d. All other measures depend on the level of expected return e. Average loss Clear my choice According to Australian Bureau of Statistics data, the percentage of assets in Australian equities held by Australian superannuation funds stood at 29% in September 2008, just prior to the Global Financial Crisis (GFC) during which equity markets declined sharply and bond markets rose. By December 2008, the weighting in Australian equities had fallen to 24%. What was the likely major cause of this decline? (1 mark) Select one: a. Market movements, i.e. asset value changes O b. Funds diversifying their portfolio, by switching from equities to alternative assets O c. Each of the above factors is responsible to an approximately equal extent Od. Investors taking their money out of their superannuation funds during the GFC O e. Funds "de-risking" during the GFC, by switching from equities to fixed income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started