Answered step by step

Verified Expert Solution

Question

1 Approved Answer

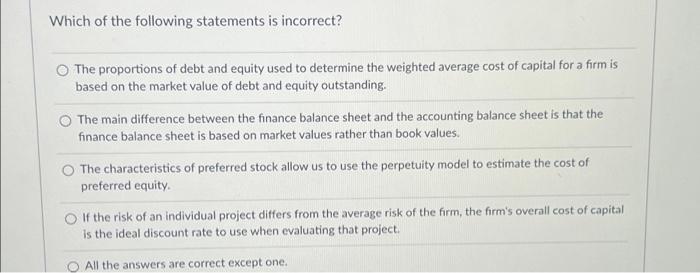

Which of the following statements is incorrect? O The proportions of debt and equity used to determine the weighted average cost of capital for a

Which of the following statements is incorrect? O The proportions of debt and equity used to determine the weighted average cost of capital for a firm is based on the market value of debt and equity outstanding. O The main difference between the finance balance sheet and the accounting balance sheet is that the finance balance sheet is based on market values rather than book values. O The characteristics of preferred stock allow us to use the perpetuity model to estimate the cost of preferred equity. If the risk of an individual project differs from the average risk of the firm, the firm's overall cost of capital is the ideal discount rate to use when evaluating that project. All the answers are correct except one.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started