Question

Which of the following statements regarding internal controls is INCORRECT? a. An effective set of internal controls addresses the opportunity element of the fraud triangle.

Which of the following statements regarding internal controls is INCORRECT?

| a. | An effective set of internal controls addresses the "opportunity" element of the "fraud triangle". | |

| b. | Most people are able to resist pressure and the tendency to rationalize ethical or legal misconduct which materially reduces the need for "physical controls" to protect assets. | |

| c. | Internal controls are "policies and procedures" designed to ensure that a firm's objectives will be accomplished. | |

| d. | The "separation of duties" is a widespread basic internal control practice. |

The following information is provided for Beck Company. Select the correct statement regarding the financial statement impact of misclassifying the $5,000 in material costs as general (period) costs.

| a. | Net income will be overstated. | |

| b. | Net income will be correct. | |

| c. | Ending inventory will be overstated. | |

| d. | Ending inventory will be understated. |

-

During its first year of operations, Teddy Company paid $4,000 for direct materials and $8,500 for production workers' wages. Lease payments and utilities on the production facilities amounted to $500 and on the administrative building amounted to $1000. General, selling, and administrative expenses totaled $3,000. The Company owns $30,000 of manufacturing equipment. The equipment has a 4-year useful life and a $2,000 salvage value and uses straight-line depreciation. The company produced 5,000 units and sold 4,000 units at a price of $7.50 a unit. What is the amount of ending finished goods inventory for the first year?

a. $14,000

b. $16,000

c. $ 5,000

d. $ 4,000

-

During its first year of operations, Teddy Company paid $4,000 for direct materials and $8,500 for production workers' wages. Lease payments and utilities on the production facilities amounted to $500 and on the administrative building amounted to $1000. General, selling, and administrative expenses totaled $3,000. The Company owns $30,000 of manufacturing equipment. The equipment has a 4-year useful life and a $2,000 salvage value and uses straight-line depreciation. The company produced 5,000 units and sold 4,000 units at a price of $7.50 a unit. What is the amount of cost of goods sold for the first year?

a. $16,000

b. $20,000

c. $28,000

d. $23,200

-

During its first year of operations, Teddy Company paid $4,000 for direct materials and $8,500 for production workers' wages. Lease payments and utilities on the production facilities amounted to $500 and on the administrative building amounted to $1000. General, selling, and administrative expenses totaled $3,000. The Company owns $30,000 of manufacturing equipment. The equipment has a 4-year useful life and a $2,000 salvage value and uses straight-line depreciation. The company produced 5,000 units and sold 4,000 units at a price of $7.50 a unit. The average cost per unit is which of the following amounts?

a. $4.60

b. $4.00

c. $5.00

d. $5.75

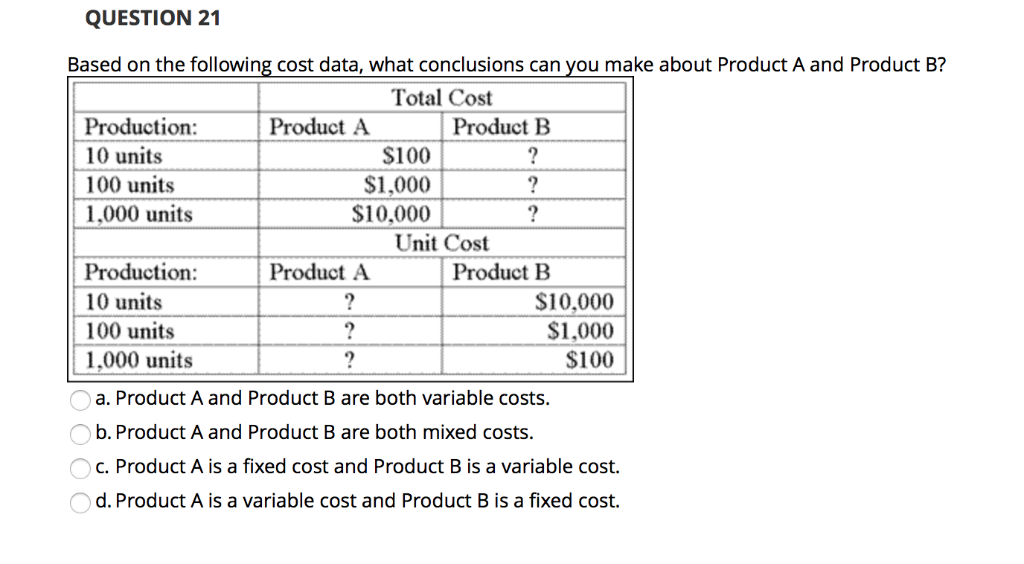

QUESTION 21 Based on the following cost data, what conclusions can you make about Product A and Product B? Total Cost Production: 10 units 100 units 1,000 units Product A Product B S100 $1,000 $10,000 Unit Cost Production: 10 units 100 units 1,000 units Product A Product B $10,000 $1,000 $100 a. Product A and Product B are both variable costs. b. Product A and Product B are both mixed costs c. Product A is a fixed cost and Product B is a variable cost. d. Product A is a variable cost and Product B is a fixed cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started