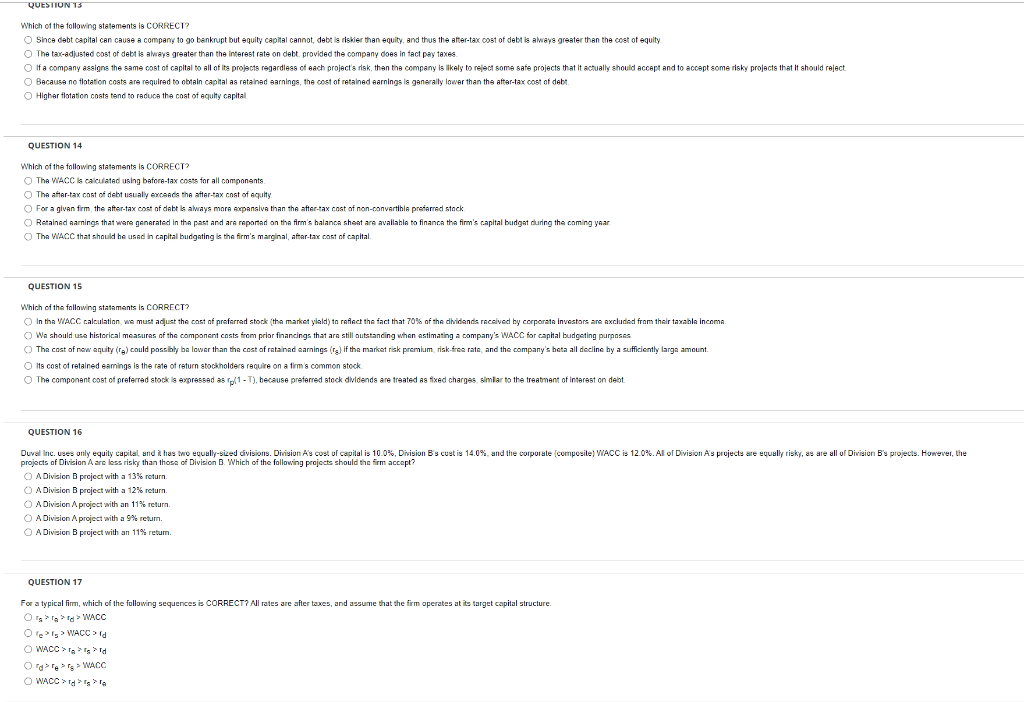

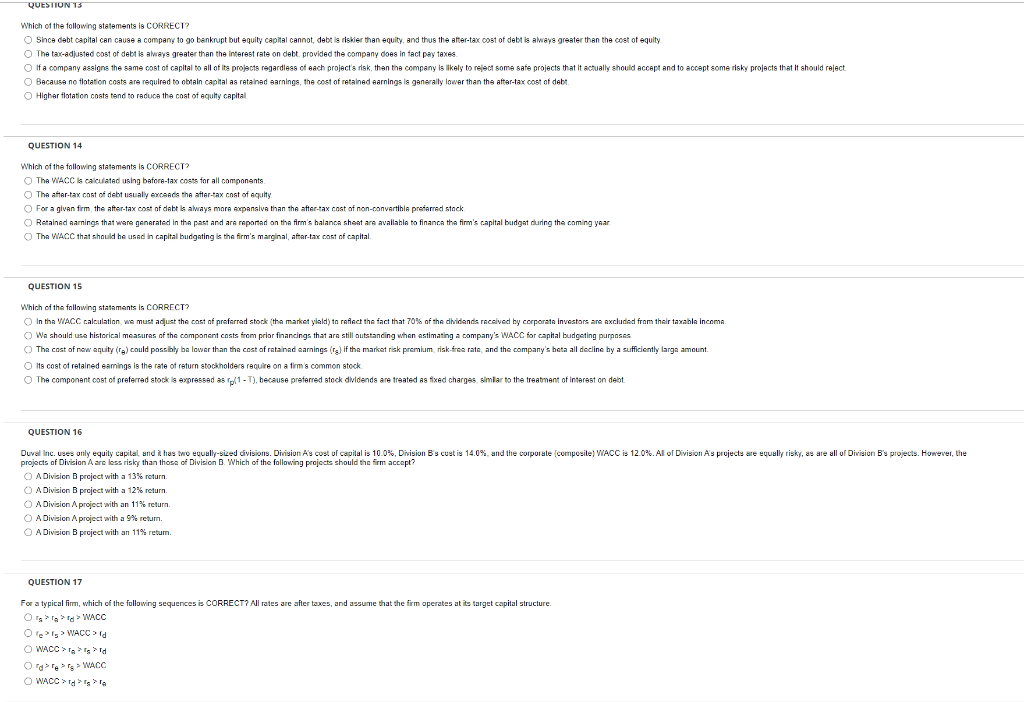

Which of the following statements is CORRECT? Shce debt capital cen cause a company to go banknupt but equity capital cannot, debt is risker than equity, and thus the atter-tax cost of debt is always greater then the cost of equity. The tac-edjusted cast of debt ls always greater then the interest rate on debt provided the company does in fact pary texes. Because no flatation costs are required to obtain capital as retained earnings, the cost of retained earnings is generaily lower than the after-tar cost of debt. Highar flotation costs tand to reduce the cost of equily capital. QUESTION 14 Which of the following stataments is CORRECT? The WACC ls calculated using before-tax costs for all components. The ather-tax cost of debt usualy exceads the after-tax cost of equity. For a givan frm the after-tax cost of dabt ls always mare expanalva than the after-tax cost of non-convertible prefarred stock: Retained aarnings that ware genarated in tha past and are reportad on the firm's halanca sheat are avaliabla to financa tha firm's capital budgat during the coming yaar Tha WACC that should he usad in capital budgating is the firm's marginal, aftar-tax cost af capital. QUESTION 15 Which of the following stataments is CORRECT? Wa should use historical measuras of the component costs firom priar financings that ara still outstancing whan astimating a company's WACC for capital budgeting purpnses Its cost of retained eamings is the rate of return stockholders require on a firm 8 common stock. The component cost of preferred stock ls exgressed as rpht - T'), because preferred stock dividends are treated es fixed charges. simlar to the treatment of interest on delot. QUESTION 16 projects of Division A are loss risky than those of Division B. Which of the fallowing projocts should the frm accept? A Division B project with a 13% return. A Divisien B project with a 12% return. A Division A project with an 11% return. A Division A project with a 9% return. A Division B project with an 11% return. QUESTION 17 For a typical firm, which of the following sequences is CORRECT? Al rates are after texes, and assume that the firm operates at its target copital structure. rg>rA>rd>WACCre>r5>WACC>rdWACC>r9>rg>rdrd>rA>rg>WACCWACC>rd>rg>rA