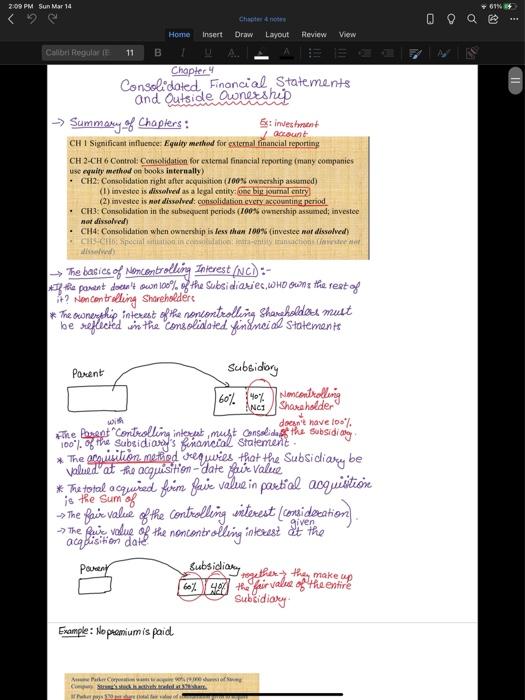

Which of the following statements is correct regarding the initial analysis in CH. 4 when a 20% non-controlling interest (NCI) exists. A. The initial analysis is exactly the same as that in CH. 3 when NCI does not exist. The first big box in the initial analysis is the sum of two components at the acquisition date: B.(1) the fair value of the controlling interest and (2) the fair value of the noncontrolling interest. C. The second big box in the initial analysis is 80% of the fair value (FV) of the subsidiary's identifiable net assets (...). D.NCI should be excluded from Initial analysis since it is not owned by the parent company. 2:09 PM Sun Mar 14 61% Chapter 4 Home Insert IN Draw Layout Review View Color Regular 11 B Chapter Consolidated Financial Statements and Outside Ownership -> Summary of Chapters: est invest attaunt CH 1 Significant influence Equity method for external financial reporting CH2-CH 6 Control: Consolidation for external financial reporting (many companies use equity method on books internally) CH2. Consolidation night after acquisition (100% ownership assumed) (1) investee is dissolved as a legal entity: one big journal entry) (2) investee is not dissolved: consolidation every accounting period - CH3: Consolidation in the subsequent periods (100% ownership assumed investee lanired CH4: Consolid when ownership is less than 100% investee or dissolved) CHSCH Special ition -cntly inactione Wisse - The basics of Noncentrolling Interest (NC):- *the parent doesn't own 100% of the subsidiaries.wHD WWE the rest go ##? Non controlling Shareholdere * The owneyeship interest of the noncontrolling Shareholders must be reflected in the consolidated financial Statements Ponent Subsidiary 60% 9% econtrolling Anca / Shareholder doant have to: the bageft"Controlling interest must consolidare the subsidian * The acquisition method, requiries that the Subsidiary be Valued at the acquisition - date fuit Value * The total acquired forem faire value in partial acquisition > The Rain value of the controlling interest (conei decation - The Bure value the noncontrolling interest at the date Pareny Subsidiary rogether they make 60% ] the fair value of the entire Subidiary Example: No premium is paid re Comwell