Answered step by step

Verified Expert Solution

Question

1 Approved Answer

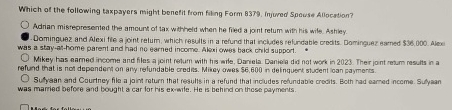

Which of the following taxpayers might benefit from filing Form 8 3 7 9 , injured Speuse Allocation? Adrian misrepresented the amount of tax witheld

Which of the following taxpayers might benefit from filing Form injured Speuse Allocation?

Adrian misrepresented the amount of tax witheld when he fied a jont retum with his wile Ashiley.

Dominguez and Alexi tie a joint relum, which resulis in a refund that inclutes refundatie credits. Dominguez Bamed $ Alex

was a stayathome parent and had no earned income. Aloxi owes back child support.

Mikey has aamed income and files a joint rehum with his arie, Daviela. Daniela ded not work in Ther jont retum results in a

refund that is not depandent on any refundable crediss. Mirey owes $ in definquent student ioan payments.

Subyan and Courtney file a jaint return that regults in a refund that noludes rehundabie croots. Both nad earned ncome. Sulyaan

was married before and bought a car for his exrife. He is behind on those payments.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started