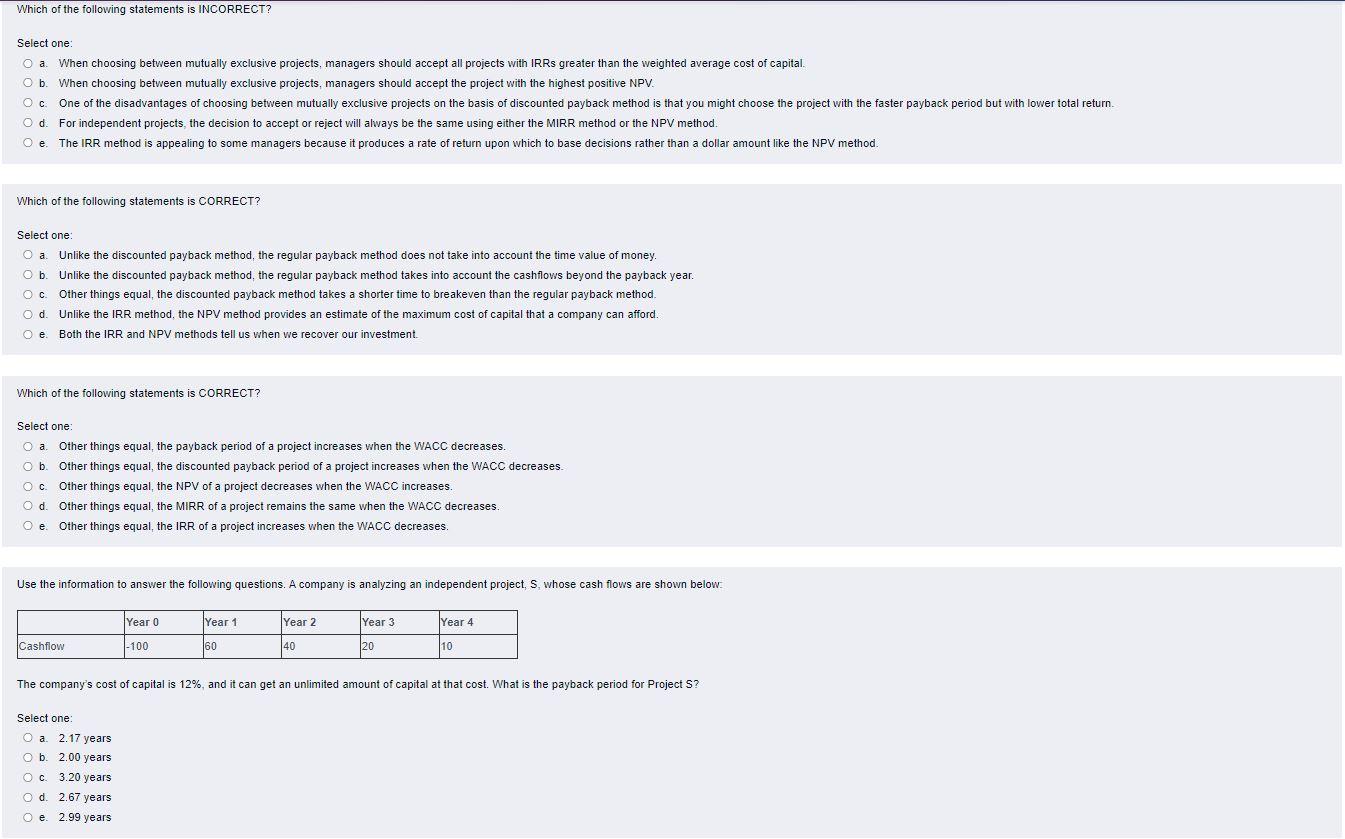

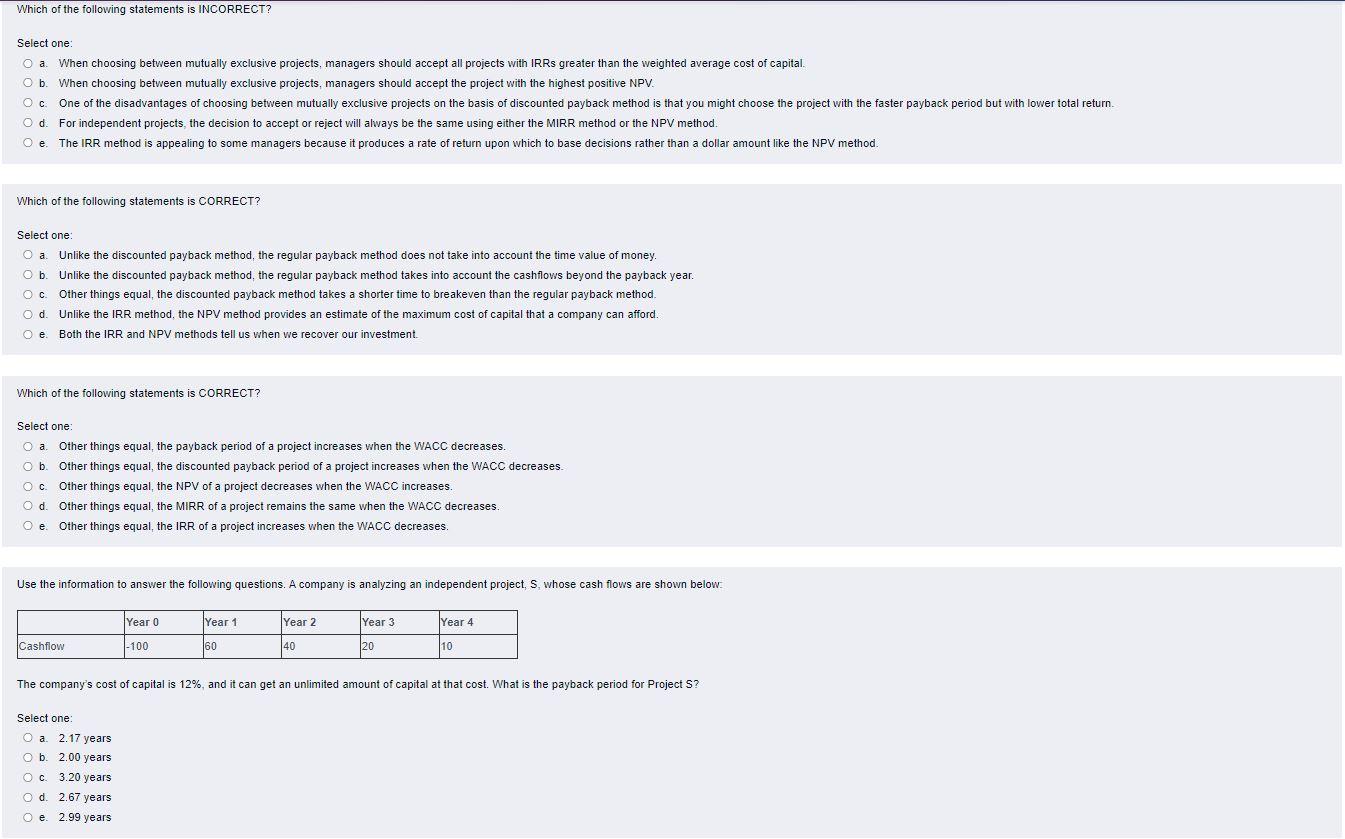

Which of the following statements is INCORRECT? Select one O a When choosing between mutually exclusive projects, managers should accept all projects with IRRs greater than the weighted average cost of capital. Ob When choosing between mutually exclusive projects, managers should accept the project with the highest positive NPV. One of the disadvantages of choosing between mutually exclusive projects on the basis of discounted payback method is that you might choose the project with the faster payback period but with lower total return. d. For independent projects, the decision to accept or reject will always be the same using either the MIRR method or the NPV method. Oe. The IRR method is appealing to some managers because it produces a rate of return upon which to base decisions rather than a dollar amount like the NPV method. Which of the following statements is CORRECT? Select one: O a Unlike the discounted payback method, the regular payback method does not take into account the time value of money. Ob Unlike the discounted payback method, the regular payback method takes into account the cashflows beyond the payback year. Oc Other things equal, the discounted payback method takes a shorter time to breakeven than the regular payback method. Unlike the IRR method, the NPV method provides an estimate of the maximum cost of capital that a company can afford Oe e. Both the IRR and NPV methods tell us when we recover our investment. Od Which of the following statements is CORRECT? Select one: O a Other things equal, the payback period of a project increases when the WACC decreases. Ob Other things equal, the discounted payback period of a project increases when the WACC decreases Other things equal, the NPV of a project decreases when the WACC increases. O d. Other things equal, the MIRR of a project remains the same when the WACC decreases. Oe Other things equal, the IRR of a project increases when the WACC decreases. Use the information to answer the following questions. A company is analyzing an independent project, S, whose cash flows are shown below Year 0 Year 1 Year 2 Year 3 Year 4 Cashflow -100 160 40 20 10 The company's cost of capital is 12%, and it can get an unlimited amount of capital at that cost. What is the payback period for Project S? Select one O a 2.17 years Ob 2.00 years Oc 3.20 years od 2.67 years O e 2.99 years