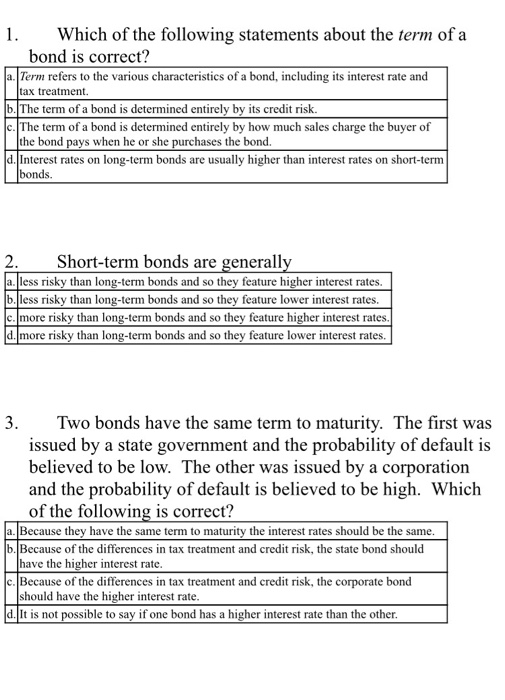

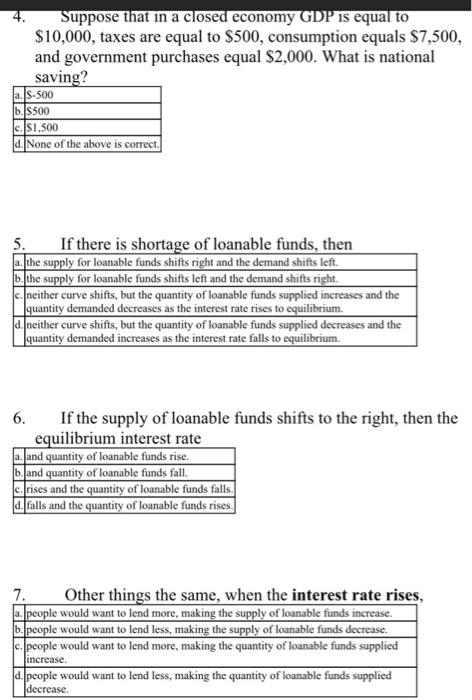

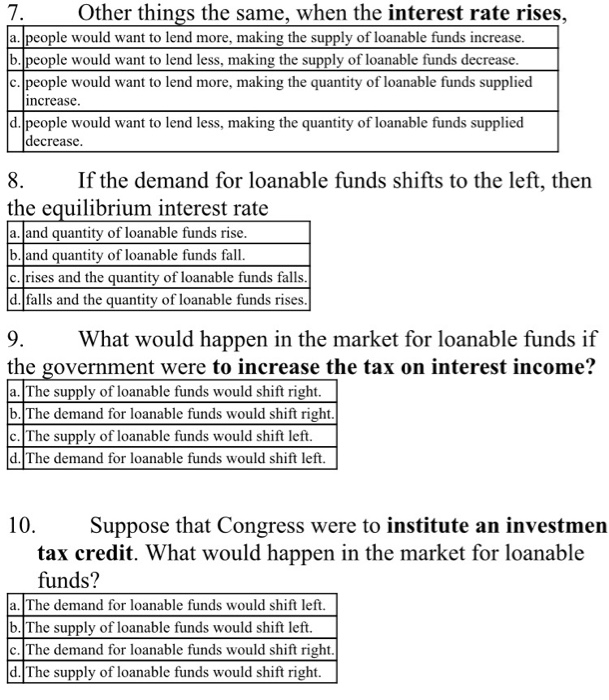

Which of the following statements about the term of a bond is correct? a. Term refers to the various characteristics of a bond, including its interest rate and tax treatment b.lThe term of a bond is determined entirely by its credit risk The term of a bond is determined entirely by how much sales charge the buyer of the bond pays when he or she purchases the bond d.Interest rates on long-term bonds are usually higher than interest rates on short-term bonds. Short-term bonds are generall a. less risky than long-term bonds and so they feature higher interest rates. b. less risky than long-term bonds and so they feature lower interest rates more risky than long-term bonds and so they feature higher interest rates more risky than long-term bonds and so they feature lower interest rates 3. Two bonds have the same term to maturity. The first was issued by a state government and the probability of default is believed to be low. The other was issued by a corporation and the probability of default is believed to be high. Which of the following is correct? a. Because they have the same term to b.Because of the differences in tax treatment and credit risk, the state bond should the interest rates should be the same have the higher interest rate Because of the differences in tax treatment and credit risk, the corporate bond should have the higher interest rate It is not possible to say if one bond has a higher interest rate than the other uppose that in a closed economy is equal to $10,000, taxes are equal to $500, consumption equals $7,500, and government purchases equal $2,000. What is national saving? S-500 S500 S1,500 None of the above is correct 5. If there is shortage of loanable funds, then the s the s neither curve shifts, but the quantity of loanable funds supplied increases and the for loanable funds shifts right and the demand shifts left. for loanable funds shifts left and the demand shifts demanded decreases as the interest rate rises to equilibrium. neither curve shifts, but the quantity of loanable funds supplied decreases and the y demanded increases as the interest rate falls to equilibrium. 6. If the supply of loanable funds shifts to the right, then the equilibrium interest rate and and rises and the falls and the tity of loanable funds rise tity of loanable funds fall tity of loanable funds falls of loanable funds rises Other things the same, when the interest rate rises, would want to lend more, making the s of loanable funds increase of loanable funds decrease e would want to lend less, making the s would want to lend more, making the quantity of loanable funds supplied people would want to lend less, making the quantity of loanable funds supplied decrease