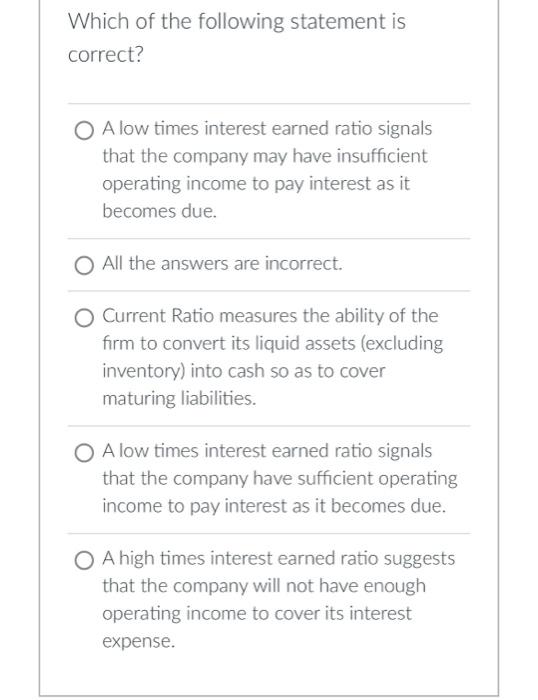

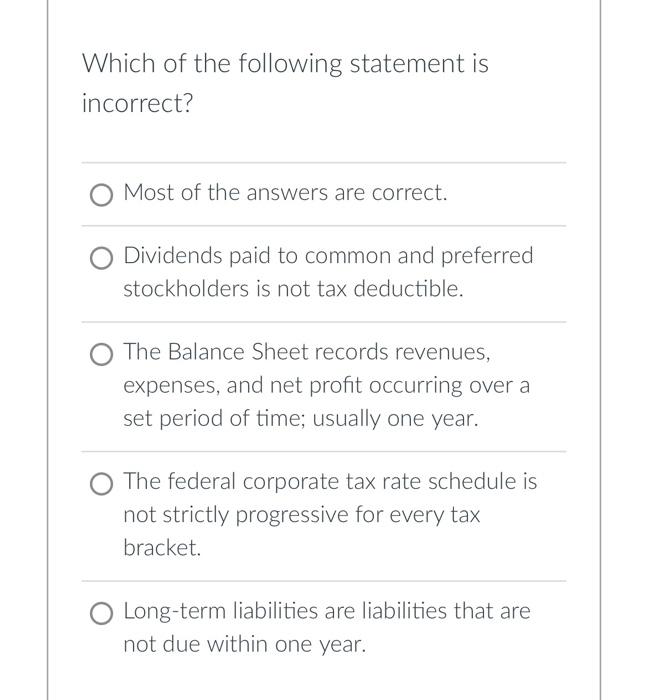

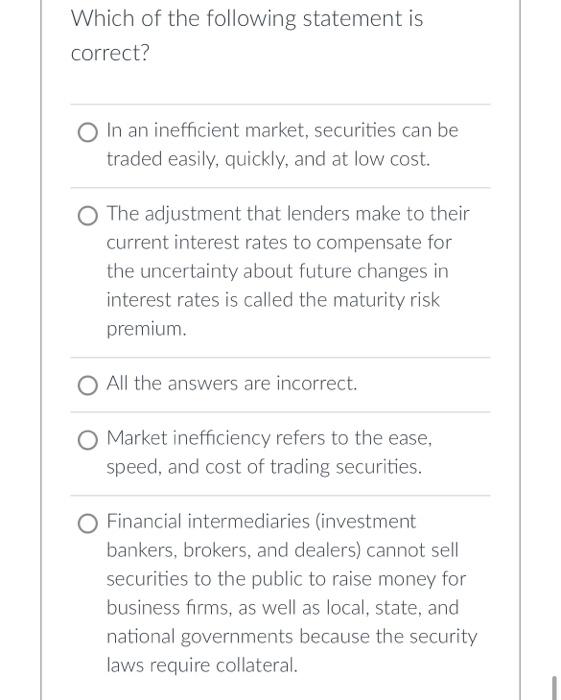

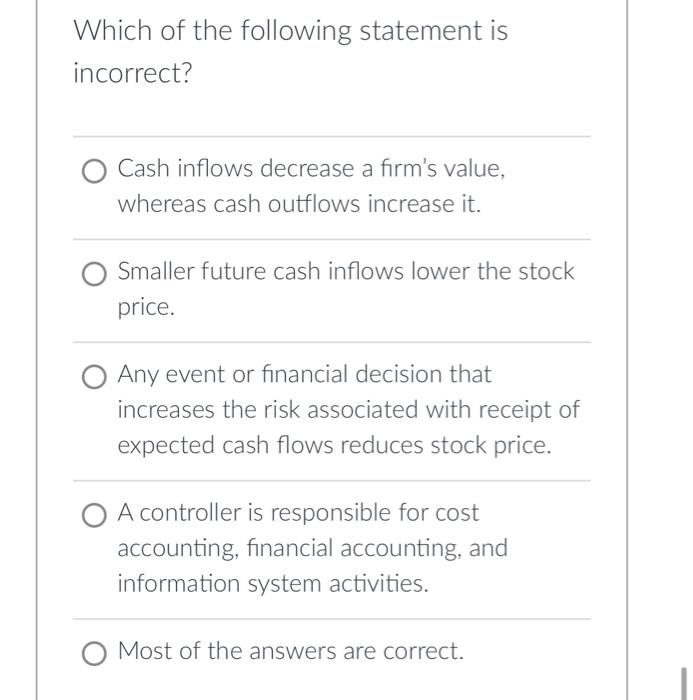

Which of the following statement is correct? O A low times interest earned ratio signals that the company may have insufficient operating income to pay interest as it becomes due. O All the answers are incorrect. O Current Ratio measures the ability of the firm to convert its liquid assets (excluding inventory) into cash so as to cover maturing liabilities. O A low times interest earned ratio signals that the company have sufficient operating income to pay interest as it becomes due. O A high times interest earned ratio suggests that the company will not have enough operating income to cover its interest expense. Which of the following statement is incorrect? Most of the answers are correct. Dividends paid to common and preferred stockholders is not tax deductible. The Balance Sheet records revenues, expenses, and net profit occurring over a set period of time; usually one year. The federal corporate tax rate schedule is not strictly progressive for every tax bracket. O Long-term liabilities are liabilities that are not due within one year. Which of the following statement is correct? O In an inefficient market, securities can be traded easily, quickly, and at low cost. O The adjustment that lenders make to their current interest rates to compensate for the uncertainty about future changes in interest rates is called the maturity risk premium. O All the answers are incorrect. O Market inefficiency refers to the ease, speed, and cost of trading securities. O Financial intermediaries (investment bankers, brokers, and dealers) cannot sell securities to the public to raise money for business firms, as well as local, state, and national governments because the security laws require collateral. Which of the following statement is incorrect? Cash inflows decrease a firm's value, whereas cash outflows increase it. Smaller future cash inflows lower the stock price. Any event or financial decision that increases the risk associated with receipt of expected cash flows reduces stock price. O A controller is responsible for cost accounting, financial accounting, and information system activities. O Most of the answers are correct