Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following statements concerning the use of life insurance as an incidental benefit provided by a qualified retirement plan is ( are )

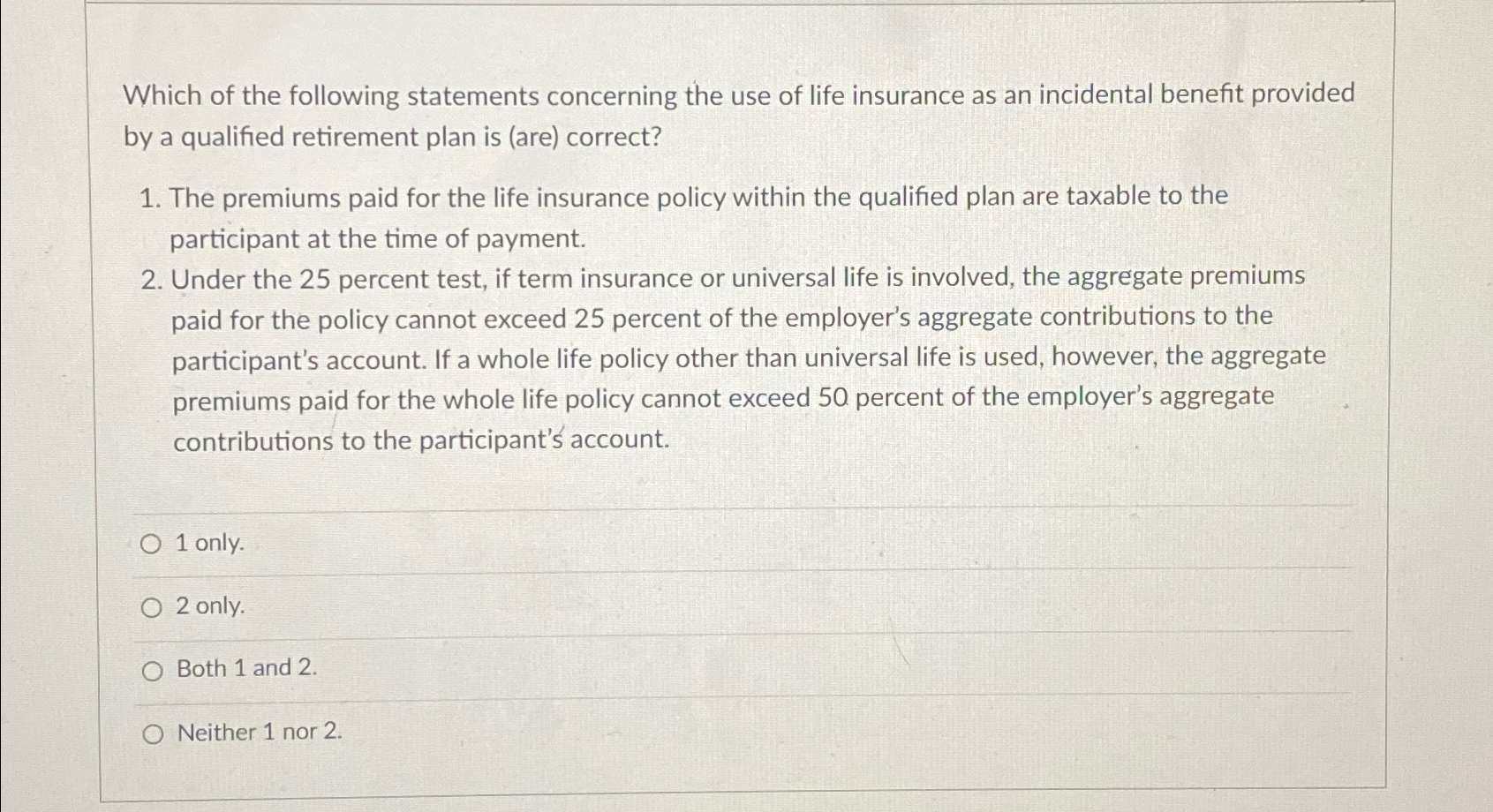

Which of the following statements concerning the use of life insurance as an incidental benefit provided by a qualified retirement plan is are correct?

The premiums paid for the life insurance policy within the qualified plan are taxable to the participant at the time of payment.

Under the percent test, if term insurance or universal life is involved, the aggregate premiums paid for the policy cannot exceed percent of the employer's aggregate contributions to the participant's account. If a whole life policy other than universal life is used, however, the aggregate premiums paid for the whole life policy cannot exceed percent of the employer's aggregate contributions to the participant's account.

only.

only.

Both and

Neither nor

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started