Answered step by step

Verified Expert Solution

Question

1 Approved Answer

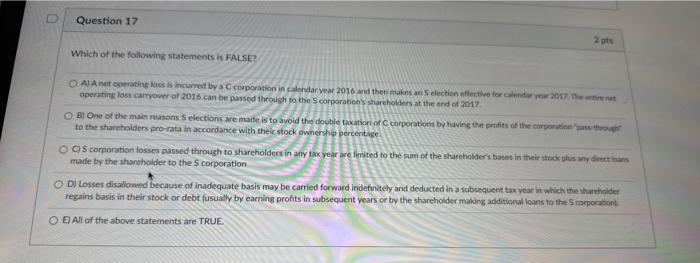

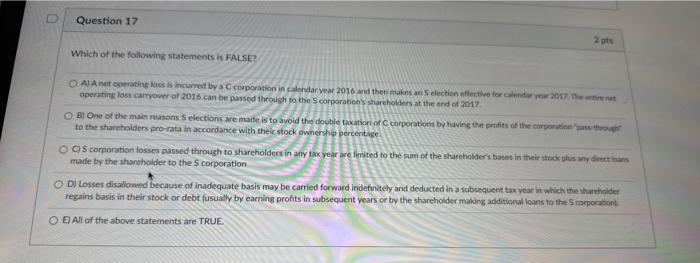

Which of the following statements is FALSE? A) A net operating loss is incurred by a C corporation in calendar year 2016 and then makes

Which of the following statements is FALSE?

A) A net operating loss is incurred by a C corporation in calendar year 2016 and then makes an S election effective for calendar year 2017. The entire net operating loss carryover of 2016 can be passed through to the S corporation's shareholders at the end of 2017. O B) One of the main reasons S elections are made is to avoid the double taxation of C corporations by having the profits of the corporation "pass-through" to the shareholders pro-rata in accordance with their stock ownership percentage.

C) S corporation losses passed through to shareholders in any tax year are limited to the sum of the shareholder's bases in their stock plus any direct loans made by the shareholder to the S corporation

D) Losses disallowed because of inadequate basis may be carried forward indefinitely and deducted in a subsequent tax year in which the shareholder regains basis in their stock or debt (usually by earning profits in subsequent years or by the shareholder making additional loans to the S corporation).

E) All of the above statements are TRUE.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started