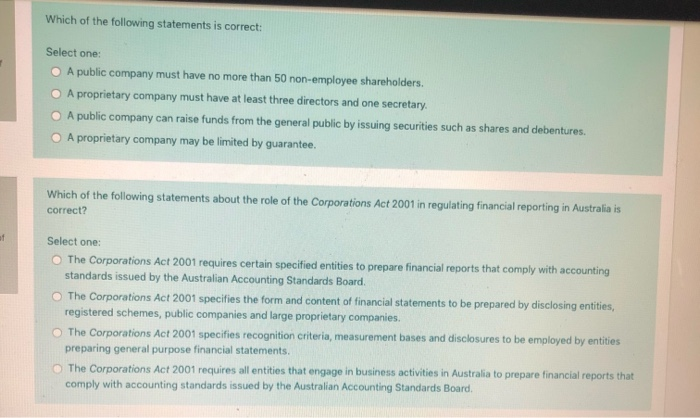

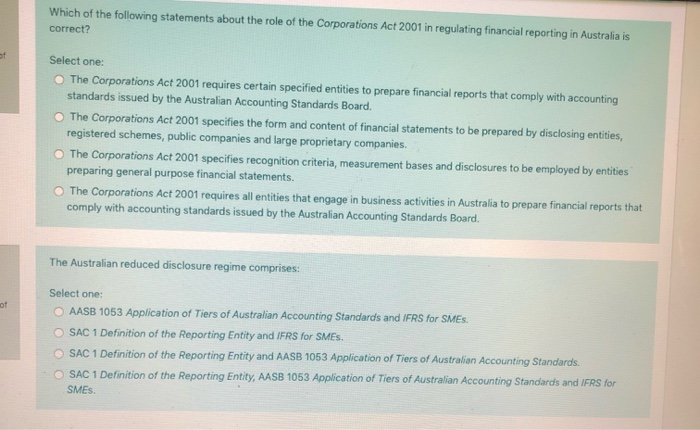

Which of the following statements is correct: Select one: A public company must have no more than 50 non-employee shareholders. A proprietary company must have at least three directors and one secretary, A public company can raise funds from the general public by issuing securities such as shares and debentures. A proprietary company may be limited by guarantee. Which of the following statements about the role of the Corporations Act 2001 in regulating financial reporting in Australia is correct? Select one: The Corporations Act 2001 requires certain specified entities to prepare financial reports that comply with accounting standards issued by the Australian Accounting Standards Board The Corporations Act 2001 specifies the form and content of financial statements to be prepared by disclosing entities, registered schemes, public companies and large proprietary companies. The Corporations Act 2001 specifies recognition criteria, measurement bases and disclosures to be employed by entities preparing general purpose financial statements. The Corporations Act 2001 requires all entities that engage in business activities in Australia to prepare financial reports that comply with accounting standards issued by the Australian Accounting Standards Board Which of the following statements about the role of the Corporations Act 2001 in regulating financial reporting in Australia is correct? Select one: The Corporations Act 2001 requires certain specified entities to prepare financial reports that comply with accounting standards issued by the Australian Accounting Standards Board. The Corporations Act 2001 specifies the form and content of financial statements to be prepared by disclosing entities, registered schemes, public companies and large proprietary companies The Corporations Act 2001 specifies recognition criteria, measurement bases and disclosures to be employed by entities preparing general purpose financial statements. The Corporations Act 2001 requires all entities that engage in business activities in Australia to prepare financial reports that comply with accounting standards issued by the Australian Accounting Standards Board. The Australian reduced disclosure regime comprises: Select one: AASB 1053 Application of Tiers of Australian Accounting Standards and IFRS for SMEs. SAC 1 Definition of the Reporting Entity and IFRS for SMES. SAC 1 Definition of the Reporting Entity and AASB 1053 Application of Tiers of Australian Accounting Standards. SAC 1 Definition of the Reporting Entity, AASB 1053 Application of Tiers of Australian Accounting Standards and IFRS for SMES