Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following statements is (are) true about preference shares? (There may be more than one correct answer. ) Select one or more: a.

Which of the following statements is (are) true about preference shares? (There may be more than one correct answer. )

Select one or more:

a. Preference shareholders dividends are paid from profit before tax.

b. None of the other statements is true.

c. Compared to ordinary shareholders, preference shareholders require a higher expected return from their investments.

d. Preference shareholders have voting rights.

e. Preference shareholders have priority over bondholders in the case of bankruptcy.

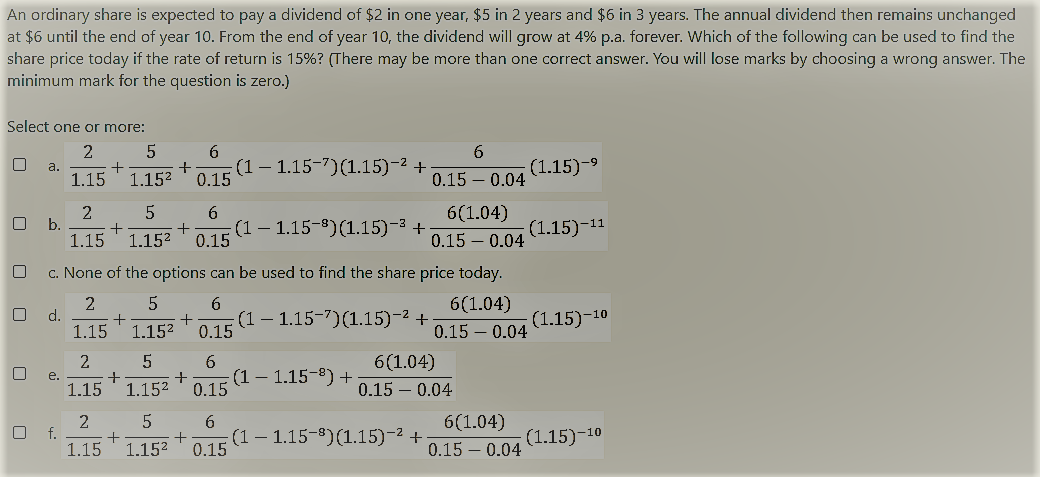

An ordinary share is expected to pay a dividend of $2 in one year, $5 in 2 years and $6 in 3 years. The annual dividend then remains unchanged at $6 until the end of year 10. From the end of year 10, the dividend will grow at 4% p.a. forever. Which of the following can be used to find the share price today if the rate of return is 15%? (There may be more than one correct answer. You will lose marks by choosing a wrong answer. The minimum mark for the question is zero.) Select one or more: 2 5 6 6 O a. + + (1 1.15-7)(1.15)-2 + 1.15 1.152 0.15 0.15 0.04 (1.15)-9 (1.15)-11 1.15 2 5 6 b. 6(1.04) + + (1 1.15-8)(1.15) -3 + 1.152 0.15 0.15-0.04 c. None of the options can be used to find the share price today. 2 5 6 d. 6(1.04) + + (1 1.15-7)(1.15)-2 + 1.15 1.152 (1.15)-10 0.15 0.15 -0.04 2 5 6 6(1.04) + + (1 - 1.15-8) + 1.15 1.152 0.15 0.15 0.04 2 5 6 f. 6(1.04) + + (1 1.15-8)(1.15)-2 + 1.15 1.152 0.15 0.15 0.04 O e. (1.15)-10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started