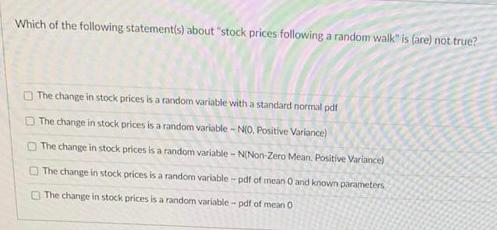

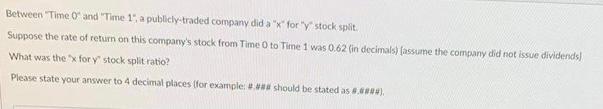

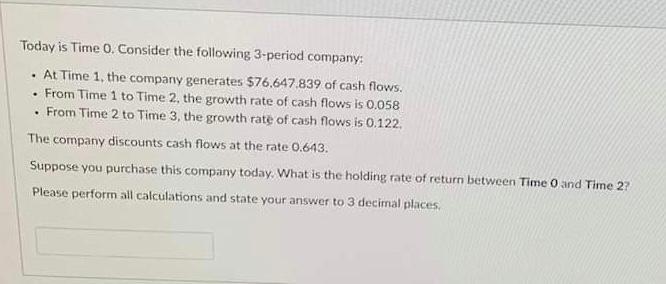

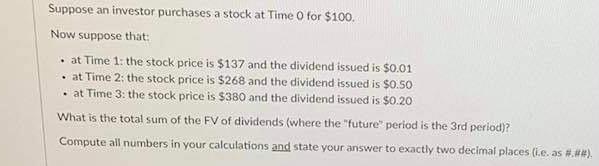

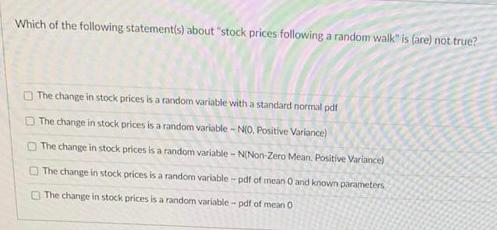

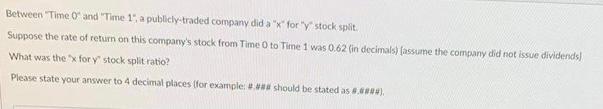

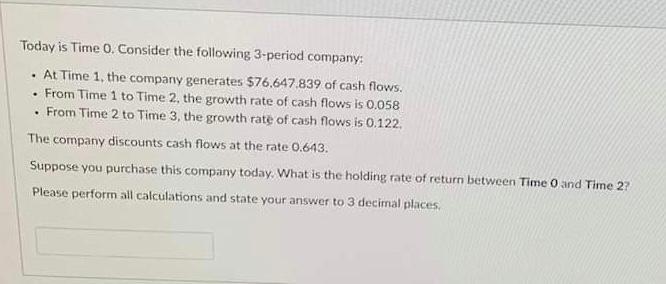

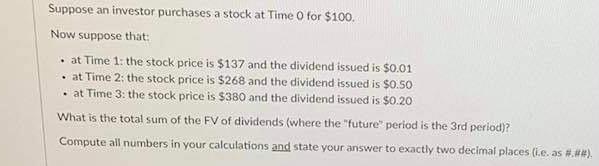

Which of the following statement(s) about "stock prices following a random walk is (are) not true? The change in stock prices is a random variable with a standard normal pdf The change in stock prices is a random variable - NO. Positive Variance) The change in stock prices is a random variable - N(Non-Zero Mean, Positive Variance) The change in stock prices is a random variable - pdf of mean and known parameters The change in stock prices is a random variable-pdf of meano Between Time and Time 1, a publicly-traded company did a x for 'stock split. Suppose the rate of return on this company's stock from Time to Time 1 was 0.62 (in decimals) lassume the company did not issue dividends) What was the x for y stock splitratio? Please state your answer to 4 decimal places (for example should be stated as 8.), . Today is Time 0. Consider the following 3-period company: At Time 1, the company generates $76,647.839 of cash flows. From Time 1 to Time 2, the growth rate of cash flows is 0.058 . From Time 2 to Time 3, the growth rate of cash flows is 0.122. The company discounts cash flows at the rate 0.643. Suppose you purchase this company today. What is the holding rate of return between Time and Time 27 Please perform all calculations and state your answer to 3 decimal places Suppose an investor purchases a stock at Time O for $100. Now suppose that at Time 1: the stock price is $137 and the dividend issued is $0.01 at Time 2: the stock price is $268 and the dividend issued is $0.50 at Time 3: the stock price is $380 and the dividend issued is $0.20 What is the total sum of the FV of dividends (where the "future" period is the 3rd period)? Compute all numbers in your calculations and state your answer to exactly two decimal places (.e. as #.##). Which of the following statement(s) about "stock prices following a random walk is (are) not true? The change in stock prices is a random variable with a standard normal pdf The change in stock prices is a random variable - NO. Positive Variance) The change in stock prices is a random variable - N(Non-Zero Mean, Positive Variance) The change in stock prices is a random variable - pdf of mean and known parameters The change in stock prices is a random variable-pdf of meano Between Time and Time 1, a publicly-traded company did a x for 'stock split. Suppose the rate of return on this company's stock from Time to Time 1 was 0.62 (in decimals) lassume the company did not issue dividends) What was the x for y stock splitratio? Please state your answer to 4 decimal places (for example should be stated as 8.), . Today is Time 0. Consider the following 3-period company: At Time 1, the company generates $76,647.839 of cash flows. From Time 1 to Time 2, the growth rate of cash flows is 0.058 . From Time 2 to Time 3, the growth rate of cash flows is 0.122. The company discounts cash flows at the rate 0.643. Suppose you purchase this company today. What is the holding rate of return between Time and Time 27 Please perform all calculations and state your answer to 3 decimal places Suppose an investor purchases a stock at Time O for $100. Now suppose that at Time 1: the stock price is $137 and the dividend issued is $0.01 at Time 2: the stock price is $268 and the dividend issued is $0.50 at Time 3: the stock price is $380 and the dividend issued is $0.20 What is the total sum of the FV of dividends (where the "future" period is the 3rd period)? Compute all numbers in your calculations and state your answer to exactly two decimal places (.e. as #.##)