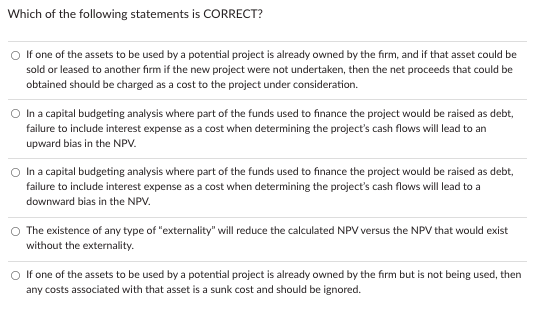

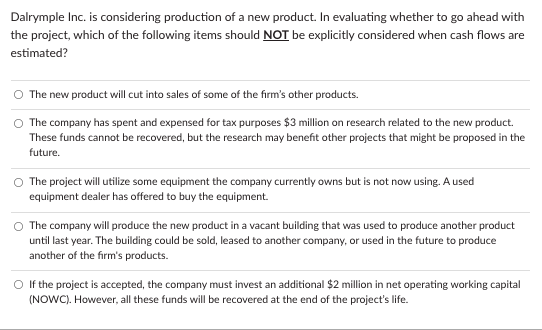

Which of the following statements is CORRECT? If one of the assets to be used by a potential project is already owned by the firm, and if that asset could be sold or leased to another firm if the new project were not undertaken, then the net proceeds that could be obtained should be charged as a cost to the project under consideration. In a capital budgeting analysis where part of the funds used to finance the project would be raised as debt, failure to include interest expense as a cost when determining the project's cash flows will lead to an upward bias in the NPV. In a capital budgeting analysis where part of the funds used to finance the project would be raised as debt, failure to include interest expense as a cost when determining the project's cash flows will lead to a downward bias in the NPV. The existence of any type of "externality" will reduce the calculated NPV versus the NPV that would exist without the externality. o If one of the assets to be used by a potential project is already owned by the firm but is not being used, then any costs associated with that asset is a sunk cost and should be ignored. Dalrymple Inc. is considering production of a new product. In evaluating whether to go ahead with the project, which of the following items should NOT be explicitly considered when cash flows are estimated? The new product will cut into sales of some of the firm's other products. The company has spent and expensed for tax purposes $3 million on research related to the new product. These funds cannot be recovered, but the research may benefit other projects that might be proposed in the future. The project will utilize some equipment the company currently owns but is not now using. A used equipment dealer has offered to buy the equipment. The company will produce the new product in a vacant building that was used to produce another product until last year. The building could be sold, leased to another company, or used in the future to produce another of the firm's products. O If the project is accepted, the company must invest an additional $2 million in net operating working capital (NOWC). However, all these funds will be recovered at the end of the project's life