Answered step by step

Verified Expert Solution

Question

1 Approved Answer

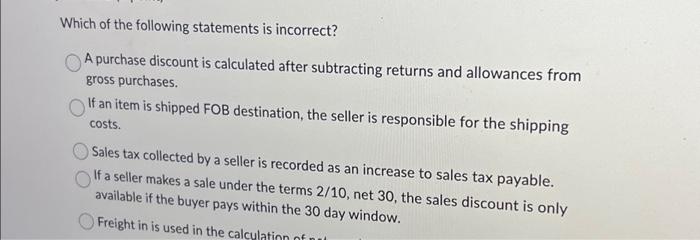

Which of the following statements is incorrect? A purchase discount is calculated after subtracting returns and allowances from gross purchases. If an item is shipped

Which of the following statements is incorrect? A purchase discount is calculated after subtracting returns and allowances from gross purchases. If an item is shipped FOB destination, the seller is responsible for the shipping costs. Sales tax collected by a seller is recorded as an increase to sales tax payable. If a seller makes a sale under the terms 2/10, net 30, the sales discount is only available if the buyer pays within the 30 day window. Freight in is used in the calculation of not

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started