Question

Which of the following statements is true about derivatives valuation? (Select all correct answers) Regardless of where you are valuing or pricing derivatives, its ok

Which of the following statements is true about derivatives valuation? (Select all correct answers)

Regardless of where you are valuing or pricing derivatives, its ok to use mid-swaps to price.

Market practitioners must use LIBOR to value derivatives.

We can use the same bootstrapping formula to calculate spot rates used in the derivatives valuation process regardless of which benchmark index we use.

The price that an unwind will be quoted will most likely not equal the mark-to-market value of that swap.

00--

Which of the following statements is true about Relative Value? (Select all correct answers)

We can use Relative Value to recognize rich or cheap bonds.

The bonds with a positive residual value (traded yield modeled yield > 0) are considered rich.

Further deviation of traded yield from the modeled yield means bonds are more attractive to buy or sell.

Using Relative Value to recognize cheap/rich bonds can only be applied to the US Treasury market.

0----

Which one of these factors are drawbacks to using cheap/rich analysis for fixed income instruments?

Cheap/rich analysis is based on mean reversion.

All the above

New issuance impacts the valuation of existing bonds.

Each bond issue may have different technicals.

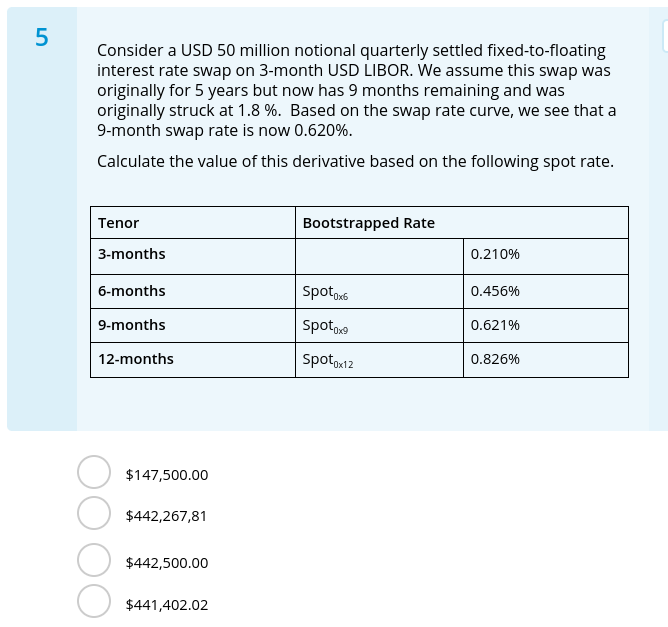

5 Consider a USD 50 million notional quarterly settled fixed-to-floating interest rate swap on 3-month USD LIBOR. We assume this swap was originally for 5 years but now has 9 months remaining and was originally struck at 1.8%. Based on the swap rate curve, we see that a 9-month swap rate is now 0.620%. Calculate the value of this derivative based on the following spot rate. Tenor Bootstrapped Rate 3-months 0.210% 6-months Spotox 0.456% 9-months Spoto 0.621% 12-months Spotox12 0.826% $147,500.00 $442,267,81 $442,500.00 $441,402.02Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started